Nirali Shah of Samco Securities said it would be prudent to remain cautious and keep sufficient liquidity in their portfolio.

The market rebounded this week after a correction of more than 2.5 percent in the previous week, and recouped some of the losses to close over a percent higher in the week ended September 11. The rally was majorly driven by index heavyweight Reliance Industries amid second round of fund raising via retail business; easing India-China border tensions amid talks between countries held in Moscow, and upside in IT stocks. But correction in banking & financials capped upside.

The BSE Sensex climbed 497.37 points or 1.30 percent to close at 38,854.55, while the Nifty50 gained 130.60 points or 1.15 percent at 11,464.45. However, the broader markets underperformed frontline indices with the BSE Midcap index falling a percent and Smallcap down third of a percent.

Experts feel the consolidation may continue in the coming week amid lack of major domestic cues and further development over India-China border issue after the five-point plan. The stock-specific action could also be seen next week and the market will closely watch global cues for any direction given the fear of delay in US economic recovery and fall in crude oil prices.

"Indications are in favour of further consolidation in the Nifty index. We may see some recovery in the banking pack ahead but traders should limit their positions mainly to the sectors which are attracting consistent buying interest," Ajit Mishra, VP - Research at Religare Broking told Moneycontrol.

Nirali Shah, Senior Research Analyst at Samco Securities feels markets globally may take comfort from subdued crude prices, economies opening up, consolidation of gold amongst a few other factors but it would be prudent to remain cautious and keep sufficient liquidity in their portfolio.

Here are 10 key factors that will keep traders busy next week:

India-China Border Row

The market will closely watch the developments at India-China borders, though India and China on September 10 have agreed on five-point plan to resolve the prolonged border face-off on the Line of Actual Control (LAC) in eastern Ladakh, and to continue to have dialogue and communication through the Special Representative(SR) mechanism on the India-China boundary question.

The five-point plan included abiding by all existing agreements and protocol on management of the frontier, maintaining peace and tranquillity and avoiding any action that could escalate matters. Now all eyes are on the actual disengagement on the Chinese side at LAC.

"With the lack of any official statements from the high level talks to defuse border tensions, investors need to be prepared for slow progress in this regard. As such, this uncertainty will keep worrying the markets for the short term," Vinod Nair, Head of Research at Geojit Financial Services told Moneycontrol.

As we are in the last week of quarterly earnings season, more than 1,000 companies, mostly smallcaps, will announce their results in the first two days of next week. September 15 is the deadline to announce June quarter earnings.

Vedanta, SpiceJet, Max India, Apollo Hospitals Enterprise, Future Retail, HUDCO, PVR, Anant Raj, Ansal Properties, Balaji Telefilms, GATI, IVRCL, ITI, NBCC (India), PC Jeweller, Raymond, SAIL, Allcargo Logistics, Future Enterprises, ITD Cementation India, Jain Irrigation Systems, MEP Infrastructure Developers, National Fertilizers, Peninsula Land, Procter & Gamble Health, Sakthi Sugars, Steel Strips Wheels, Sterling and Wilson Solar, Texmo Pipes & Products, VA Tech Wabag and Zee Media Corporation are among others to release June quarter earnings scorecard in the coming week.

The rising COVID-19 infections, which could be due to further easing in lockdown and increase in tests, is one of key reasons for current market volatility and cap in the market upside for last couple of weeks, though India has fared better in terms of recovery and fatality rates.

India reported 96,551 confirmed COVID-19 cases on September 11, taking the total infections count to 46.6 lakh with 77,472 deaths. With this, India is at second spot after United States which reported over 64.65 lakh confirmed cases with 1.92 lakh deaths so far, Johns Hopkins University data showed.

As a result, the recovery rate has shown a gradual increase in the passing week, standing at 77.68 on September 11 against 77.36 on September 4, while fatality rate dropped to 1.66 against 1.72 during same period.

On the vaccine front, Indian Council of Medical Research (ICMR) and Bharat Biotech's potential COVID-19 vaccine -- Covaxin -- generated robust immune responses in monkeys, preventing infection and disease even upon high amounts of exposure to live SARS-CoV-2 virus. The vaccine is in Phase II of clinical trials now. However, the Phase II and III of clinical trials of Oxford University and British-Swedish pharma company AstraZeneca's potential vaccine AZD1222, which is the frontrunner, suspended by Indian drug regulator DCGI.

