A week ago, the global research firm CLSA maintained an outperform rating on the stock with a target of Rs 133 per share.

Shares of Vedanta traded flat on BSE on September 15 as the company deferred its June quarter earnings announcement.

In a regulatory filing on BSE on September 14, the company said: "Due to the ongoing pandemic and other unforeseen circumstances which are beyond the company’s control, the company is unable to hold its board meeting on September 15, 2020, and accordingly we will reschedule the board meeting on or before September 30, 2020, for release of Q1 results for which the company will give the intimation separately in due course."

A week ago, the global research firm CLSA maintained an outperform rating on the stock with a target of Rs 133 per share.

According to a CNBC-TV18 report, the book value according to delisting regulation is at Rs 89.38 against calculated Rs 147 per share sets a lower floor price for delisting than earlier expectations.

It is of the view that the funds secured by promoters indicate the ability to offer Rs 128 per share for delisting.

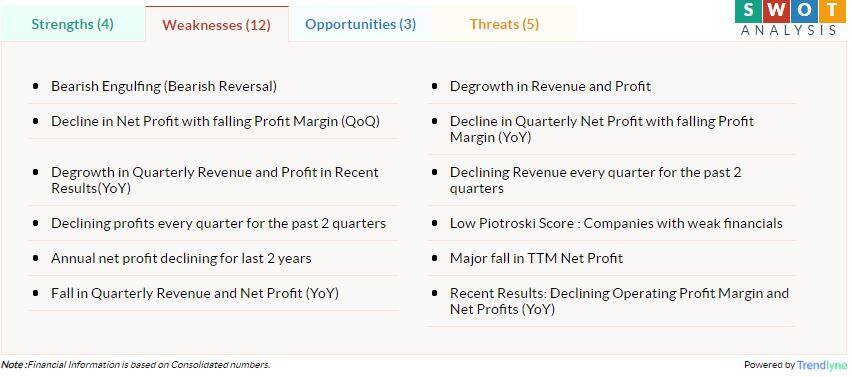

Vedanta has been witnessing a decline in revenue for the last two quarters and the recent results have shown the declining trend of operating profit margin and net profits.

However, the company is with a zero promoter pledge. The stock is above short, medium and long-term moving averages.

Around 14:40 hours, the stock was 0.15 percent up at Rs 129.85 on BSE.

_2020091018165303jzv.jpg)