DraftKings: Time To Assess Valuation As Sports Schedules Play Out To Year's End

As the only pure play in sports betting, DKNG belongs in any well balanced gaming portfolio. But at what price?

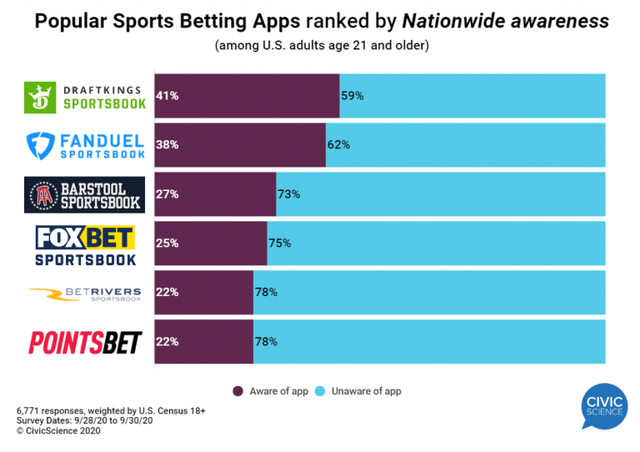

It's one of 6 sports betting apps that have relatively modest public awareness levels given their high visibility.

All DKNG's partnership deals, as is the case with their competitors, are expensive but have no proven value yet.

“Don’t tell me about the labor. Show me the baby…”

Former NY Giants, Jets, Dallas Cowboys Head Coach Bill Parcells

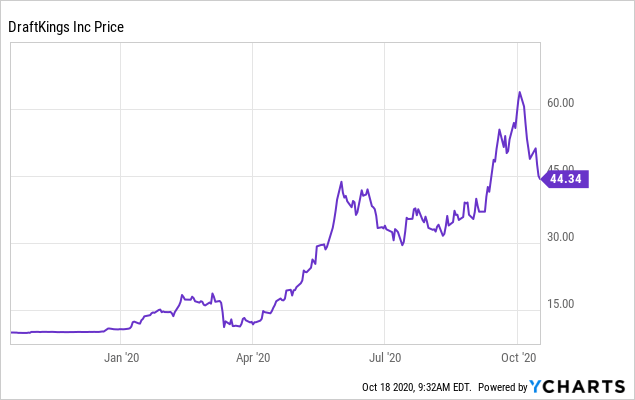

I have been on the SA record since DraftKings Inc. (DKNG) went public last April at $9 as a fan of the stock to rise organically into a realistic trading range. I still like the stock but questioned the valuation as it soared the last six months to a high of $63.78. I am not still not in tune with some of the more delusional valuations on DKNG since published by analysts who are projecting against wildly bullish expectations for the growth of the sector.

Yes, more states will legalize. There are now 16 states where sports betting has been legalized and/or pending full implementations. The big kahuna states remain problematical, but possible upstream at this point: New York (limited upstate only), California, Texas, among others. There is a good growth engine ahead for all sports betting stocks indeed. But what many analysts presume, is to me, unknowable at this early stage:

Data by YCharts

Data by YCharts

What shares of market can the 6 to 12 major players in the space ultimately achieve?

The fact is that this is going to be a balkanized marketplace with bettors characteristically chasing best odds, best deals, rather than expressing undying loyalty to keep their action confined to a single skin.

What’s more it remains also problematical as to what the brands are actually getting by signing mega partnerships deals with sports broadcasters, leagues and teams. Clearly there is some imprimatur value in such associations. But on closer examination, they tend to be little more than ad sponsorships and presentation of odds and various betting graphics during games. This is content any gambler can get any time from any one of 25 sources. This also raises the question as to the value of endorsement/marketing deals with name athletes.

They are nice to have, but how do you value their cost?

Above: This matrix of only 6 apps shows awareness levels of two leaders very close: Source: Civic Science.

