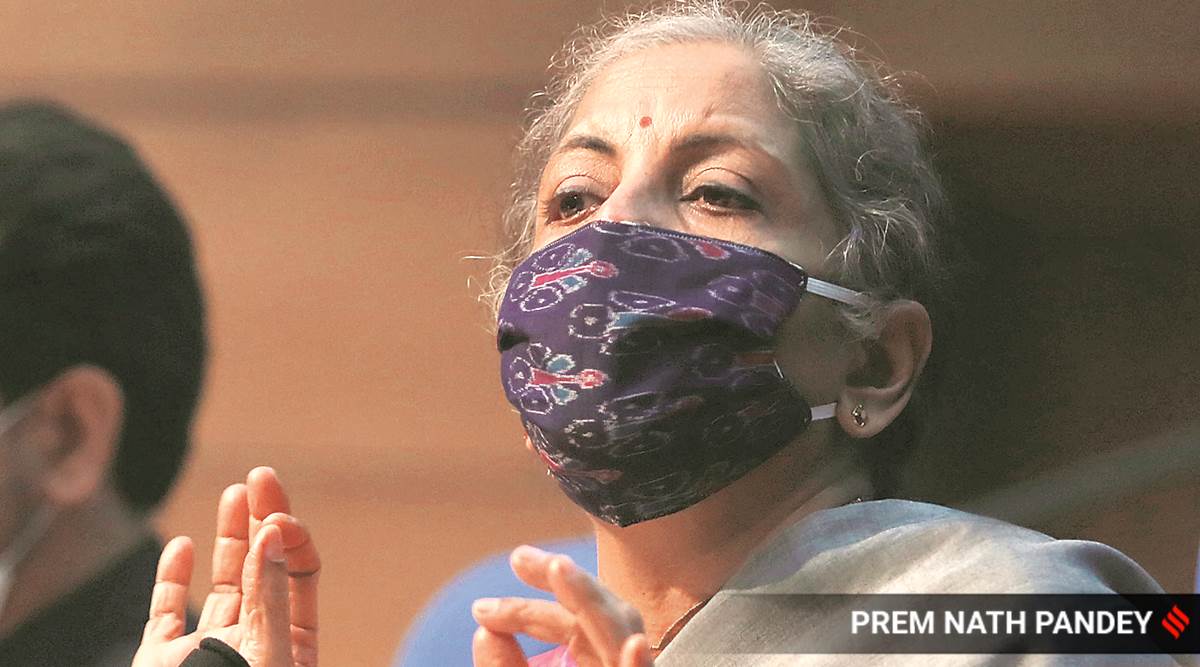

Sitharaman in New Delhi on Monday. (Express Photo: Prem Nath Pandey)

Sitharaman in New Delhi on Monday. (Express Photo: Prem Nath Pandey) To stimulate growth in the economy, the government on Monday announced a twin set of measures to boost consumption demand and capital expenditure, which along with participation of the private sector, are estimated to result in quick spending of more than Rs 1 lakh crore by March-end.

Through the Leave Travel Concession (LTC) voucher scheme, which can be availed by private sector employees as well, and a festival advance for government employees, the Finance Ministry has tried to advance consumption of non-essential, relatively high-value goods and services in the economy.

Like in the earlier leg of its relief package in May, the series of announcements made by the Finance Ministry on Monday continued with the basic design of leveraging a degree of stimulus with minimal fiscal cost to the exchequer.

Announcing the package, Finance Minister Nirmala Sitharaman said supply constraints in the economy had eased over recent months, but consumer demand remained affected — and these measures were aimed at advancing consumer spending and capex in a “fiscally prudent way”. Capital expenditure steps are “directly linked to increase in economic output (GDP), given their high multiplier effect”, she said.

Some economists argued that the amounts were too small to have any meaningful impact on economic growth, and that there was no additional spending push from the government itself. In response to a query, Department of Economic Affairs Secretary Tarun Bajaj said these measures would not require any extra borrowing by the central government.

An additional Rs 25,000 crore is being provided for capital expenditure on roads, defence infrastructure, water supply, urban development, and domestically produced capital equipment. This is expected to come through re-allocation of resources.

Special assistance will be provided to states in the form of interest-free 50-year loans of Rs 12,000 crore, which can be used only for capex purposes, with certain conditions.