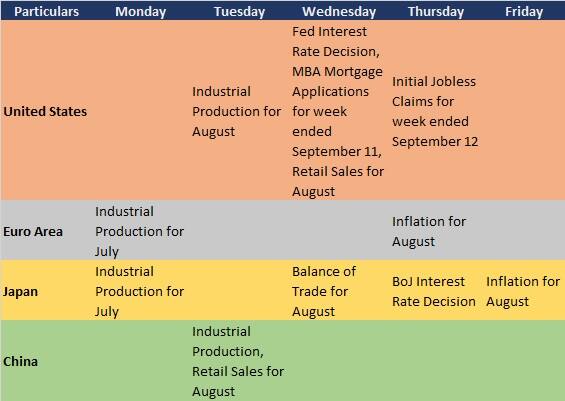

Economic Data Points

WPI and CPI inflation data for August will be released on Monday, while balance of trade for August will be announced on Tuesday. Foreign exchange reserves for week ended September 11 will be released on Friday.

CPI inflation in July rose to 6.93 percent against 6.23 percent in June (which revised from 6.09 percent earlier) due to rise in food and fuel prices. It is expected to remain around 6.8-6.9 percent for August as well.

Listing

Digital IT services provider Happiest Minds Technologies is expected to debut on bourses on September 17. The final issue price has been fixed at Rs 166 per share, the upper end of price band.

Experts largely expect Happiest to list with strong premium over its issue price given the 151 times subscription to its Rs 702-crore IPO during September 7-9. The grey market premium is around Rs 140-150 per share over issue price, sources told Moneycontrol.

FOMC Meet

The Federal Open Market Committee is set to begin its two-day meeting on Tuesday and the conclusion will be out on Wednesday midnight. Fed is largely expected to keep interest rate zero, but all eyes will be on the commentary with respect to economic recovery especially after the fall in US markets led by tech stocks and stalled much-awaited fiscal stimulus package in the Senate, and ahead of US Presidential elections in November.

Technical View

The Nifty50 gained 15.20 points on Friday and witnessed Doji kind of indecisive formation on the daily charts, while during the week, it rose 1.15 percent and formed bullish candle which resembles Hammer kind of pattern on the weekly scale, following Bearish Engulfing formation in previous week.

Hence experts expect the sideways trade to continue given the index moving in a particular range for last couple of weeks.

"Near term trend in Nifty may remain confined to the zone of 11,550 – 11,278 levels. Strength in Nifty can be expected on a close above 11,550 kinds of levels which can then expand the upswing towards 11,672 levels, whereas if the index closes below 11,278 levels then it shall be considered as initial sign of weakness so as to resume downswing," Mazhar Mohammad, Chief Strategist – Technical Research & Trading Advisory at Chartviewindia.in told Moneycontrol.

F&O Cues

On the derivative front, a huge amount of Put writing was seen at 11,400 and 11,300 strikes and the highest open interest was placed at 11,400 strike, which is likely to act as immediate support in the coming week followed by 11,300 strike.

A fresh Call writing was seen at 11,500 strike which also holds the maximum open interest and is also likely to act as an immediate hurdle.

"If Nifty breaks above 11,500 then we can expect some short covering move towards 11,600 levels. So the overall option data indicates a tug of war between Call and Put writer and expect Nifty to oscillate in the range of 11,300 - 11,600 in the coming week," Nilesh Jain of Anand Rathi told Moneycontrol.

The IndiaVIX, which measures the volatility, dropped by 6 percent to end below 21 levels. "The overall cooling off in the volatility is giving comfort to the bulls and a further drop will support the bulls and pull the index higher. Only a move beyond the 25-30 range would be a cause of concern," Jain said.

Global Cues

Here are key global data points to watch out for next week:

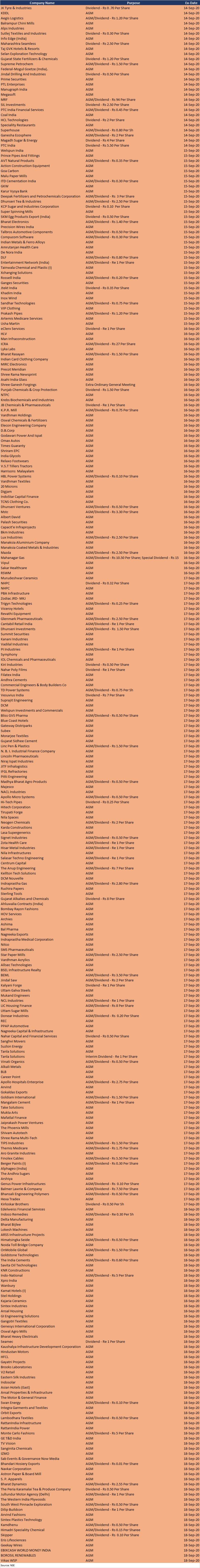

Corporate Action

Here are key corporate actions taking place in the coming week:

_2020091018165303jzv.jpg)