Net Selling From Central Banks May Not Matter For Gold

Central banks were net sellers of gold in August.

Gold corrected and consolidated- A significant central bank sale at the turn of the century launched the bull market.

Gold mining shares tend to provide a leveraged percentage gain or loss.

Gold mining stocks could be the best approach for investors for 2021.

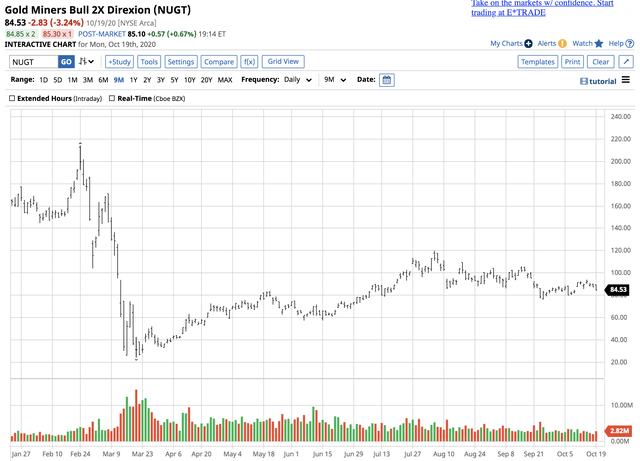

Invest in Gold Miners with GDX, and amp up your play using the leveraged NUGT product.

Since mid-September, $1900 has become a pivot point in the gold futures market as the yellow metal continues to consolidate after reaching a record high of $2063 in August.

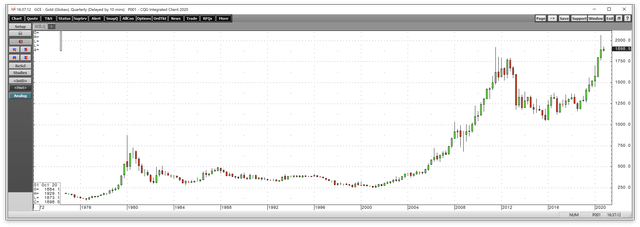

The active month December futures contract has traded at a low of $1851 on September 24 to a high of $1939.40 on October 12. The gold futures market has traded within that range since September 22. Gold took off on the upside after breaking through the July 2016 high at $1377.50 in June 2019. The price continued to move higher until March 2020, when the risk-off period took the price from over $1700 to the $1450 level. The price then surged to $2063, where it ran into profit-taking. Gold had moved to record highs in other currencies in 2019 and 2020, and gold in US dollar terms was the final shoe to drop.

The bull market in gold has been in place since back at the turn of the century when the Bank of England sold half its gold at prices mostly below the $300 per ounce level. On either side of the $1900 level, gold remains in bullish mode, and a stone’s throw away from another record peak.

