Targa Resources: Focusing On Deleveraging Didn't Last Long

Targa Resources slashed their dividends by a massive 89% earlier in 2020 to deleverage but now suddenly have decided to conduct a $500m share buyback program.

This obviously runs contrary to their previous deleveraging goal and appears to show a pivot away from deleveraging and dividends to one that favors periodic share buybacks.

It now appears that their ability to deleverage and thus reinstate their previous dividends is very limited and may possibly never eventuate.

Their liquidity deteriorated during the second quarter of 2020 and thus is now only adequate.

When the good and bad aspects of this potential investment are combined, I believe that a neutral rating is appropriate.

Introduction

Following the turmoil in early 2020 Targa Resources (TRGP) moved quickly to reduce their dividends by a massive 89% and thus push their yield to only a low level of around 2%. This undesirable action was taken to help expedite their deleveraging efforts, however, fast forward half a year and suddenly they announce a share buyback program that runs contrary to this objective. This article provides an updated analysis that follows my previous article with their subsequently released financial results that also now considers the implications for dividend investors from this pivot towards share buybacks.

Executive Summary & Ratings

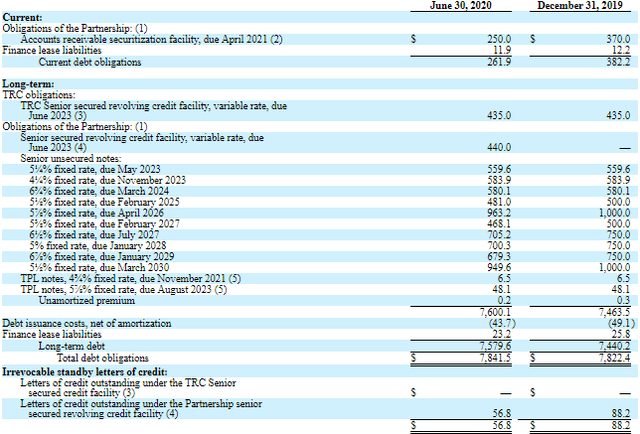

Since many readers are likely short on time, the table below provides a very brief executive summary and ratings for the primary criteria that was assessed. This Google Document provides a list of all my equivalent ratings as well as more information regarding my rating system. The following section provides a detailed analysis for those readers who are wishing to dig deeper into their situation.

Image Source: Author.

*There are significant short and medium-term uncertainties for the broader oil and gas industry, however, in the long-term they will certainly face a decline as the world moves away from fossil fuels.

**Whilst the oil and gas industry to which they service has high economic sensitivity, given the more stable nature of the midstream sub-industry this was deemed to be average.

Detailed Analysis

![]()

Image Source: Author.

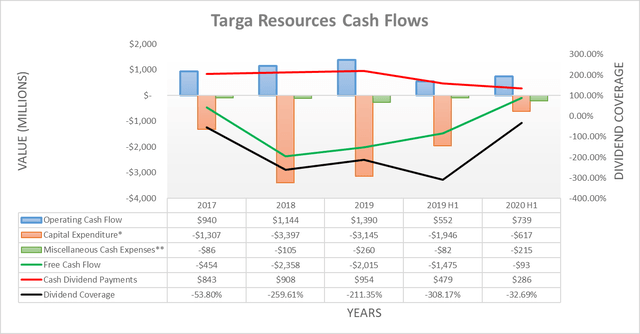

Instead of simply assessing dividend coverage through distributable cash flow, I prefer to utilize free cash flow since it provides the toughest criteria and best captures the true impact to their financial position. The main difference between the two is that the former ignores the capital expenditure that relates to growth projects, which given the very high capital intensity of their industry can create a material difference.

When conducting the original analysis, it was found that their dividend coverage going forward would be very strong with their estimated free cash flow far exceeding their new heavily-reduced dividend payments. Considering they have reduced their dividends by 89% in addition to a 73.10% reduction to their guidance for 2020 capital expenditure, this outcome is not the least bit surprising and if interested in more details, please refer to my previously linked article.

It was originally estimated that they would have $217m of free cash flow available after dividend payments to direct towards deleveraging, which would take around five to seven years to have a material impact. Following their sudden pivot towards share buybacks this already prolonged timeline is clearly thrown out the window, which is surprising given the following comments their management made during their first quarter of 2020 results conference call.

“I think that for the last year-plus, we've talked very consistently about how reducing our overall leverage was the priority for us, the Paramount priority. And as we look forward and look at our profile of generating growing free cash flow as we move through time, it would be available for the repayment of debt just as a result of the dividend reduction plus lower capital spending. That means that we'll have a lot more flexibility than we would have previously prior to the dividend reduction to reduce our leverage more quickly.”

-Targa Resources Q1 2020 Conference Call.

At the end of the day, sudden changes in strategies are a reasonably common part of investing but $500m is a relatively large share buyback program that will consume the equivalent of roughly two years of that $217m estimated free cash flow for deleveraging. Whilst this has the benefit of removing around 13% of their current $3.86b market capitalization, it obviously delays their efforts to deleverage and as a result, safely provide a materially higher dividend yield as they were previously. Whilst I understand and appreciate the fact that their earnings have held up surprisingly well recently, as subsequently discussed, it would have felt more in line to simply contribute these towards deleveraging.

