In the SARs filed with US Financial watchdog FinCEN, one common name across all transactions is Mauritius-based Trans Global Minerals and Metals Corporation which, according to the SARs, is a company incorporated in Cyprus in 2006 with a registered address in Mauritius.

In the SARs filed with US Financial watchdog FinCEN, one common name across all transactions is Mauritius-based Trans Global Minerals and Metals Corporation which, according to the SARs, is a company incorporated in Cyprus in 2006 with a registered address in Mauritius.Three different Suspicious Activity Reports (SARs) filed by Deutsche Bank Trust Company Americas (DBTCA) regarding funds received and sent by Jindal Steel and Power Ltd (JSPL) red-flag a transaction pattern where it sent money to companies based in Mauritius, Germany, and the UK, and received funds from companies based in Dubai and Switzerland within the same set of days, an investigation by The Indian Express has revealed.

The SARs show:

* Between November 24, 2014 and January 28, 2015, JSPL sent $1.799 million to Mauritius-based Trans Global Minerals and Metals Corporation (TGMM) and also sent $1.3 million to Germany-based Oceanwide Services GmbH. During the same period, JSPL received $1.323 million from Dubai-based Power Plant EPC Ltd.

* In a similar set of transactions, between April 27, 2015 and June 1, 2015, while JSPL sent $4.53 million to TGMM and another $321,209 to Singapore-based Western Bulk Pte Ltd, the company received $2.48 million from Dubai-based Power Plant EPC within the same period.

* A year later, a similar transaction pattern was seen. Between June 23, 2016 and October 26, 2016, JSPL sent $9.48 million to TGMM; $1.83 million to Singapore-based CBMM Asia Pte Ltd between May and September 2016; $1.52 million to Navalmar (UK) Ltd between May 31 and October 24, 2016. And JSPL received $16.8 million from Switzerland-based Trans Global AG between June 27 and July 21, 2016.

In the SARs filed with US Financial watchdog FinCEN, one common name across all transactions is Mauritius-based Trans Global Minerals and Metals Corporation which, according to the SARs, is a company incorporated in Cyprus in 2006 with a registered address in Mauritius.

Although transaction details related to TGMM say the payments were made for “Handling charges, Commission, and Payment towards (cargo ship) Vessel MV EIPIS,” the company’s banker, Standard Bank Mauritius, told DBTCA that the main business activity of TGMM is investment holding, international consulting & international Trading.

While the bank confirmed that the owner of the company is an Indian, Amit Gupta, with regard to a previous investigation, the bank said that TGMM had a broker-investor relation with its clients and “the purpose of payment instructions was investment of idle funds in Australian stock market”.

This doesn’t square with JSPL’s claim that its transaction was for payments towards Vessel MV EIPIS.

In fact, in the 2016 SAR where TGMM is reported to have received $9.48 million from JSPL, the bank pointed out that “no line of business was noted.”

Also Read | Fincen Files — On US radar: Dawood Ibrahim’s financier, his laundering, funding of Lashkar, Jaish

Another company with a similar name was Switzerland-based Trans Global AG from which JSPL received $16.8 million in 2016, According to the SAR, Trans Global AG is engaged in “Whole Farm Product Raw Materials”. Asked if there was any relationship between TGMM and Trans Global AG, a spokesperson for JSPL said, “We are not aware about relationship between these companies.”

“These are completely separate transactions…amount received from Trans Global AG was against export of Iron Ore Pellets to them and amount sent to TGMM was against ship charting and coal purchase,” the spokesperson said.

While JSPL received around $3.8 million from Dubai-based Power Plant EPC, the bank noted that while no line of business was found, it was also not able to determine details of the firm. It said it had not been able to confirm the commercial purpose of the transactions through independent research.

While Amit Gupta has been named as the owner of TGMM by its banker, Standard Bank Mauritius, an individual by the same name also heads Jindal Steel and Powers Oman office. JSPL, in its response, said: “We enquired from Mr Amit Gupta and he confirmed that he was not the owner of TGMM during the period 2014-2016.”

Also Read | FinCEN Files: Bank reported fraud, UK link of an IPL team sponsor

In at least five SARs filed with the FinCEN between November 2014 and November 2016, DBTCA reported that an aggregate of $79.6 million was sent and received via 359 transactions by third-party originator/beneficiary Jindal Steel and Power Ltd.

While filing its SARs, DBTCA also stated that the SAR had been filed because “negative information” was found regarding Naveen Jindal, chairman of JSPL, who was on trial on charges of criminal breach of trust and conspiracy in a case of inappropriate allocation of coal block in Jharkhand in 2008. Naveen Jindal is also considered a politically exposed person, having been a Member of Parliament.

It said that “due to the ongoing concerns about Naveen Jindal, DBTCA is filing this SAR out of an abundance of caution. In addition, most of the transactions were processed on consecutive, alternating or closely grouped days through high risk jurisdictions.”

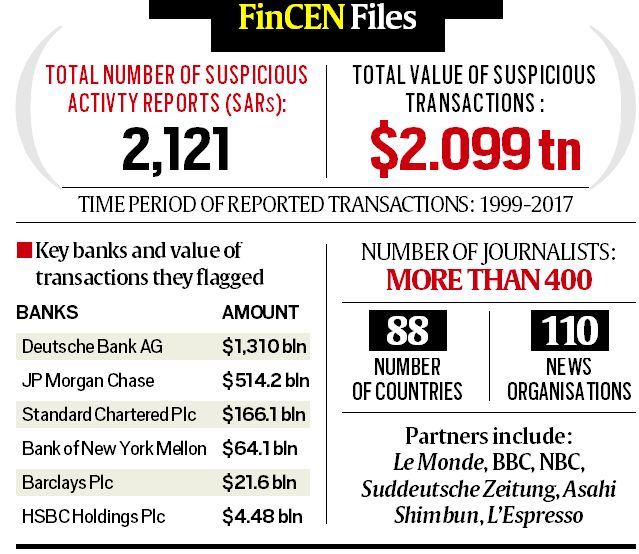

Also Read | Swiss Leaks, Panama Papers, now SARs: bank reports that alert law-enforcement agencies

The JSPL spokesperson said: “The money sent to M/s Trans Global Minerals and Metals was for ocean freight and demurrage & other related charges only and not under any other head. The Company has submitted all relevant documents to the concerned authorised dealer banks at the time of sending respective remittance as per extent regulatory guidelines.

As per our understanding, TGMM, during that period, was in business of ship charting/coal trading and did not have any broker-investor relation with us. JSPL had no direct relationship with TGMM and our transactions with TGMM are purely commercial transactions. We had received money from M/s Power Plant EPC against supply of fabricated steel structures/ Steel/ Machinery equipment.”

📣 The Indian Express is now on Telegram. Click here to join our channel (@indianexpress) and stay updated with the latest headlines

For all the latest Express Exclusive News, download Indian Express App.