NOIDA: The demand for general loans in Noida has been hit hard by the Covid pandemic. This inference can be drawn from an analysis of the annual credit plan disbursement for Gautam Budh Nagar, which reveals that only a limited number of residents approached banks or other financial institutions in the first quarter of this fiscal to secure loans for buying homes, automobiles, or funding education.

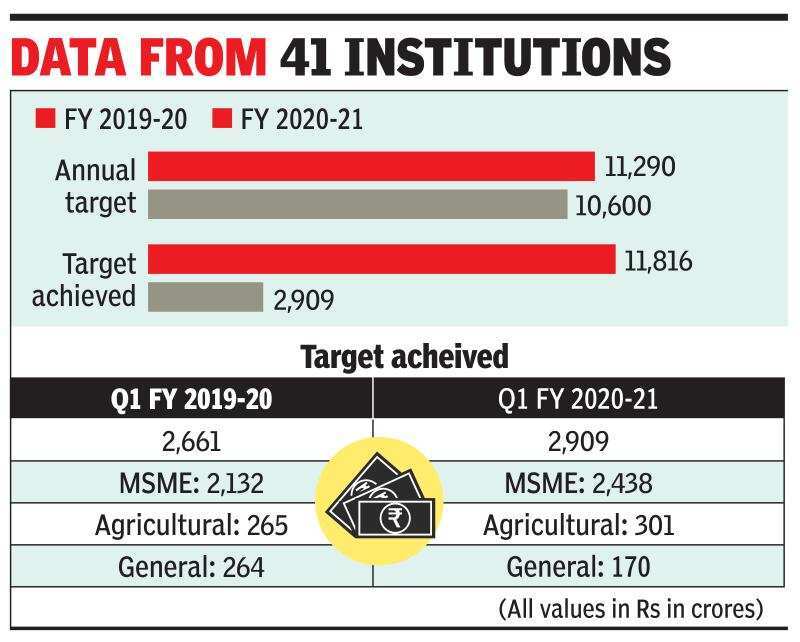

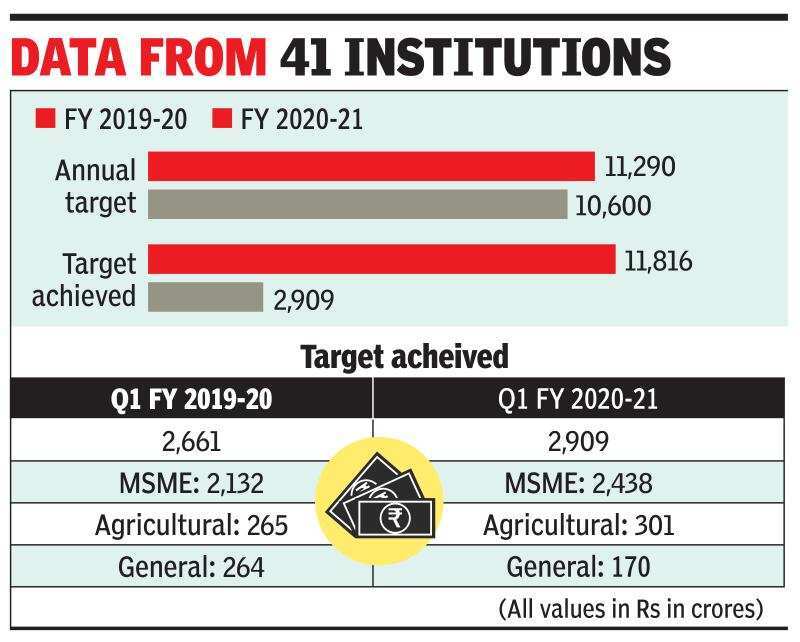

The credit outflow is broadly divided into three categories — micro, small and medium enterprises (MSME) loans, agricultural loans and general loans. While there were few takers for general loans, the maximum number of loans has been disbursed to MSMEs (over 80%), followed by the agricultural sector, the data reveals. Gautam Budh Nagar is home to 41 different financial institutions that operate 525 branches.

While year-on-year lending to MSMEs exceeded expectations by growing from Rs 2,132 crore to Rs 2,438 crore and that to the agricultural sector went up from Rs 265 crore to Rs 301 crore, general loans came down from Rs 264 crore to Rs 170 crore. So, while the two categories registered a growth of about 14%, general loans went down by 36% in the first quarter of this fiscal, the data reveals.

