These PMS schemes are largely from the small & midcap space. Some of the stocks they invested in include Jindal Steel & Power, Future Enterprises, DCB Bank, Max Healthcare and KPIT Technologies.

Indian market recorded positive returns in August and as many as 120 Portfolio Management Services (PMS) schemes managed to outperform the index in the same period, data from PMSBazaar.com showed.

As many as 127 PMS schemes across themes rallied more than 3 percent in August compared to 2.8 percent gain seen in the Nifty50. Out of 127 schemes, 24 gave double-digit returns in the same period.

PMSes cater to wealthy investors with portfolio sizes exceeding Rs 50 lakh. The professional fee structure is also different from a regular mutual fund (MFs).

related news

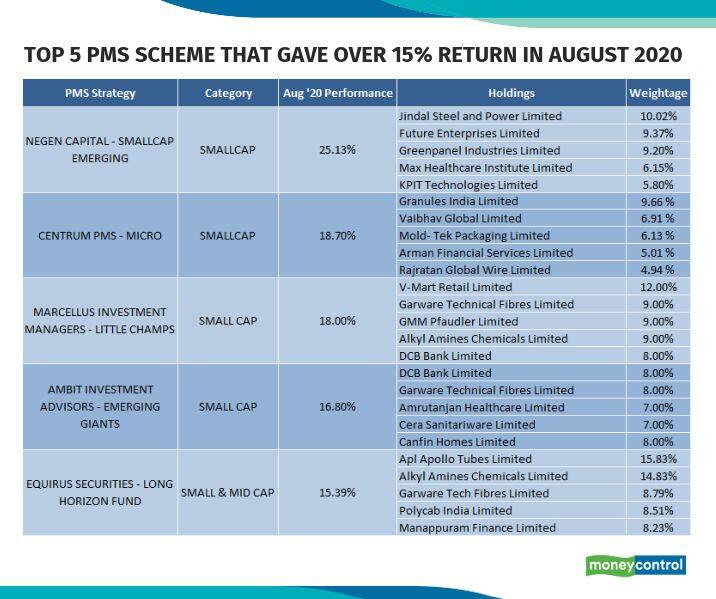

The schemes which recorded double-digit returns in August were largely from the small & midcap space. Negen Capital's Small Cap Emerging topped the list with a whopping 25.13 percent return during August.

Top 5 holdings of Negen Capital’s Smallcap Emerging Fund are Jindal Steel & Power, Future Enterprises, Greenpanel Industries, Max Healthcare and KPIT Technologies.

“We are predominantly value investors. But, lately, we are also paying a lot of attention to growth. A combination of value plus growth has been the reason for our stocks to do well,” Neil Bahal - Managing Director - Negen Capital told Moneycontrol.

“Recently, we have also developed a system which enables us to pin-point on sectors where there is a tailwind of earnings. Once you can identify a sector that is doing well, then the job becomes easier to identify the leaders in the space,” he said.

A close look at the data suggests that the broader market was clearly in favour and with SEBI guidelines on multicaps coming into play the interest is likely to increase further.

Data suggests that mutual fund (MF) flows into midcap stocks improved further in August while outflows were largely seen from largecaps and marginal selling in smallcaps.

“The small and midcap category could attract institutional flows in an environment of continued global liquidity post the new ‘flexible inflation targeting’ framework of the US Fed, valuation discount post the significant underperformance of small and mid-caps to large-caps since January 2018 and regulatory push,” ICICI Securities said in a note.

“The latest circular by SEBI mandates the largest category of equity schemes offered by MFs to hold a minimum 25 percent of AUM in each of the mid and small-cap stocks categories,” it said.

Gaurav Garg, Head of Research at CapitalVia Global Research Ltd told Moneycontrol that small and midcaps have become the new choice among investors who are willing to expand this segment in their portfolio.

“This segment has not reached its stagnation and a good amount of upside movement is possible, therefore this sphere is attracting a lot of investors and it can be said that considerable sums are flowing here,” he said.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.