Adding NextEra Energy To The Carbon Thesis Portfolio

Carbon spread thesis is the market will reward energy companies that are moving toward renewables and punish companies that are stuck with fossil fuels.

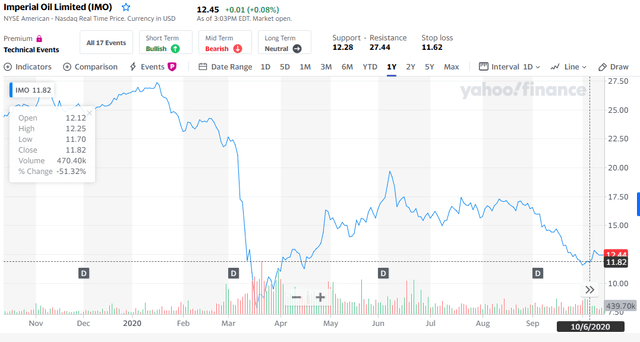

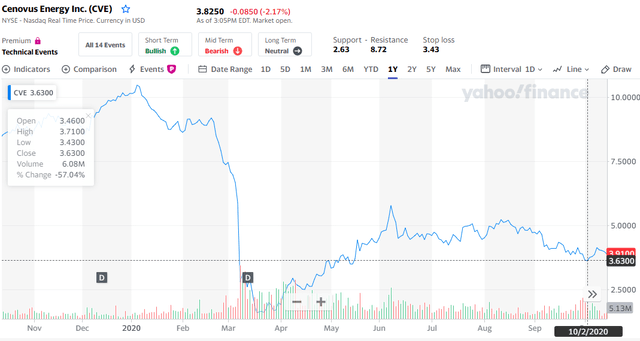

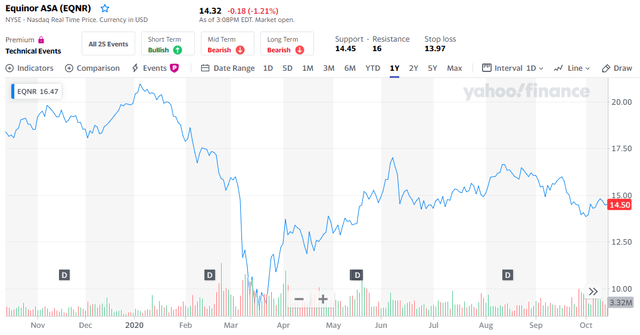

Initial spread was long EQNR, short IMO and CVE oil sand stocks.

Added NEE as a new long and added to short CVE position.

On July 30th, my article, “Trading The Carbon Spread: Long Equinor, Short Imperial Oil And Cenovus Energy,” was published on Seeking Alpha. The thesis is that the market will reward energy companies that are strategically moving toward clean energy sources and punish those whose future is focused on fossil fuels, even if they try to reduce their greenhouse gas emissions.

My first positions were long Equinor (EQNR) and short Imperial Oil (IMO) and Cenovus Energy (CVE). EQNR also has an offshore wind portfolio that includes three wind farms off of the UK, and is involved in large-scale wind projects off of the UK, Germany and the US. Empire Wind, off of Long Island, New York, is projected to power one million homes starting in 2025.

IMO and CVE are Canadian oil sands producers. After 50+ years of production, the oil sands remain among the world’s most carbon-intensive large-scale crude oil operations. Though both companies had announced plans to reduce their greenhouse emissions, Norges Bank announced its decision to exclude certain oil companies from its portfolio, due to ethical considerations, including IMO and CVE.

Since the positions were initiated on July 29th, the IMO share price has dropped 26%, CVE has dropped 16%, and EQNR has dipped 6%. Therefore, the carbon spread has been profitable already. I view this position as a long-term hold.

Source: Yahoo Finance.

Source: Yahoo Finance.

Source: Yahoo Finance.

