EUR/CAD continues to trade at levels that are materially above the pair's opening price of circa 1.45.

New joint debt issuance in the EU appears to show promise as a recent (albeit small) issuance was massively over-subscribed.

With greater fiscal harmonization and the prospect of a much larger and long-term EU debt market, EUR is starting to become more attractive.

Changes in energy prices this year have also benefited EUR at the expense of CAD. The real yield for EUR/CAD has also improved.

While EUR/CAD might not rise with vigor, the medium- to long-term picture appears constructive (from 2021 through 2022).

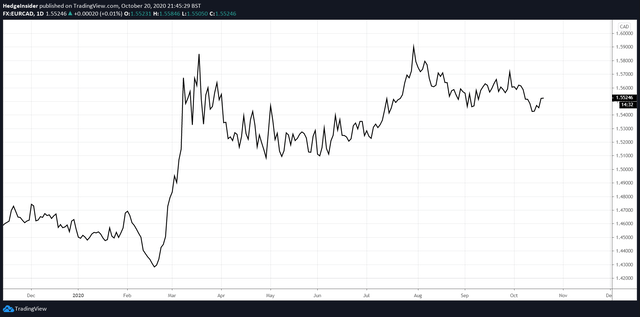

The EUR/CAD currency pair, which expresses the value of the euro in terms of the Canadian dollar, continues to trade with relative stability as compared to the euro's rapid ascent in Q1 2020. EUR has, in effect, stabilized at materially higher prices in relation to CAD. Opening the year at circa 1.45, EUR/CAD has subsequently almost hit the 1.60 handle, in both March and July. At present, EUR/CAD is trading off its highs between 1.54 and 1.56.

(Source: TradingView. The same applies to price charts presented hereafter.)

(Source: TradingView. The same applies to price charts presented hereafter.)

The first ascent was enabled by collapsing risk sentiment, which hit both equities and oil prices (through March 2020). Oil prices are important for CAD, since the energy industry has historically contributed around 10% to Canadian GDP; Canada remains one of the world's key net-exporters of crude oil. While many other risk-on currency pairs have retraced their steps from these initial moves (including the AUD/USD exchange rate, for instance), EUR/CAD continues to trade firmly at these much higher levels.

Looking on a longer-term monthly chart, we are reminded of the long-term decline in EUR/CAD. Most recent prices correspond with a "line of best fit" which references previous cyclical highs, as illustrated by the blue line in the chart below.

This long-term trend does, however, seem to be weakening. Cyclical lows, over time, have been registering at higher prices than would otherwise be found if such lows were to follow a similar trajectory as the drops in each cyclical high. Meanwhile, more recent highs have clearly broken out of this trend. It is possible EUR/CAD has the capacity to achieve even higher prices with enough market confidence propelling higher prices.

This long-term trend does, however, seem to be weakening. Cyclical lows, over time, have been registering at higher prices than would otherwise be found if such lows were to follow a similar trajectory as the drops in each cyclical high. Meanwhile, more recent highs have clearly broken out of this trend. It is possible EUR/CAD has the capacity to achieve even higher prices with enough market confidence propelling higher prices.

Something notable happened recently, as reported by the Financial Times. The headline is: EU enjoys ‘outrageous demand’ for first Covid-related bond. The joint debt issuance experiment is underway, and markets priced a 10-year bond at -0.26% (higher than the German bund yield of less than -60 basis points, but nevertheless still negative).

Investors placed bids for more than €233bn, far exceeding the €17bn of bonds on offer, according to one of the banks arranging the deal.

Demand for these bonds is strong, and it is possible that EU debt could provide EUR with a source of long-term demand, support and confidence. This year has brought about a rather stark change for the EU, and in spite of the economic mayhem surrounding the COVID-19 pandemic, the panic has catalyzed this joint bond programme. EU bonds could become the "U.S. Treasuries of Europe," and long-term confidence in the market for EU debt could even kill the long-term bearish trend in the euro.

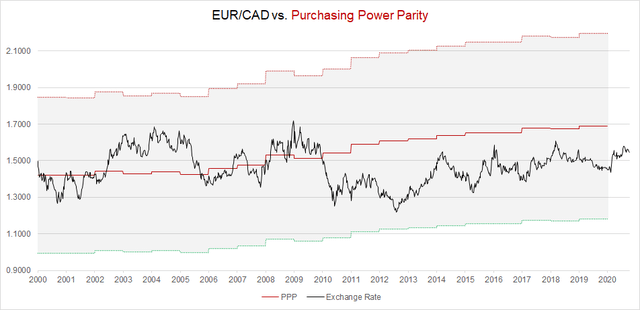

In light of the long-term decline in EUR/CAD, one model to help contextualize this with fundamental data is Purchasing Power Parity. PPP models estimate the fair value of currencies as being reflective of their international purchasing power. I construct the chart below using the OECD's PPP model data through to the most recent data point of 2019 (price action is illustrated by the black line, while the annual fair value estimate is illustrated by the red line). Upper and lower bands have been added to reflect 30% deviations from fair value.

