The Swiss Franc Is Overvalued

The Swiss Franc remained the best performing major currency of 2020.

However, some fundamental indicators reveal that CHF may be overvalued.

It appears that SNB's main objective is to curb excessive strength in Swiss franc.

If USDCHF stays above 0.9040, it seams reasonable to expect a decent rebound towards 0.9350.

As the coronavirus pandemic continues to rattle the world, Swiss franc (CHF) continues to appreciate steadily. It is already up some 8.1% y-o-y (the most among 28 currencies). There are some good reasons why the Swiss franc is currently trading above its long-term moving averages. The most important reason is that CHF has always been regarded as a safe heaven. Money managers are attracted by the relative security and macro stability of Switzerland - especially, during the uncertain times. But how likely is CHF to depreciate further? Will USDCHF drop below 0.90 as some analysts expect?

I do not think that the bullish case for Swiss Franc is strong enough. Range bound trading with a slight bearish bias is more likely to prevail. I see USDCHF trading in the 0.89-0.96 range over the next six months.

The Bearish Case

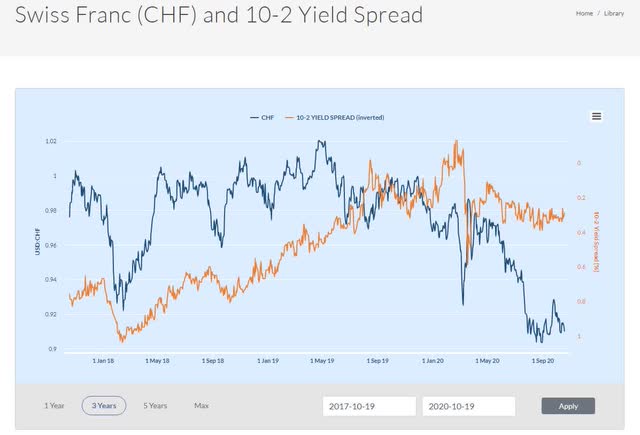

10-2 Yield Spread

One only needs to look at the chart below to ask an obvious question: is the CHF significantly overvalued?

Source: Bluegold Trader (website)

Source: Bluegold Trader (website)

The chart above shows daily closing exchange rates for 1 US dollar to Swiss francs and the yield spread between the 10-year government bond and the 2-year government bond (10-2 yield spread). In this particular chart, the 10-2 yield spread is a simple difference between the yields on 10- and 2-year Swiss government securities at constant maturity. The curve showing 10-2 yield spread is intentionally inverted because USDCHF is a direct forex quote. Rising USDCHF means that the U.S dollar is appreciating, while the Swiss franc is depreciating. Declining USDCHF means that the U.S. dollar is depreciating, while the Swiss franc is appreciating.

The yield spread is often included among the leading forex indicators because interest-rate spreads determine the shape of the yield curve and the shape of the yield curve embodies fixed-income traders' expectations about the economy. When the 10-2 yield spread rises, the yield curve is steepening (becoming more upward-sloping). Upward-sloping yield curves have normally preceded economic expansions as bondholders demand a higher rate of return from the inflationary risks accompanying economic upturns. When the 10-2 yield spread falls, the yield curve is flattening. Flat yield curves usually signal an approaching economic slowdown or expansion, depending on which stage of the economy had initially prevailed. When 10-2 yield spread dips below zero, it means that the yield curve is “inverted”. Inverted yield curves usually signal economic slowdowns and are often harbinger of recession. The negative slope of the yield curve shows that short-term yields are higher than long-term yields as bond traders expect lower interest rates ahead. Historically, yield curve inversions have started about 12 to 18 months before a recession.

The 10-2 yield spread in Switzerland has been relatively stable for the past two months but is not far from an all-time low. At the same time, the USDCHF exchange rate is trading near multi-year low (in other words, USD looks too cheap compared to CHF). I see a major bullish divergence here (for USDCHF pair).