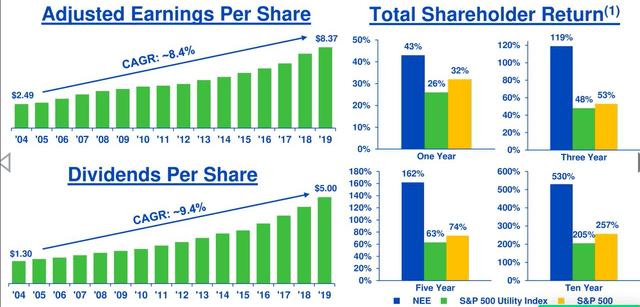

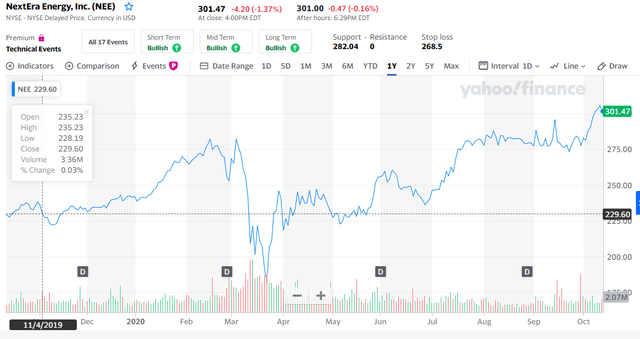

I added another long position to my carbon spread portfolio, long NextEra Energy (NEE) to be offset by additional short positions in the oil sands stocks. NEE is the largest electric utility in the United States by retail MWh sales. It is also the largest energy company in the U.S. with a market capitalization ($147.6 billion) exceeding Exxon Mobil (XOM) ($144.7 billion) and Chevron (CVX) ($141.3 billion), as of October 13th. NEE is the world leader in generating electricity from the wind and sun.

NEE has a long-term track record in rewarding investors:

Source: Yahoo Finance.

The company has been striving to grow the world’s largest wind, solar and storage portfolio for 25 years.

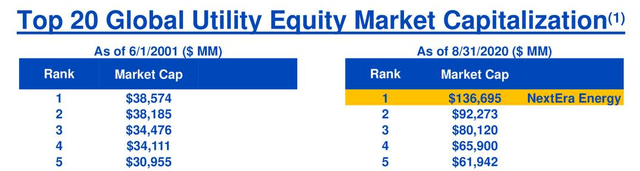

And it grew from number 30 in 2001 to number 1 in 2020.

In addition to being the world's largest generator of renewable energy from the wind and sun and a world leader in battery storage, NextEra Energy generates clean, emissions-free electricity from eight commercial nuclear power units in Florida, New Hampshire, Iowa and Wisconsin.

According to its materials, NextEra Energy is ranked No. 1 in the electric and gas utilities industry on Fortune's 2020 list of "World's Most Admired Companies" and ranked among the top 25 on Fortune's 2018 list of companies that "Change the World."

Stock Split

NextEra Energy's board of directors has approved a 4-for-1 stock split in a bid to "make stock ownership more accessible to a broader base of investors." With a lower price per share, more investors could find the stock affordable. The record date will be Oct. 19, 2020, they will distribute the additional share to shareholder accounts on Oct. 26.

It also raised its guidance through 2023, the first time that the renewable energy company is issuing guidance for 2023.

NextEra raised its guidance range by $0.20 per share and now expects adjusted earnings of $9.60 to $10.15 per share in 2021. Furthermore, NextEra expects earnings in 2022 and 2023 to grow by 6% to 8% off its projected 2021 adjusted EPS. Management is confident of hitting the top end of its guidance range in each of the three years while maintaining a strong credit rating and delivering value to shareholders.

"The market for low-cost renewables continues to rapidly expand, and we believe our best-in-class development skills leave us uniquely positioned to capitalize on these significant investment opportunities," said CEO Jim Robo.

Conclusions

NEE is a world leader in renewables and clean energy and has a bright future as the world decarbonizes. A long position in the company, offset by short positions in the oil sand producers provides an attractive risk-reward investment because it is largely immune to oil prices due to the offsets and the clear positive direction for NEE and negative outlooks for IMO and CVE.

To guide investors who are interested in profiting from outstanding opportunities in the energy sector, I provide a service on Seeking Alpha’s Marketplace oriented toward individual investors, Boslego Risk Services. A long/short Model portfolio is continuously updated, along with on-going analysis of the oil market.

I am now accepting new members to Boslego Risk Services and invite you to sign up. There are monthly and annual pricing options as described here. You may also read reviews posted by members here.

Disclosure: I am/we are long NEE, EQNR. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Short CVE and IMO.