Compass Diversified Acquires BOA Tech; Updating Estimates

CODI added a tenth platform company, BOA Technology, on October 19.

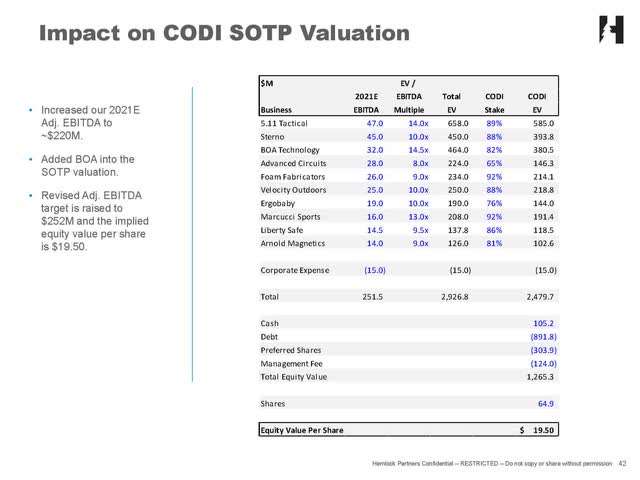

As it relates to the remainder of the portfolio, we tweaked our 2021 estimates, increasing adjusted EBITDA by about 4%, or $10 million, to $220 million.

In total, for all ten businesses, we are targeting adjusted EBITDA of $252 million for 2021. As a result, our fair value estimate is now $19.50, 10% above Wednesday's close.

Snapshot

On September 22, Compass Diversified Holdings (NYSE:CODI) announced its intention to acquire BOA Technology (BOA), a seller of dial-based lacing systems integrated onto performance footwear. BOA will serve as the tenth platform for the CODI portfolio.

The addition of BOA adds an attractive growth story to the CODI portfolio and continues the mix shift towards greater consumer exposure. Based on our initial research, we like the business quite a bit, but BOA will need to grow materially over the next five years to justify the frothy purchase price.

At current levels, we view CODI as fairly valued on a sum-of-the-parts methodology. Our revised 12-month price target is $19.50 based on our estimate of 2021 EBITDA.

Our perspective is that shareholders can rely on a secure dividend, but material capital appreciation is unlikely.

Overview

Headquartered in Westport, CT, CODI owns controlling interests in North American-based, middle market businesses.

Historically, the investment team has focused on identifying targets in the consumer and industrial market segments. However, over the last 24 months, consumer has become a much greater focus.

CODI's strategy is to acquire, grow, and eventually divest companies which:

- maintain leadership positions in attractive market niches;

- generate stable cash flows;

- face limited technology and/or competitive obsolescence; and

- employ strong management teams.

Excluding the most recent addition, CODI owns a majority stake in nine entities, which are engaged in the following lines of business:

Branded Consumer Subsidiaries

- The design and marketing of purpose-built technical apparel and gear serving a wide range of global customers (5.11);

- The development and marketing of wearable baby carriers, strollers, and related products (Ergobaby);

- The design and production of premium home and gun safes (Liberty Safe);

- The innovation and manufacture of baseball/softball equipment and associated apparel (Marucci Sports);

- The design, fabrication, and marketing of airguns, archery products, optics, and related accessories (Velocity Outdoor).

Niche Industrial Subsidiaries

- The manufacture of quick-turn, small-run, and production-rigid printed circuit boards (Advanced Circuits);

- The manufacture of engineered magnetic solutions for a wide range of specialty applications and end-markets (Arnold Magnetic Technologies);

- The design and production of custom-molded protective foam solutions and OE components (Foam Fabricators); and

- The manufacture and marketing of portable food warming systems, creative indoor and outdoor lighting, and home fragrance solutions for the food service industry and consumer markets (Sterno).

CODI utilizes the cash flow generated by its subsidiaries, as well as, the proceeds associated with divestments to invest in organic/inorganic growth initiatives and to make cash distributions to shareholders.

Shares of CODI tend to be quite popular with retail investors as it provides access to the private equity (PE) investment class, as well as, a significant dividend yield. Exposure to PE is viewed as highly desirable due to the expectation of long-term value creation and limited correlation with the public equity markets.

CODI is treated as a partnership for U.S. federal income tax purposes, and as such, holders of the common stock must file a K-1 form.

Regarding the dividend, at this writing, CODI trades at $17.75, offering an attractive, reliable 8.1% yield.

Update

In September, CODI announced its intention to acquire a tenth subsidiary - BOA, the inventor, designer, and manufacturer of a unique lacing system, which is integrated onto specialty footwear products. The transaction closed October 19.

The announcement surprised us. CODI has traditionally been a patient, value-oriented investor, and current M&A valuations are robust. Despite significant dry powder, we predicted CODI would sit out this sellers' market and wait for the deal environment to normalize.

The purchase price of $454 million equates to a hearty 15x multiple on BOA's $30 million of trailing twelve-month EBITDA.

CODI funded the transaction with $100 million in cash, $300 million from the existing credit facility, and $62 million of rollover equity from BOA management/existing owners.

Founded in 2001, the patented BOA system is used predominantly in performance footwear, with strong traction in the snowboard segment. The company is also generating positive momentum in other applications, such as golf, cycle, hike/trail, and run/train.

While the price tag appears quite expensive, management provided several key factors that drove the strategic rationale.

Pre-COVID-19, BOA was expanding rapidly with revenue growth rates of 18% (2017-2019 CAGR). CODI anticipates strong growth ahead for the BOA system due to a large addressable market and a relatively small share today.

From a cash flow perspective, BOA generates high margins (30% adjusted EBITDA margin) and requires minimal capex (4% of revenue).

Valuation

Our fair value estimate for CODI is based on a sum-of-the-parts methodology.

For each operating subsidiary, the analysis forecasts a 2021E adjusted EBITDA and applies an appropriate enterprise-to-EBITDA multiple based on comparable public peers and previous M&A transactions. Subsequently, we deduct net debt and management fees to arrive at our equity valuation.

To account for the acquisition of BOA, we added $107 million and $32 million of revenue and adjusted EBITDA, respectively, in 2021.

As it relates to the remainder of the portfolio, we tweaked our estimates by about 4% to reflect a more optimistic perspective on 2021 prospects. The net impact boosts adjusted EBITDA by ~$10 million to $220 million (excluding BOA).

In total, for all ten businesses, we are now targeting adjusted EBITDA of $252 million for 2021. As a result, our fair value estimate jumps to $19.50.

Conclusion

In summary, BOA appears to be a compelling addition. CODI acquired an attractive growth story and continues its strategic mandate to shift the portfolio towards greater consumer exposure.

Based on our initial research, we like the business quite a bit, but BOA will need to grow materially over the next five years to justify the purchase price.

At current levels, we view CODI as fairly valued on a sum-of-the-parts methodology. Our revised 12-month price target is $19.50 based on our estimate of 2021 EBITDA.

We believe shareholders can rely on a secure dividend, but notable capital appreciation is unlikely.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.