MUMBAI: Newly appointed chairman of State Bank of India, Dinesh Khara, has said that the Covid-related stress on the borrowers of the country’s largest bank is manageable and there is not much visibility on clients seeking restructuring. He, however, said that SBI would continue with its tradition of making upfront provisions for stressed loan accounts.

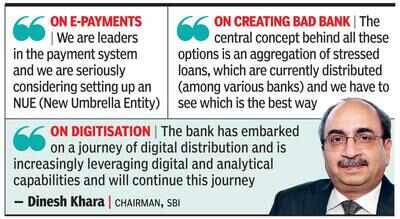

Addressing the media for the first time after taking charge, Khara said he was proud to be part of the bank and humbled with the appointment. He listed his priorities to include health of employees & customers, maintaining asset quality and generating value for all stakeholders. “The bank has embarked on a journey of digital distribution and is increasingly leveraging digital and analytical capabilities and will continue this journey,” said Khara.

Speaking on the likelihood of bad loans rising in the wake of the Covid pandemic, Khara said the bank has fully provided for all its legacy loans. “Right now, we do not have a visibility on the cases that will need to undergo restructuring because of Covid. Overall, we are not envisaging this as a concern,” said Khara. He added that one of the indicators of stress was the change in cash flows into large corporate accounts and the bank has been monitoring these during the lockdown. “While I would not say everything is hunky dory, what is seen is manageable,” he said.

Khara said the bank had raised subordinated debt and was not planning to immediately raise equity capital. “Our capital adequacy is sufficient. We will reach out for equity capital-raising as and when we see building up of assets,” said Khara. At the same time, he pointed out that while there was good growth in retail, corporates were moving away from credit market to the bond markets to raise funds. Responding to a query on business recovery, Khara said that while there was an improvement, the business was still 70-80% of pre-Covid levels. On growth, Khara said SBI had a market share of 23%, which was significant given the economy’s size. He said that while the bank would grow, the focus would be on asset quality and net interest margins. Pointing out that SBI’s price-to-book value was only 0.3 times, he said that any CEO would like to see an improved valuation. He, however, ruled out any immediate value-unlocking by listing any of the subsidiaries — SBI General Insurance or SBI Mutual Fund.

From all indications, the new leadership is unlikely to result in a change in the overall strategy and digitisation for the bank. “The bank has embarked on a journey of digital distribution and is increasingly leveraging digital and analytical capabilities and will continue this journey,” said Khara. He also reaffirmed the bank’s intention of pursuing a licence for setting up a new umbrella entity (NUE) in the payment space where the RBI had called for applications. “We are leaders in the payment system and we are seriously considering setting up an NUE,” he said.

On the need for a bad bank to take over legacy bad loans and clean up books of banks, Khara said that various options were being looked at by lenders including a bad bank and asset reconstruction company. “The central concept behind al these options is an aggregation of stressed loans, which are currently distributed (among various banks) and we have to see which is the best way,” said Khara.

Addressing the media for the first time after taking charge, Khara said he was proud to be part of the bank and humbled with the appointment. He listed his priorities to include health of employees & customers, maintaining asset quality and generating value for all stakeholders. “The bank has embarked on a journey of digital distribution and is increasingly leveraging digital and analytical capabilities and will continue this journey,” said Khara.

Speaking on the likelihood of bad loans rising in the wake of the Covid pandemic, Khara said the bank has fully provided for all its legacy loans. “Right now, we do not have a visibility on the cases that will need to undergo restructuring because of Covid. Overall, we are not envisaging this as a concern,” said Khara. He added that one of the indicators of stress was the change in cash flows into large corporate accounts and the bank has been monitoring these during the lockdown. “While I would not say everything is hunky dory, what is seen is manageable,” he said.

Khara said the bank had raised subordinated debt and was not planning to immediately raise equity capital. “Our capital adequacy is sufficient. We will reach out for equity capital-raising as and when we see building up of assets,” said Khara. At the same time, he pointed out that while there was good growth in retail, corporates were moving away from credit market to the bond markets to raise funds. Responding to a query on business recovery, Khara said that while there was an improvement, the business was still 70-80% of pre-Covid levels. On growth, Khara said SBI had a market share of 23%, which was significant given the economy’s size. He said that while the bank would grow, the focus would be on asset quality and net interest margins. Pointing out that SBI’s price-to-book value was only 0.3 times, he said that any CEO would like to see an improved valuation. He, however, ruled out any immediate value-unlocking by listing any of the subsidiaries — SBI General Insurance or SBI Mutual Fund.

From all indications, the new leadership is unlikely to result in a change in the overall strategy and digitisation for the bank. “The bank has embarked on a journey of digital distribution and is increasingly leveraging digital and analytical capabilities and will continue this journey,” said Khara. He also reaffirmed the bank’s intention of pursuing a licence for setting up a new umbrella entity (NUE) in the payment space where the RBI had called for applications. “We are leaders in the payment system and we are seriously considering setting up an NUE,” he said.

On the need for a bad bank to take over legacy bad loans and clean up books of banks, Khara said that various options were being looked at by lenders including a bad bank and asset reconstruction company. “The central concept behind al these options is an aggregation of stressed loans, which are currently distributed (among various banks) and we have to see which is the best way,” said Khara.

Download

The Times of India News App for Latest Business News

more from times of india business

Quick Links

ELSS Mutual Funds BenefitsIncome Tax Refund statusWhat is AssochamITR Filing Last DateHome Loan EMI TipsHome Loan Repayment TipsPradhan Mantri Awas YojanaTop UP Loan FeaturesIncrease Home Loan EligibilityHome Loan on PFTax Saving Fixed DepositLink Aadhaar with ITRAtal Pension YojanaNita AmbaniIndian EconomyRBIAadhaar CardSBIReliance CommunicationsMukesh AmbaniIndian Bank Ifsc codeIDBI Ifsc codeIndusind ifsc codeYes Bank Ifsc CodeVijay Bank Ifsc codeSyndicate bank Ifsc CodePNB Ifsc codeOBC Ifsc codeKarur vysya bank ifscIOB Ifsc codeICICI Ifsc codeHDFC Bank ifsc codeCanara Bank Ifsc codeBank of baroda ifscBank of America IFSC CodeBOM IFSC CodeAndhra Bank IFSC CodeAxis Bank Ifsc CodeSBI IFSC CodeGST

Get the app