Ajit Mishra of Religare Broking advises traders to prefer stocks that are participating in the move rather than betting on underperforming counters in anticipation of a rebound.

The market turned strong after five days of consolidation and correction and jumped over 1.5 percent on September 10. Reliance Industries with 7 percent rally, and buying in select bank, IT and FMCG stocks lifted sentiment.

The BSE Sensex surged 646.40 points or 1.69 percent to close at 38,840.32, while the Nifty50 jumped 171.30 points or 1.52 percent to 11,449.30 and formed a bullish candle on the daily charts.

"Nifty is currently placed at the cluster resistance of opening downside gap area of September 4, minor up sloping trend line on the daily and significant intermediate trend line on the weekly chart (as per role reversal) around 11,450-11,500 levels. Hence, this area is going to be a crucial hurdle for the market in the short term. A renewed buying participation could only occur above this resistance," Nagaraj Shetti, Technical Research Analyst at HDFC Securities told Moneycontrol.

The broader markets also gained momentum as the Nifty Midcap index was up 1.23 percent and Smallcap climbed 1.6 percent.

"Apart from the global cues, participants will now be closely eyeing the upcoming macroeconomic data viz. IIP and CPI data for cues on economic recovery. Besides, the ongoing tensions between India and China would also be on investors' radar," said Ajit Mishra, VP - Research at Religare Broking, who advised traders to prefer stocks that are participating in the move rather than betting on underperforming counters in anticipation of a rebound.

We have collated 14 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three- month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty is placed at 11,363.07, followed by 11,276.93. If the index moves up, the key resistance levels to watch out for are 11,499.67 and 11,550.13.

Nifty Bank

The Bank Nifty snapped a five-day losing streak on September 10, rising 199.20 points to 22,466.20. The important pivot level, which will act as crucial support for the index, is placed at 22,234.7, followed by 22,003.2. On the upside, key resistance levels are placed at 22,688.2 and 22,910.2.

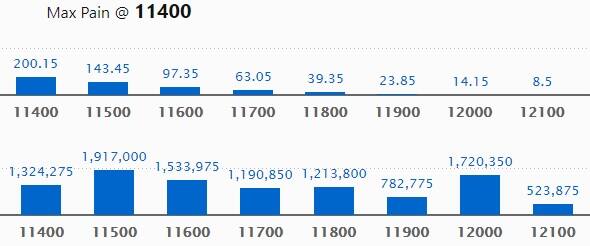

Call option data

Maximum Call open interest of 19.17 lakh contracts was seen at 11,500 strike, which will act as crucial resistance in the September series.

This is followed by 12,000 strike, which holds 17.2 lakh contracts, and 11,600 strike, which has accumulated 15.33 lakh contracts.

Call writing was seen at 12,000 strike, which added 83,625 contracts, followed by 11,700, which added 83,475 contracts, and 11,400 strike, which added 80,475 contracts.

Call unwinding was seen at 11,500 strike, which shed 3.57 lakh contracts, followed by 11,300 strike, which shed 2.02 lakh contracts.

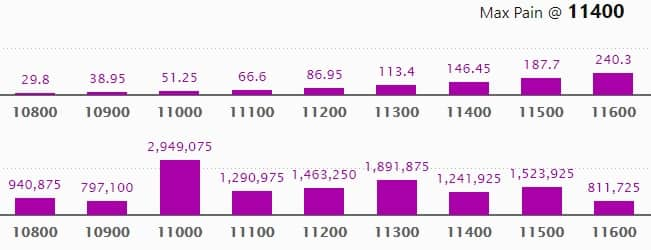

Put option data

Maximum Put open interest of 29.49 lakh contracts was seen at 11,000 strike, which will act as crucial support in the September series.

This is followed by 11,300 strike, which holds 18.91 lakh contracts, and 11,500 strike, which has accumulated 15.23 lakh contracts.

Put writing was seen at 11,300 strike, which added 3.12 lakh contracts, followed by 11,400 strike, which added 2.78 lakh contracts and 11,100 strike which added 2.26 lakh contracts.

Put unwinding was witnessed at 10,700, which shed 38,325 contracts, followed by 11,200 strike which shed 32,700 contracts and 11,900 strike, which shed 15,075 contracts.

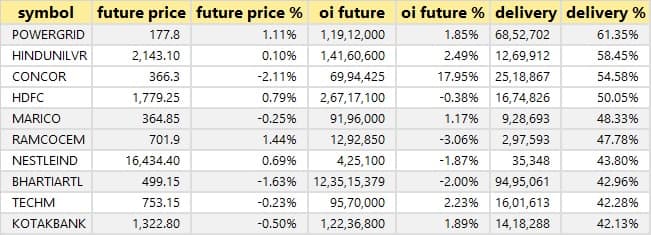

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

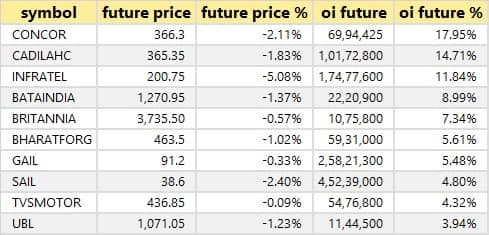

36 stocks saw long build-up

Based on the open interest future percentage, here are the top 10 stocks in which long build-up was seen.