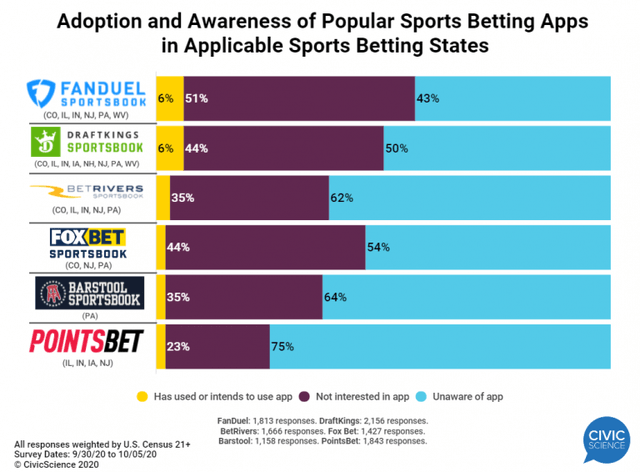

Above: This matrix of only 6 apps shows awareness levels of two leaders very close: Source: Civic Science. Above: In states where legal, Fan Duel awareness is significantly ahead of DKNG. But again, these six are half of total viable peers. Source: Civic Science)

Above: In states where legal, Fan Duel awareness is significantly ahead of DKNG. But again, these six are half of total viable peers. Source: Civic Science)

One scary prospect for the value of these deals is the current collapse of TV sports ratings: NBA Finals down 50%, US Open, down 40%, Kentucky Derby down 43%, Stanley Cup Finals down 61%, MLC down 40%. The pandemic appears to be the principal villain in these disastrous numbers as it has crowded the sports calendar into an eyeball traffic jam. Other observers sense a growing resentment over the virtue messaging that has intruded into what had long been considered by fans an oasis from the daily woes in the general media. There is little doubt ratings will rally at some point post pandemic. But to what extent? Will there be collateral post-Covid damage here?

The bigger question for betting app operators in such deals is this: Are core sports audiences these days so diverted by social media, tons of streaming shows, and other demands on eyeball time that they may never recover the ratings that are the engine of the valuation of their businesses? And by extension, the value for dollar spent on the partnerships with sports betting entities can reasonably come into question.

As ever, betting volume will follow compelling games and lapse when they are a shrug to fans. So sports betting volume growing exponentially may not be a total given.

DKNG has a deal with Michal Jordan. I think it’s fair to state that like most sports fans, my interest in Jordon today lies mostly within the confines of memories of watching his spectacular talent on display on the basketball court. But that was 35 years ago, a time when most millennials had not even been born.

(Above: Jordan's high positives may not translate into betting action over the long term. Jordan enjoys gambling in real life but whether it translates, is another matter when most millennials were either babies or not born when his fame was at its height. Source: DKNG archives)

(Above: Jordan's high positives may not translate into betting action over the long term. Jordan enjoys gambling in real life but whether it translates, is another matter when most millennials were either babies or not born when his fame was at its height. Source: DKNG archives)

DKNG does not sell sneakers. If as a kid you were among the millions who begged your parents to buy you the next pair of Air Jordans, you presumably are now at the age where you can legally bet on sports. Believing you could leap ten feet into the air wearing his sneakers when you were 8 years old does not translate now as a motivation for selecting a betting app. Best deal, best odds seem more likely to win your loyalty.

The point is this: Whether its Jordan or anyone else. Whether it’s this sports network or that one, these deal cost big time dollars. So when you’re in a business where your revenue hold on bets runs about 7% against a massive monthly expense for customer acquisition you’d better be sure that your partnership deals go beyond a corporate ego massage (Note last month’s record NJ handle of $748m sounds great but hold was down to 6% And overall volume y/y in football was flattish). The big gains in y/y handle came from a confluence of NHL, NBA and MLB pandemic schedules into a tightly packed betting calendar that may not reflect post-pandemic realities.

Yet on September 6th, the day the Jordan deal was announced, DKNG shares popped 6% to $41. (Price at writing here: $44). It was also within weeks when the company announced a $68.9m loss for 1Q20. This stock’s trade has become a creature of irrational responses to any media news positive or negative. It comes with the territory of course. And it will continue. All the more reason investors need to understand that fully.

So it all comes down to the famous movie quote fm Jerry McGuire “Show me the money!” Or as equally well put by Bill Parcells in the quote above.

Hard facts vs. hot breath

Let’s try to construct a realistic assessment of the future of the US sports betting sector and DKNG based on real world assumptions, not the trees grow to the skies projections we are getting from some analysts in the space.