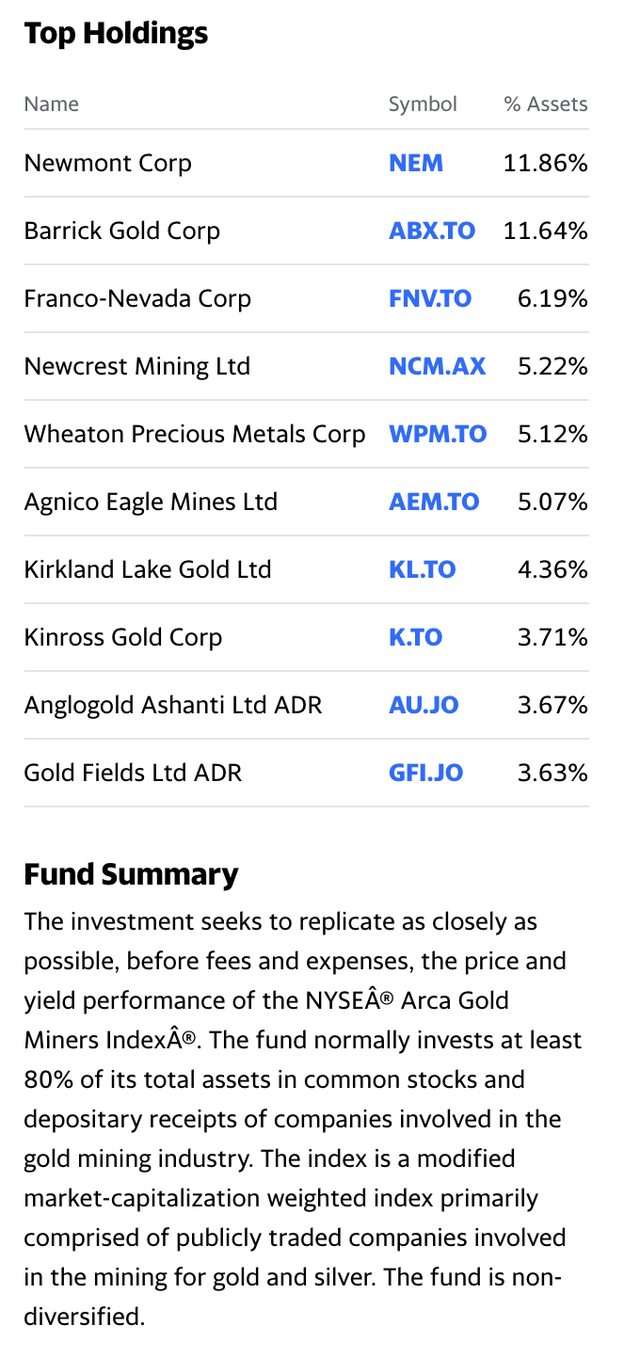

Gold mining shares tend to outperform the gold futures market on a percentage basis on the upside and underperform on the downside. Therefore, producer shares often offer market participants a leveraged view of the gold market. The VanEck Vectors Gold Miners ETF product (GDX) holds a diverse portfolio of shares in the leading gold mining companies. The Direxion Daily Gold Miners Index Bull 2X Shares (NUGT) provides double leverage for the GDX product.

Central banks were net sellers of gold in August

At the end of September, an article on Bullion Vault highlights that central bank gold buying declined by 40% over the first seven months of 2020 compared to the previous year. Over the period, they bought 15.8 million ounces in 2019 and only 8.4 million from January through August 2020. The Bank of China, a consistent buyer over the past years, has not reported any new purchases in 2020. The central bank of Russia suspended purchases beginning in April 2020. Both the Chinese and Russians, both leading gold-producing countries, have been vacuuming in all domestic output. However, they consider their holdings a state secret and matter of national security, so there is no concrete data on if they continue to add the domestic output to reserves.

In August, central banks sold a net of 12.3 metric tons or just under 400,000 ounces of gold. According to the World Gold Council, Uzbekistan sold 31.7 tons, which offset purchases by India, Kyrgyzstan, and Turkey.

Gold corrected and consolidated- A significant central bank sale at the turn of the century launched the bull market

Gold hit a new all-time high in early August, which was the first month in a long time when central banks turned net sellers.

Source: CQG

As the quarterly chart shows, gold rose to a new record high of $2063 on the continuous futures contract in early August. Since then, the price corrected to the $1900 level. Meanwhile, the COMEX futures settled at $1890 at the end of the third quarter. A settlement above that price at the end of 2020 would be the ninth consecutive quarter of gains. From the final quarter of 2008 through 2011, the gold futures market posted twelve successive quarterly gains.

The bull market in gold began in 1999 when the price reached rock bottom at $252.50 per ounce. After higher lows at $255 in Q1 and Q2 2001, the price took off on the upside. The gold market name nicknamed the 1999 low as the “Brown bottom.” Gordon Brown, the Chancellor of the Exchequer in the UK, in his infinite wisdom, decided that gold was a barbarous relic of days gone by, and he sold half of the nation’s holdings. Brown held that position from 1997 through 2007. By the end of his term, gold had already moved to a high of $847.40 per ounce and was heading for a new all-time peak above the 1980 record level at $875. With his fingers off the purse strings and nest egg of his nation, the British decided it was safer to put him in a less dangerous position. Brown served as the Prime Minister from 2007 through 2010.

Meanwhile, central bank sales do not necessarily mean that the price of gold is going to fall. These days, the bottom line is that central bank liquidity, government stimulus are factors, and the Fed’s encouragement of higher inflationary pressures is a potent prescription for higher gold prices even if some central banks continue to shed their holdings. If the UK’s experience with the gold market is a model, any short-term weakness because of official sector sales will create a buying opportunity.

Promoting the man who sold half the nation’s gold holdings to the highest civilian position in the government was more than the embodiment of the Peter Principle. Brown rose to his level of incompetence and kept on rising through the ranks.

Gold mining shares tend to provide a leveraged percentage gain or loss

I like to use leveraged tools for short-term positions on the long and short sides of markets. However, whenever I step up to the plate with a leveraged instrument, I use both a price and a time stop as leverage erodes value over time.

Gold mining shares have unique properties compared to the price of the precious metal. They often perform like leveraged tools without time erosion. Gold mining is a leveraged business. Investors pour millions into a hole in the ground, hoping to extract the metal. Mark Twain, the American author who lived from 1835 through 1910, once said a gold mine is a hole in the ground with a liar standing at the top of the hole. Most gold miners lure investors with a promise of riches through proven and probable reserves. There have been many scams and disappointments in gold mining over the years, which is why I favor a diversified approach. Owning a portfolio of the gold mining stocks mitigates some of the risks of holding an individual company. When buying gold on a dip, I embrace the leverage afforded by a portfolio of gold mining companies.