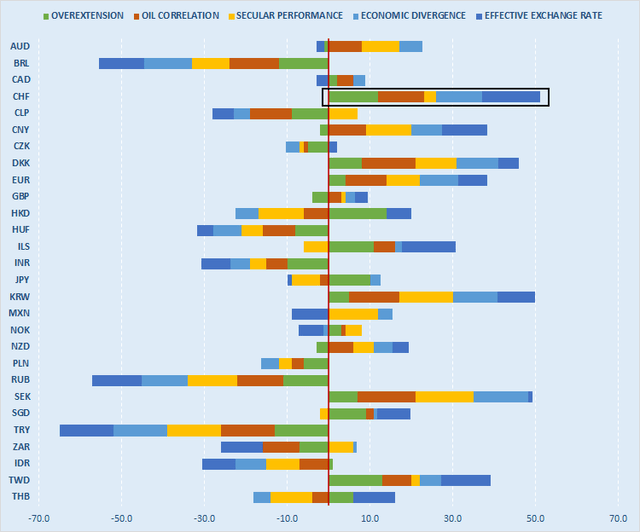

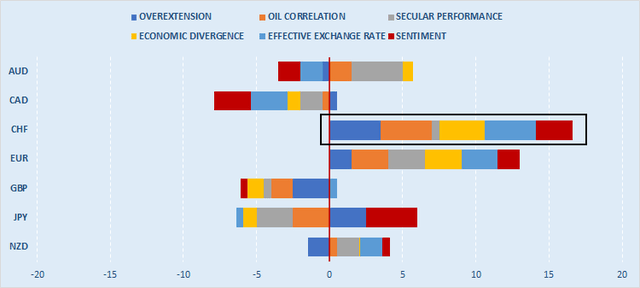

Relative Valuation

Swiss franc remains the most overvalued currency among 29 currencies that I track (see the chart below). All five econometric studies (overexertion analysis, oil correlation, secular performance review, economic divergence analysis and effective exchange rate study) + traders' sentiment indicate that CHF is heavily overbought.

Source: Bluegold Trader (website)

To read more about Forex Relative Valuation, see this article.

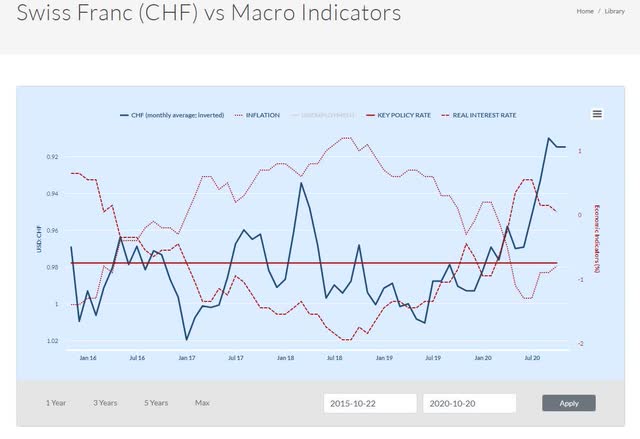

Prices

Swiss inflation struggles to stay positive. According to the Swiss Federal Statistical Office, producer and import prices edged up by meager 0.1% in September, up from the 0.4% drop in August. Year-over-year, however, they have slumped 3.1%. Import prices fell 5.6%, while producer prices tumbled 1.9%.

Source: Bluegold Trader (website)

Source: Bluegold Trader (website)

In its latest policy statement, Swiss National Bank (SNB) said that it expects deflation to stay until 2021 and explicitly reiterated the view that Swiss franc remained "highly valued" and stressed the commitment to intervene in the FX market. Indeed, it appears that SNB's main objective is to curb excessive strength in Swiss franc.

There is a famous investment policy (or proverb) - "Don't fight the Fed" - which suggests that investors should align their choices with the actions of the Federal Reserve System, or FED. Perhaps traders should not fight the SNB either - particularly, given that it is one of the oldest central banks in the world with very, very deep pockets.

Technicals

USDCHF found support near 0.9010, which is 1.236 Fibo projection level of a major retracement that took place in mid-March (see the chart below). Interestingly, that level now acts as the lower bound of an ascending parallel channel, which is a bullish pattern. In addition, there is a bullish divergence on 14-day RSI indicator. If USDCHF stays above 0.9040, it seams reasonable to expect a decent rebound towards the upper level of that ascending channel - probably near 0.9350.

Conclusion

The bullish case for CHF is unconvincing. Instead consider looking for shorting opportunities. I would recommend either shorting a broad CHF index or to go long selected forex pairs - particularly, USDCHF, CADCHF. And if you prefer exotic pairs, RUBCHF and MXNCHF.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.