A good place to begin is roughly one year ago. Morgan Stanley sponsored a presentation of the future of sports betting with top casino executives. At that session, MS laid down a forecast under an assumption that all states would have one form of sports betting or another by 2025. Out of that came their projection of a $15b industry by that year. That won’t happen for any number of reasons too lengthy to go into here. But I believe the MS estimate too low.

For perspective we looked at the total dollars wagered on sports since the US Supreme Court Decision in May 2018 striking down PASPA. Between June 2018 and up to an including October 12 of 2020, the total accumulated handle from all legal states was $27.4b. which yielded revenue to the sites totaling $1.860b. The hold percentage throughout this period was averaged at 6.8%.

For 2019 alone, the first full year of legal sports betting, the sites drew $13b in handle winning just under $1b. Beginning with these numbers, we contacted a panel of industry colleagues from casinos already deeply engaged in sports betting with both live books and mobile apps. For perspective we looked at the total dollars legally wagered on sports since the court ruling. Bear in mind, the American Gaming Association has put the total of illegal action at an estimated $150b a year.

With this baseline in mind, we looked for a consensus take on where our panel saw sports betting headed. The assumptions were these: First, that between 85% and 90% of all sports betting action going forward would come through mobile or desktop apps with around 10% from live books. Secondly, that we would be well past the pandemic with a full slate of pro and college sports schedules being played. Third that we would have between 24 and 28 states legalized. And we add here that these are estimates from on the ground gaming executives whose companies are all in on sports betting live and mobile.

The consensus range of revenues estimates (win) ran between a low of $5.2b to a high of $8.2b. All agreed that an average of 6.7% to 7% hold would prevail against the handle no matter the region of the country.

We took a guesstimate of total win at the best case scenario, ie., $8.2b which makes a 10% share of market worth approximately $800m. We think there are probably 6 to 8 sites that could clear the bar at 10% share of market by 2025. Of course, market leaders like DKNG and Fan Duel (OTCPK:PDYPY) are already well past that marker. But as the market expands, gaining share becomes harder and costlier to maintain. At some point the cost of adding marginal customers after core markets are shared out, outpaces per capita win potential. So our conclusion: The prospects for a scaling up from continuing losses to breakeven and most critically, the sky high earnings projections of some analysts in our view are overly bullish to extrapolate now. The move from losses to breakeven will be easier, as will low margin net operating profits. But forecasting massive money machines in light of how the industry is structured now, does not pass the test of the hard -nosed operatives we polled. There are just too many fine horses running in this race to produce a pure chalk favorite.

For context, total handle of all US race tracks live and online for 2019 came to $11b, slightly down from the previous year. For US casinos, total win (commercial and tribal) for the 1,000 properties ran around $71b last year. Hold percentages are considerably higher for casino games than they are for sports bets. They vary widely but we took an average between table games and slots of about 15% implying a handle in a range of ~$550b.

Because of the share of wallet factor making one stop shopping for casino and sports betting, Caesars is one of my top picks. (CZR). Their acquisition of William Hill plc (OTCPK:WIMHY) integrated into its 62m data base will produce a dominant share of wallet for seamless casino and sports betting revenues combined.

DraftKings: It’s tough to value now, easier next year with a full, normally sequential sports calendar.

DKNG generated $71m in 2Q20 revenue and is guiding pro forma revenue of $500m to $540m for all of 2020. The sports calendar from here to year’s end is rich in that it still has NFL, The World Series, The Masters Golf Tournament, and other fat betting opportunities.

But the Super Bowl will fall into 2021 as will the kick off of the 2021 NBA season. But we also have our ants at the picnic to contend with against so expansive a proforma as that made by DKNG. The biggest of these is of course what we call the emperor of all headwinds, the pandemic. We hope to see the NFL season play out unfettered by the much feared second pandemic wave expected to imminently break over all our heads. That could mean cancelled games here and there best case and worse case, a cancelled season if contagion rises to the horror story stages as it did last March/April. I

It could mean more cancellations throughout the entire sports calendar, until the arrival and mass inoculation of a family of vaccines. Right now, best possible guesswork by medical sources is anywhere between December and next April. DKNG could take a big fall. But not to worry. If DKNG soars by the media it also dives by the media. That’s key in an investment decision here. It’s a roller coaster ride you need to prepare for the day you buy the stock.