Gold mining stocks could be the best approach for investors for 2021

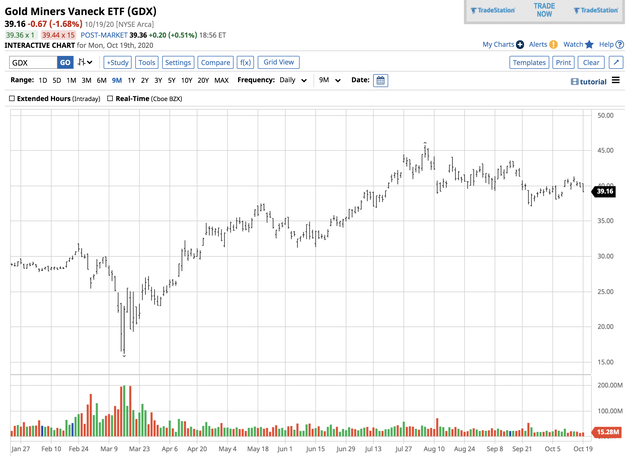

We are coming into a time of the year when gold tends to trade lower. The final months often create short or medium-term bottoms in the gold futures market, as we witnessed in 2015 and 2016. As the markets face the second wave of COVID-19, the potential for a risk-off period is a clear and present danger. In March 2020, gold reached a low of $1450.90 per ounce before moving over $600 higher in August. Meanwhile, the results of the US election could cause volatility in markets across all asset classes. However, liquidity and stimulus add up to higher gold prices over the coming years. While I hold a long position in physical gold, I will be buying gold mining stocks on any price dips over the coming weeks. Instead of worrying about specific companies, the VanEck Vectors Gold Miners ETF product (GDX) will be my product of choice, on a scale-down basis.

Investing with GDX trading with NUGT

I will be using GDX as an investment vehicle. The top holdings and fund summary for the ETF include:

Source: Yahoo Finance

As the chart shows, GDX holds shares in a portfolio of the top gold mining companies worldwide. The ETF has net assets of just over $17 billion, trades an average of over 28.2 million shares each day, and charges an expense ratio of 0.53%. The continuous futures contract on COMEX rose from $1450.90 in mid-March to $2063.00 in early August or 42.2%.

Source: Barchart

Over the same period, GDX rose from $16.18 to $45.78 per share or 182.9% as the gold mining ETF turbocharged the gold futures performance as the GDX rose over four times more on a percentage basis.

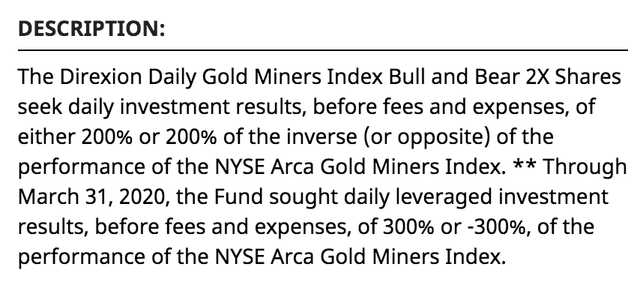

For those looking for real explosive short-term action, the Direxion Daily Gold Miners Index Bull 2X Shares (NUGT) leverages GDX’s performance. The fund summary for NUGT states:

Source: Barchart

NUGT has net assets of over $1.0 billion, trades an average of over 3.6 million shares each day, and charges a 1.17% expense ratio.

Source: Barchart

During the period when gold futures rose 42.2%, and GDX moved 182.9% to the upside, the turbocharged NUGT product rose from $24.15 to $119.80 per share or 396%.

I buy gold as a core holding. When the price of the yellow metal suffers a significant correction, I add to my physical holdings and buy the GDX product on a scale-down basis. When it comes to trading, I look to buy the NUGT product on price weakness with a tight stop to capitalize on short-term movements.

The net selling from central banks does not necessarily mean that gold is heading lower. The last time a central bank sold a substantial percentage of their holdings, gold made a bottom from which the price rarely looked back. As we move into the weakest seasonal period of the year for the gold market, any weakness could create buying opportunities for 2021.

The Hecht Commodity Report is one of the most comprehensive commodities reports available today from the #2 ranked author in both commodities and precious metals. My weekly report covers the market movements of 20 different commodities and provides bullish, bearish and neutral calls; directional trading recommendations, and actionable ideas for traders. I just reworked the report to make it very actionable!

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The author always has positions in commodities markets in futures, options, ETF/ETN products, and commodity equities. These long and short positions tend to change on an intraday basis.

The author is long gold and silver.