Due to pandemic, the target for this fiscal was brought down from the level achieved in the previous financial year.

Financial institutions were able to lend Rs 11,816 crore against the target of Rs 11,290 crore in the last fiscal. However, the target for this fiscal has been brought down to Rs 10,600 crore soon after the Covid lockdown was imposed from March 25.

Officials who worked on the analysis said that downward trend was expected as people have been refraining from taking on more responsibilities and financial burden due to the prevailing uncertainty in the market.

Lead district manager Vedratna Kumar said, “Almost no transactions took place in April. Financial activity and lending picked up only from May 15, days after the PM announced the economic package and the UP government initiated loan mela. Applications of MSMEs were processed on a priority basis. Volume of general loans is down As not many families are interested in taking loans. It shall pick up during the festival season.”

Chief development officer of the district Anil Kumar Singh said, “Banks have been asked to focus on educational loans during the meeting that took place on Monday. Also funding to those from the economically backward classes under different schemes and the ones interested in small-scale enterprising has to be provided.”

The credit outflow is broadly divided into three categories — micro, small and medium enterprises (MSME) loans, agricultural loans and general loans. While there were few takers for general loans, the maximum number of loans has been disbursed to MSMEs (over 80%), followed by the agricultural sector, the data reveals. Gautam Budh Nagar is home to 41 different financial institutions that operate 525 branches.

While year-on-year lending to MSMEs exceeded expectations by growing from Rs 2,132 crore to Rs 2,438 crore and that to the agricultural sector went up from Rs 265 crore to Rs 301 crore, general loans came down from Rs 264 crore to Rs 170 crore. So, while the two categories registered a growth of about 14%, general loans went down by 36% in the first quarter of this fiscal, the data reveals.

Due to pandemic, the target for this fiscal was brought down from the level achieved in the previous financial year.

Financial institutions were able to lend Rs 11,816 crore against the target of Rs 11,290 crore in the last fiscal. However, the target for this fiscal has been brought down to Rs 10,600 crore soon after the Covid lockdown was imposed from March 25.

Officials who worked on the analysis said that downward trend was expected as people have been refraining from taking on more responsibilities and financial burden due to the prevailing uncertainty in the market.

Lead district manager Vedratna Kumar said, “Almost no transactions took place in April. Financial activity and lending picked up only from May 15, days after the PM announced the economic package and the UP government initiated loan mela. Applications of MSMEs were processed on a priority basis. Volume of general loans is down As not many families are interested in taking loans. It shall pick up during the festival season.”

Chief development officer of the district Anil Kumar Singh said, “Banks have been asked to focus on educational loans during the meeting that took place on Monday. Also funding to those from the economically backward classes under different schemes and the ones interested in small-scale enterprising has to be provided.”

Coronavirus outbreak

Trending Topics

LATEST VIDEOS

City

‘Will expose you': Kangana Ranaut slams Uddhav Thackeray and Karan Johar 'gang' after BMC razes her office

‘Will expose you': Kangana Ranaut slams Uddhav Thackeray and Karan Johar 'gang' after BMC razes her office  Kangana vs Sena: Battle between demolishing house and demolishing ego

Kangana vs Sena: Battle between demolishing house and demolishing ego  Two Pakistani smugglers gunned down by BSF near Rajasthan border; pistols, drugs recovered from site

Two Pakistani smugglers gunned down by BSF near Rajasthan border; pistols, drugs recovered from site  Was BMC in a hurry to demolish Kangana Ranaut's home?

Was BMC in a hurry to demolish Kangana Ranaut's home?

More from TOI

Navbharat Times

Featured Today in Travel

Quick Links

Kerala Coronavirus Helpline NumberHaryana Coronavirus Helpline NumberUP Coronavirus Helpline NumberBareilly NewsBhopal NewsCoronavirus in DelhiCoronavirus in HyderabadCoronavirus in IndiaCoronavirus symptomsCoronavirusRajasthan Coronavirus Helpline NumberAditya ThackerayShiv SenaFire in MumbaiAP Coronavirus Helpline NumberArvind KejriwalJammu Kashmir Coronavirus Helpline NumberSrinagar encounter

Get the app