We think yes, DKNG and its peers could take a big hit if mass game cancellations materialize, but I also think they will recover quickly with the arrival of the vaccine within reasonable reach of 120 days. But just how much remains a puzzle.

We examined the management proforma guidance of $500m to $540m this year. While we don’t think it’s crazy, we do think it sort of getting ahead of itself. Assuming the NFL, fingers crossed, traverses the regular season with no disruption, we are putting our estimate somewhat more conservative at around the $410, to $425m range. Nobody knows yet what we are about to see both in the NFL and fan favorite SEC college football contests.

Our theory is simple:

Even in a best case growth scenario of a $8.2b market by 2025, if DKNG can muster a 15% share, which we think it can, you are looking at a projected revenue of ~$1.123b for the company in that year. We see losses continuing in the 60c to 75c per share for the company through to 2Q22 with breakeven in sight sometime by Q4 or before. Most of it is related to the continuing rise in customer acquisition costs which ran over $200m in 2Q and are likely to rise in Q3.

DKNG’s solid $1.2b cash position is a plus but it’s not a business, it’s a piggy bank. But even, the fattest piggy banks of being shook too long start sounding hollow. DKNG’s aggressive commitment to racing head to head with all competitors to capture market share with ever larger expenditures does have its limits. The reason: And this is not applicable only to DKNG. All competitive apps have succumbed to the same illnesses: The good old fashioned give away promotions that often attract as many worthless customers among much fewer potentially good ones. I speak from experience.

A current snapshot for context in 2019

Company 2019 revenues Stock price at writing

Churchill Dwns (CHDN) $1.329b. $172

(Online betting div) 61.8m

Fan Duel USA (OTCPK:PDYPY)) 419m $86.18

DraftKings 273m $44

Considering the above, DKNG looks like a great value. But is it?

So if we take DKNG’s proforma number for 2020 revenue at $500 million either in a close tie, or slightly less than Fan Duel, what does that auger for their competitors growing at the same time, in the same market subject to the exact headwinds and tailwinds of the sector? If DKNG got a strong revenue result in 2Q20 of $71m that would still bring it in around ~$300m far from its proforma guidance. However, we do believe in the growth trajectory for the entire sector will be buoyant. But headwinds could blow strong in 4Q20 so time will tell.

Marketing spend: All in or easy way out

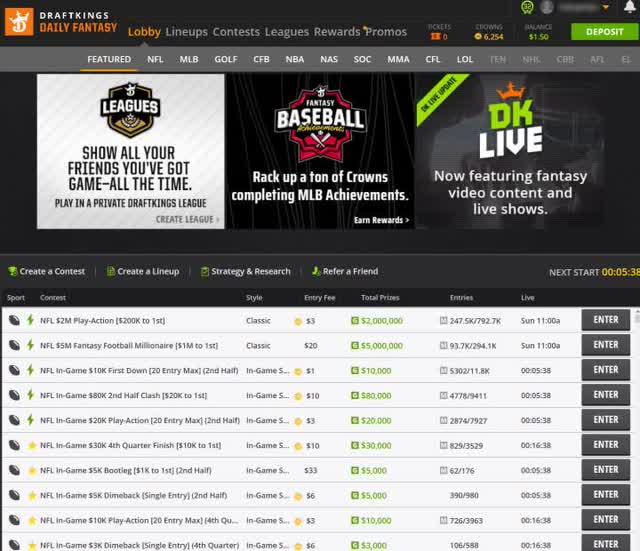

(Above: DKNG has done a good job in converting its DFS base into cash sports bettors. But will the same marketing techniques work long term in a highly fractionalized field?) Source: DKNG archives

(Above: DKNG has done a good job in converting its DFS base into cash sports bettors. But will the same marketing techniques work long term in a highly fractionalized field?) Source: DKNG archives

Some history first. Two staples of casino slot marketing promotion for decades have been the sweepstakes and car giveaways. These two promotional ideas are based on the old conviction: bring in the bodies, as many as you can, get the personal info, then bombard them with direct mail (back in the day) and now email promotional blasts. We all, in our frustration before the advent of sophisticated customer tracking programs, fell victim to it when in down cycles, we had the wits scared out of us when we walked the casino floor and saw a morgue. And yes, I gave away cars. And millions in free slot play over the years. The idea was to ID players. The problem was out of 25,000 entries to either win a car or a sweepstakes, usually resulted with as much as 90% worthless names as to their gaming potential. But seeing the casino floor with lots of bodies milling around the entry boxes was better than a morgue. Technology has since taken giant steps to improve the odds of such promotions working. But the truth is, when you give too much free stuff, you debase the value perception of the product you want to sell for cash.