Even more importantly, this pivot seems to show that management no longer has the same resolve to deleverage and now favors periodically conducting share buybacks. Whilst I have no issues with share buybacks in general, I believe they are not suited to companies that are normally sought after for their high and steady income. Regardless if other investors feel the same, it does not change the fact that these will leave their financial position weaker and thus hampers their ability to reinstate their previous dividends.

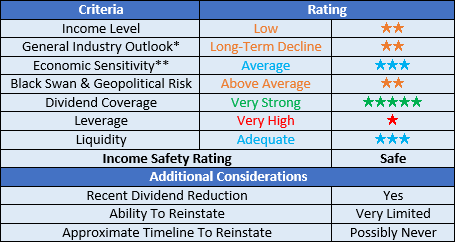

Image Source: Author.

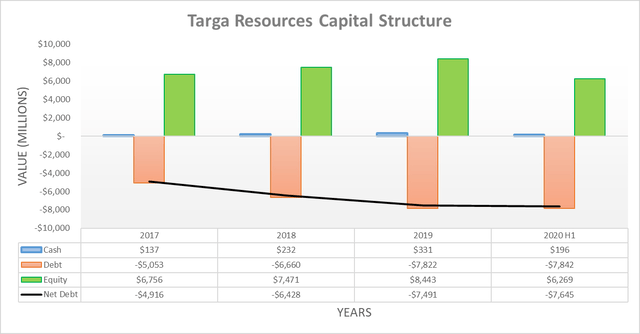

When looking at their capital structure it can be observed that it has essentially remained unchanged since the end of 2019 and the first quarter of 2020. This means that their requirement to deleverage has not suddenly changed in such a short length of time.

![]()

Image Source: Author.

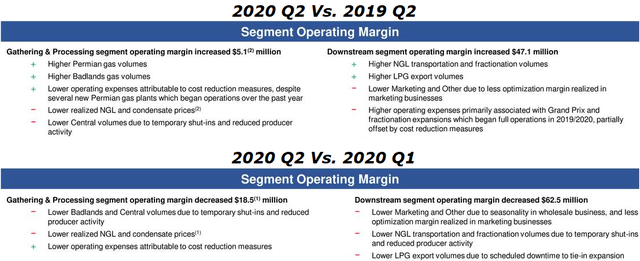

When reviewing their financial metrics it may appear on the surface that their very high leverage was easily resolved during the first half of 2020 with their net debt-to-EBITDA decreasing into the moderate territory at 3.61. Sadly for their shareholders, the situation is not this simple since it largely results from volatility in their segment operating margins that change quarter to quarter, as the slide included below displays.

Image Source: Targa Resources Second Quarter Of 2020 Results Presentation.

Due to this situation, their leverage should still be considered very high since their net debt-to-EBITDA was consistently above 5.00 during 2018-2019 and their net debt has only subsequently crept higher. This means that until such time as they actually deleverage, their general risks will remain elevated and restrict their ability to safely return cash to shareholders. The original analysis estimated this would take upwards of five to seven years, however, these share buybacks appear likely to create at least a two-year delay. Given the prospects that they may not be the last share buybacks, it seems reasonable to now question whether they will ever adequately deleverage and thus their ability to reinstate their previous dividends is now very limited and may never eventuate.

![]()

Image Source: Author.

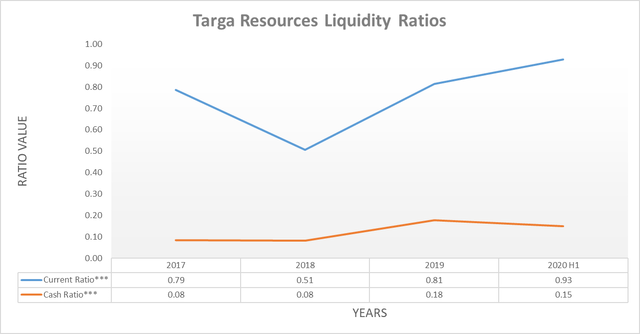

When looking at their liquidity they saw both their current and cash ratios deteriorate during the second quarter of 2020, falling to 0.93 and 0.15 respectively. Whilst this does not pose any risk to their ability to remain a going concern, it no longer is sufficient to consider their liquidity strong, especially since their share buybacks will consume their post dividend payment free cash flow. This means that their liquidity is only adequate and more reliant on their credit facilities than was previously the case. They still retain a combined $1.938b available through their two credit facilities that will provide ample support for their liquidity, but having to rely on these in less than ideal.

Since they do not face any material debt maturities until May 2023, it provides them with breathing room to either repay or refinance their debt, as the table included below displays. They have recently upsized a $1b note offering at competitive interest rates and thus there are no short to medium-term reasons to think they cannot continue refinancing their debt maturities.

Image Source: Targa Resources Q2 2020 10-Q

Conclusion

It seems that shareholders should brace for them to possibly never completely reinstate their previous dividends since they are ignoring deleveraging to conduct share buybacks, plus in turn showing that they are likely to pursue them over dividends. On one hand, their share price is trading towards multi-year lows, but on the other hand, ignoring deleveraging to pursue share buybacks is unfavorable in my eyes and thus I believe that maintaining my neutral rating is appropriate.

Notes: Unless specified otherwise, all figures in this article were taken from Targa Resources’ Q2 2020 10-Q (previously linked), 2019 10-K and 2017 10-K SEC Filings, all calculated figures were performed by the author.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.