“It (the package) will help a little bit on the demand side, but amounts are very small… There will be some demand impetus, but how much it will be, I don’t know. It will be very small I guess… Also the Rs 12,000 crore, when divided among all the states, comes to nothing,” Pronab Sen, former Chief Statistician of India, said.

“This is really not the stimulus that is required. Now we need a much stronger stimulus. This involves virtually no additional expenditure for the central government. After all, somebody has to make the additional expenditure,” Sen said.

Sitharaman argued steps were being taken keeping in mind that these “must not burden the common citizen with future inflation”, and “must not put government debt on an unsustainable path”.

Central government employees will be provided tax benefits on LTC component without having to actually travel. The employees would be required to spend three times the LTC fare component to purchase items that attract 12% or more Goods and Services Tax (GST). What this effectively means is that if your fare component of LTC is Rs 40,000, you need to spend Rs 1.2 lakh on goods that fall in the 12% or more GST slab in order to save tax on Rs 40,000.

As for the leave encashment component of LTC, the employee will have to spend an equivalent amount towards purchase of goods that attract GST of 12% or more.

Through the LTC consumption boost plan, the government expects a demand generation of Rs 28,000 crore in the economy. While it expects additional demand creation of around Rs 19,000 crore on account of demand from central government employees, another Rs 9,000 crore is estimated from state government employees. Private sector employees can also avail of this scheme.

“The AtmaNirbhar package that was announced earlier addressed the requirement of essential goods for needy sections of the society. Now these measures aim at promoting consumption of high-value items by those employees whose salaries and jobs have not been affected by Covid-19 pandemic,” a senior Finance Ministry official said.

Since most employees have not been able to travel after the start of pandemic, the shifting of the LTC benefit is expected to generate demand elsewhere, although it may impact the travel and tourism industry — where demand has already been severely dented — negatively.

Under the festival advance scheme, all central government employees will get interest-free advance of Rs 10,000 that will be recovered in 10 instalments. It will be given in the form of a pre-loaded RuPay card of the advance value. The government expects to disburse Rs 4,000 crore under the scheme by March 31.

According to the Finance Ministry, if all states provide similar advances, another Rs 8,000 crore is likely to be disbursed.

“The timing of these announcements is just right, as we are entering the festival season, and this should help improve consumer sentiment and demand in the economy,” FICCI president Sangita Reddy said.

“Some people who are in need of buying household items will definitely go for it – say, to buy items such as TVs, computers, laptops, iPads as these are required now given most work has moved online. But the benefits are not much, and it is conditional – maybe 15-20 per cent of employees may go for it,” said a senior central government employee, who asked not to be named.

“Overall, the amount of demand stimulus is underwhelming, and we view the impact on both fiscal and growth as quite limited. With the previous rounds of budgetary fiscal support around 1% of GDP, today’s demand stimulus measures take total fiscal support (on budget) to about 1.2% of GDP, which is small compared with the size of the growth hit, and reflects India’s weak fiscal starting position,” Nomura said in its assessment of the measures.

For the 50-year interest-free loans to boost capex, states have been categorised into three groups: Group 1, which includes the Northeastern states (Rs 1,600 crore) and Uttarakhand and Himachal Pradesh (Rs 900 crore); Group 2, which has other states which will get Rs 7,500 crore in proportion to their share as per the Finance Commission devolution; and Group 3, having states which will get a total Rs 2,000 crore if they meet three out of four reforms, including One Nation One Ration, outlined in the government’s AtmaNirbhar package.

The funds, which need to be spent by March 31, 2021, can be used by states for ongoing and new projects and settling contractors’ bills on such projects. The funds provided to states will be over and above their borrowing ceilings.

“The government is seeking to time this boost to coincide with the upcoming festive period and spur overall consumption while also being spending-lite so as not to put additional burden on the exchequer, in the midst of a notable shortfall in tax and divestment revenues. For an outsized boost to demand, the private sector will be required to take the cue and mirror some of the benefits announced by the Finance Ministry. For states, if tapped, part of these funds might be channelled to finance brown/shovel-ready projects as well as plug near-term dues,” Radhika Rao, economist, DBS Group Research, said.

📣 The Indian Express is now on Telegram. Click here to join our channel (@indianexpress) and stay updated with the latest headlines

For all the latest Business News, download Indian Express App.