(Sources: Investing.com and OECD)

(Sources: Investing.com and OECD)

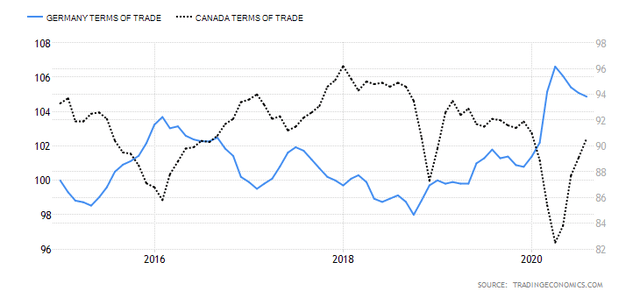

CAD, due to its "commodity currency" status, is generally considered to be riskier than several other major currencies across G10 FX. This would certainly include the traditional safe havens of USD, JPY and CHF. The euro is not viewed as a safe haven, and in contrast to Canada, the euro area is in fact a net-importer of crude oil products. The moves in oil this year have improved the terms of trade of the euro area (using Germany as a proxy for the euro area, in the chart below) at the expense of Canada. However, while crude oil prices are still about a third lower on the year, a rebound from the lows has helped to close much of this gap.

(Source: Trading Economics)

(Source: Trading Economics)

Few would have thought the euro would rally in 2020, but the world has slashed interest rates in the face of this year's pandemic and ensuing economic crisis. As such, interest rate spreads with the euro have collapsed. While the ECB maintains a negative rate of -50 basis points (deposit facility rate), and while this is still materially lower than the Federal Reserve's short-term rate target of between 0 and +25 basis points, the euro does not look nearly as bad to hold as before. Meanwhile, adjustments in energy markets have enabled EUR/CAD to justify a higher baseline throughout 2020.

The addition of the phenomenon of joint debt issuance to potentially form a new EU debt market in the long term is likely to provide the euro with further strength. With all available information prior to 2020, the euro did not look attractive. Yet with the radical fiscal and monetary interventions and developments this year, the euro is starting to show potential. As shown in the PPP model in the penultimate chart above, EUR/CAD is also probably still trading at a discount to fair value (2019 estimated fair value: 1.69).

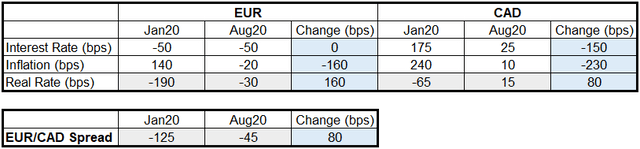

We can also look at changes in inflation rates for the euro area and Canada, using January and August 2020 as start and end points, and use these to adjust the central bank rate changes this year. We can then generate an impression of the change in the "real yield" for EUR/CAD (see below).

As the calculation above shows, EUR/CAD's real yield (as implied by inflation-adjusted short-term official rates) has improved by 80 basis points between January and August. If we assume these rates will remain lower for longer, but also assume that the ECB is not going to lower rates further, of the two economies (the euro area and Canada), it is possibly more likely that Canada will achieve higher rates of inflation than the euro area.

As the calculation above shows, EUR/CAD's real yield (as implied by inflation-adjusted short-term official rates) has improved by 80 basis points between January and August. If we assume these rates will remain lower for longer, but also assume that the ECB is not going to lower rates further, of the two economies (the euro area and Canada), it is possibly more likely that Canada will achieve higher rates of inflation than the euro area.

The euro area has struggled to generate significant levels of inflation historically, and is currently even finding deflation. In a global economic rebound, Canadian inflation is much more likely to surge than euro area inflation (judging by history). This is going to be especially true if the euro can maintain its new-found strength against certain other currencies (including not only CAD, but also USD and JPY). A stronger euro makes euro area exports pricier in international terms, thus reducing the probability of higher inflation.

Lower inflation (or deflation) enhances real yield, and makes currencies more attractive ("on paper," at least). This current state of affairs, combined with the fact that EUR/CAD is still trading at a probable discount to fair value and seems to be breaking out of its long-term bearish trend, seems to bode well for even higher prices. Any economic rebound is also likely to support oil prices, which will place a drag on further EUR/CAD strength. Yet a more gradual rise (or otherwise relative stability, over the longer term) could enable EUR/CAD the chance to achieve its fair value at circa 1.69. It is also possible that the 2020 PPP fair value figure will be modestly higher than 1.69, provided Canadian inflation continues to exceed euro area inflation.

In summary, while EUR/CAD does not appear to provide "aggressive" long opportunity, the market and the broader context we are seeing do seem constructive for this pair. Further strength through to the 1.69 handle would not be unsurprising over the medium to long term (from 2021 through 2022).

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.