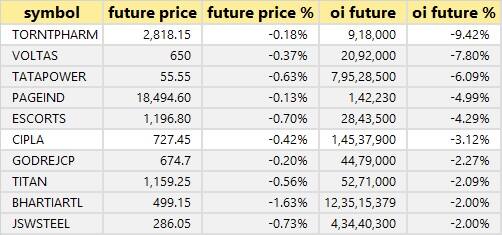

18 stocks saw long unwinding

Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

30 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which short build-up was seen.

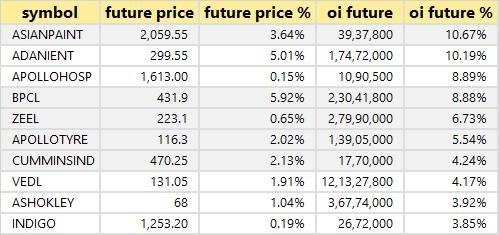

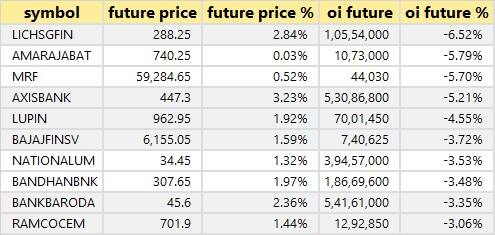

54 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

Bulk deals

Future Supply Chain Solutions: Edelweiss Crossover Opportunities Fund sold 10,02,385 shares in the company at Rs 116.65 per share on the NSE.

Max India: Vijit Asset Management acquired 9 lakh shares in the company at Rs 48.05 per share on the NSE, whereas Doric Asia Pacific Small Cap Mauritius sold 4,62,265 shares at Rs 49.8 per share.

(For more bulk deals, click here)

Earnings on September 11

IRCTC, BHEL, Adani Green Energy, Arvind SmartSpaces, BF Utilities, BGR Energy Systems, Eros International Media, Future Supply Chain Solutions, ITDC, Jindal Stainless (Hisar), Lloyds Steels Industries, Parsvnath Developers, Premier Explosives, Rail Vikas Nigam, Sharon Bio-Medicine, Sintex Plastics Technology are among 104 companies to announce quarterly earnings on September 11.

Stocks in the news

HealthCare Global Enterprises: V-Sciences Investments Pte Ltd sold 83,20,805 equity shares representing 9.38 percent of share capital of the company pursuant to the open offer on September 8.

National Fertilizers: The company reported total fertilizer sale of 23.81 lakh MT and production of 16.11 lakh MT urea in April-August, 2020.

Hindustan Aeronautics: The company reported profit at Rs 148.65 crore in Q1FY21 against Rs 564.69 crore, revenue fell to Rs 1,736.7 crore from Rs 3,289.5 crore YoY.

SRG Housing Finance: The company reported profit at Rs 3.53 crore in Q1FY21 against Rs 4.15 crore, revenue declined to Rs 15.8 crore versus Rs 16.3 crore YoY.

Jay Bharat Maruti: The company reported loss at Rs 21.04 crore in Q1FY21 against profit at Rs 7.8 crore, revenue declined to Rs 70.2 crore versus Rs 442.9 crore YoY.

Mirc Electronics: The company reported loss at Rs 10.74 crore in Q1FY21 against profit at Rs 0.88 crore, revenue dropped to Rs 94.54 crore versus Rs 177.57 crore YoY.

Vaibhav Global: The company successfully commissioned 1MW solar PV power generation project.

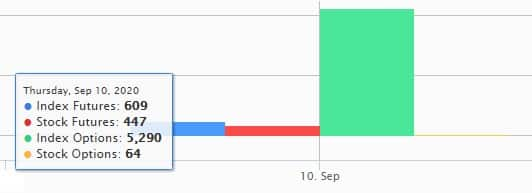

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net bought shares worth Rs 838.37 crore, whereas domestic institutional investors (DIIs) net offloaded shares worth Rs 317.3 crore in the Indian equity market on September 10, as per provisional data available on the NSE.

Disclaimer: "Reliance Industries Ltd. is the sole beneficiary of Independent Media Trust which controls Network18 Media & Investments Ltd which publishes Moneycontrol."

_2020091018165303jzv.jpg)