MUMBAI/NEW DELHI: The finance ministry asked banks in a meeting with the lenders on Friday to speed up disbursement of loans under the PM Street Vendor’s AtmaNirbhar Nidhi (PM SVANidhi) scheme. As part of this, any street vendor registered with an urban body is eligible for a collateral-free loan of Rs 10,000.

The government has put in place an online platform where it can get a view on the status of all loans disbursed under the scheme. Although the PM SVANidhi — aimed at benefiting 50 lakh street vendors — was announced by the finance minister, it is being operationalised through a tie-up between the housing & urban affairs ministry and Sidbi. As against the targeted 50 lakh, only 21 lakh applications have been collected, 9 lakh loans sanctioned and 2.7 lakh disbursed.

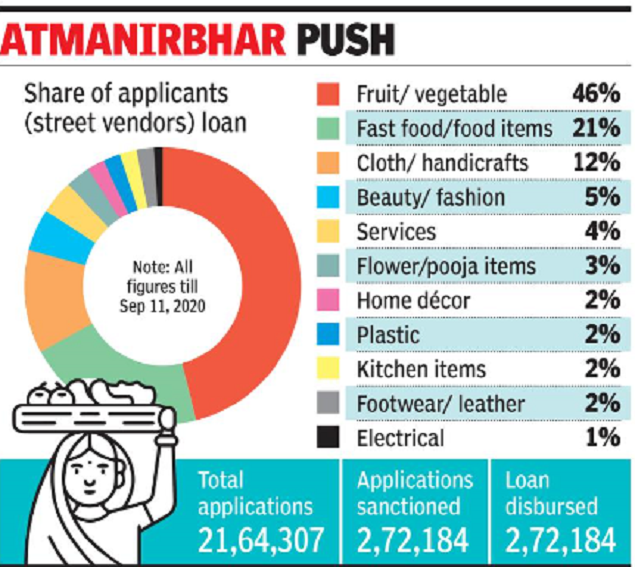

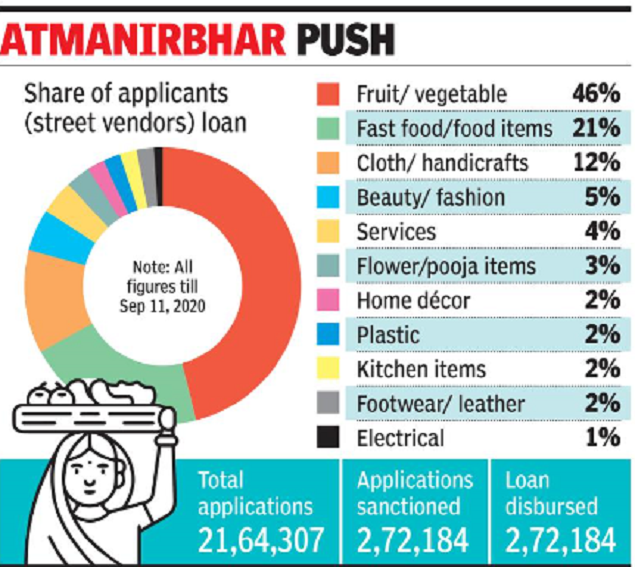

Street vendors selling fruits and vegetables have the maximum share of 46% of total 21.64 lakh loan applications that the banks and financing agencies have received under the scheme. Women vendors comprise 40% of all the applications received till Sunday.

The official data show that Varanasi Municipal Corporation leads the list of municipal areas where 10,000 vendors have got the loan followed by Indore (7,838) and Bhopal (7,483). A total of only 271 street vendors have got the loan in Delhi, which has four municipal bodies and one cantonment area.

The total disbursed amount is Rs 266 crore. SBI tops the list with 5.2 lakh applications and 75,000 sanctioned loans, followed by Union Bank which has received 2.2 lakh applications and has sanctioned 45,000. Others in the top five are Bank of India, Canara Bank and Central Bank.

Among all states and UTs, a maximum of 1.19 lakh applicants have got the loan where bypolls are scheduled for 28 seats. Telangana has the second highest such applications (44,000) followed by Uttar Pradesh (43,200).

The scheme provides for incentives in the form of interest subsidy at 7% per annum on regular repayment of loan and cash-back upto Rs 1,200 per annum on undertaking prescribed digital transactions.

Moreover, on timely or early repayment, the vendors will be eligible for the next cycle of working capital loan with an enhanced limit.

The government has put in place an online platform where it can get a view on the status of all loans disbursed under the scheme. Although the PM SVANidhi — aimed at benefiting 50 lakh street vendors — was announced by the finance minister, it is being operationalised through a tie-up between the housing & urban affairs ministry and Sidbi. As against the targeted 50 lakh, only 21 lakh applications have been collected, 9 lakh loans sanctioned and 2.7 lakh disbursed.

Street vendors selling fruits and vegetables have the maximum share of 46% of total 21.64 lakh loan applications that the banks and financing agencies have received under the scheme. Women vendors comprise 40% of all the applications received till Sunday.

The official data show that Varanasi Municipal Corporation leads the list of municipal areas where 10,000 vendors have got the loan followed by Indore (7,838) and Bhopal (7,483). A total of only 271 street vendors have got the loan in Delhi, which has four municipal bodies and one cantonment area.

The total disbursed amount is Rs 266 crore. SBI tops the list with 5.2 lakh applications and 75,000 sanctioned loans, followed by Union Bank which has received 2.2 lakh applications and has sanctioned 45,000. Others in the top five are Bank of India, Canara Bank and Central Bank.

Among all states and UTs, a maximum of 1.19 lakh applicants have got the loan where bypolls are scheduled for 28 seats. Telangana has the second highest such applications (44,000) followed by Uttar Pradesh (43,200).

The scheme provides for incentives in the form of interest subsidy at 7% per annum on regular repayment of loan and cash-back upto Rs 1,200 per annum on undertaking prescribed digital transactions.

Moreover, on timely or early repayment, the vendors will be eligible for the next cycle of working capital loan with an enhanced limit.

Download

The Times of India News App for Latest India News

Coronavirus outbreak

Trending Topics

LATEST VIDEOS

India

Must avoid large gatherings in festival season: Health minister

Must avoid large gatherings in festival season: Health minister  Gymnast Dipa Karmakar flags off cycle rally in Agartala

Gymnast Dipa Karmakar flags off cycle rally in Agartala  Mangaluru student develops ‘AgriBot’ to assist farmers

Mangaluru student develops ‘AgriBot’ to assist farmers  Donald Trump’s ‘biggest fan’ in India dies of cardiac arrest

Donald Trump’s ‘biggest fan’ in India dies of cardiac arrest  MP bypolls: Jyotiraditya calls himself 'Maharaja Scindia', Congress fires salvo

MP bypolls: Jyotiraditya calls himself 'Maharaja Scindia', Congress fires salvo  Shopian school under scanner after 13 students found linked to terror groups

Shopian school under scanner after 13 students found linked to terror groups

More from TOI

Navbharat Times

Featured Today in Travel

Quick Links

Coronavirus in MumbaiCoronavirus in KolkataCoronavirus in HyderabadCoronavirus in DelhiCoronavirus in BangaloreCoronavirus symptomsCoronavirus in IndiaWhat is CoronavirusCoronavirus NewsSolar EclipseNPRWhat is NRCCAB BillCAB and NRCRTI BillPodcast newsLok SabhaShiv SenaYSRCPCongressBJP newsUIDAIIndian ArmyISRO newsSupreme Court

Get the app