Today we have a sports betting operators using “free money giveaways“ betraying the same lack of ground rooting, customer by customer development contact and events to grow a viable data base. Some of these promotions border on the ludicrous where operators a paying off “bets” that a given team will score a single touchdown. Others pay $1,000 site credits for betting a buck on absurd sure things. We are slowly entering beggar thy neighbor territory among the operators that could come crashing down on all their heads sooner rather than later given the high cost of measured media to advertise these promotions. So within the context of my experience in the gambling business what we have now in the realm of sports betting marketing is a direct descendant of the old bingo hall hustle, transmogrified into slot promotions now in full flower on sports betting apps.

Remember in sports betting the products are not the app: The product is the game and the passion it arouses. The product is the odds, the exotic bets conjured, the ease of transaction. All sites share that reality in common.

DKNG and its competitors certainly have the cash to run out the clock till profits arrive for certain. And the guiding strategy of glomming as many new customers as possible at any cost in a pie that’s growing bigger by the month isn’t so much wrong. It’s entirely understandable. What I do not see anywhere yet is the hard road ahead of hand to hand combat for quality customers tiered by average monthly laydowns, win and loss records and potential expansion.

That’s what happens when you have a business predominately conducted without face to face contact, but merely button pushing on screens. (Most sports betting apps are absolutely technically great. Their consumer facing bet processing is excellent and it’s hard to pick any one that is superior in any way to any other. It’s a commodity to be frank). Some investors see it as a utility business and celebrate that prospect. But utilities are regional monopolies. Sports betting apps work in markets with more than 10 competitors on average. So my guess is what all this will lead to is this: No single app will emerge in the space with a dominant enough market share to justify some of the prices to which their stocks have risen.. All of the best ones will do well. Once they get past the present promotional hysterics and focus in on hand to hand combat with deals precisely layered to customer potential to a much more sophisticated level than now employed, watch those losses begin to shrink. You will have mass slashing of data bases that contain untold minions of worthless customers. You will see more to more one on one contact through special events where key marketing personnel can interact with valuable customers and build solid, long term relationships.

In the meantime, sports betting stocks are being driven by what I believe are almost South Sea Bubble levels of soaring prices. Investors need to realize that. Good for everyone who bought in cheap and now sits on a nice fat gain. My advice: Sell, put the money into a a gaming ETF like VanEck Vectors, and more specifically, BETZ and wait it out.

These portfolios will have you covered for all the best of breed in the space until such time when you begin to see losses shrinking, top side revenue beginning to reach management pro forma guidance. Then it’s time to pounce.

DKNG has a good management, sound tech support, a great customer interface and a management benefitting from its first mover position since all this madness began.

For that reason we guide as follows:

- If you are holding DKNG at a fat profit, unload it and buy a good gaming ETF. They hold the stock as well.

- If you don’t own it yet, it does belong in your portfolio. Over the next few weeks we can see some softening possible. If DKNG drops into the high twenties, buy. if we have a second wave that decimates the NFL season, we could see a very attractive entry point. Post pandemic I’m guiding iDKNG back up to the $42 to $48 range.

- Don’t be overly impressed by the joint marketing and partnership deals. DKNG recently closed a deal with Turner Sports to become their official sports betting partner.

It's nice to have, but its costly and its value is yet to be proven to this grizzled old gaming guy.

Most of all, in DKNG you have a pretty sound management group at the helm. They do some head scratching things but overall they are fast learners when toes are stubbed.

It’s not here yet, but the time is getting closer where DKNG will have to show us the baby.

The House Edge Moves Ahead

- Returning 20.8% on average

- Producing a 68% hit rate

- Ranked in the top 1% of bloggers.

Sign up now for The House Edge and get in for $40/month or $350/year. Get the House Edge on your side!

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.