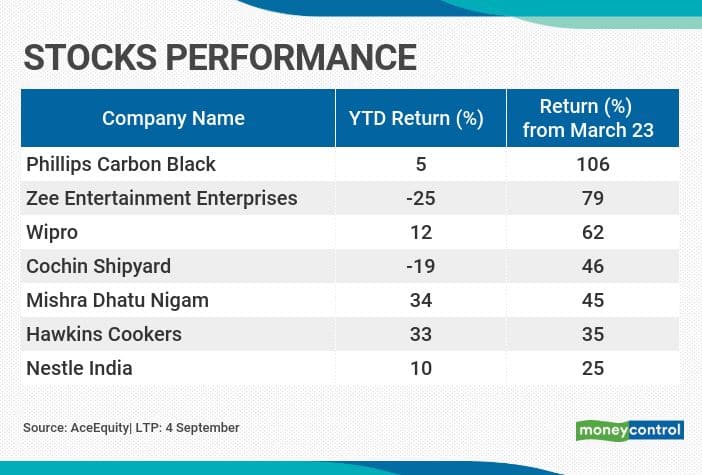

Experts have picked seven stocks that are from sectors such as IT, consumption, media and chemicals. Most of them have rallied in double digits post-March 23, when Nifty hit a low of 7,500

Benchmark indices have rallied by about 50 percent each from March lows and a similar momentum was seen in stocks that are likely to benefit from the outbreak of COVID-19 and from the 'Make in India' initiative.

India’s economic situation is improving but not fast enough for us to take a more positive view on the market, especially when ‘quality’ consumption stocks are already factoring in a sharp normalization in demand, suggest experts.

The reward-risk balance is a bit muddled at current prices and a lot will depend on the performance of the financial sector, which in turn will depend on the extent of normalization of economic activity over the next few months, Kotak Institutional Equities said in a note.

Recent data suggests that the COVID-19 pandemic in India is yet to peak with a record number of new cases daily. The continued increase in cases will restrict activity in the labour-intensive services sector, which in turn, will cramp recovery in household income growth and thereby consumption.

“Most stocks in the ‘COVID proof’ sectors (consumer staples, IT, pharmaceuticals, and telecom) trade at full valuations on FY22E basis. Stock prices have rebounded from their March 2020 lows to pre-COVID levels in most cases and above pre-COVID levels in the case of IT and pharmaceuticals stocks,” said the Kotak Institutional Equities note.

“‘COVID-recovery’ stocks (consumer discretionary, financials, industrials/capital goods/construction materials) are still evolving and will largely depend on the eventual impact of Covid-19,” it said.

Economic activity is recovering but at a slow pace. Most analysts are factoring in robust earnings growth in FY22. To leverage any upside in the markets, investors should try and allocate capital towards sectors that will produce tomorrow’s leaders.

Sectors with global exposures have been the most resilient and likely to remain so as despite the fall in global trade, competition has indeed intensified more.

“Sectors that are emerging to play the China substation story viz., Pharma, Chemicals, Auto ancillary too are well-positioned. Commodity could be an interesting anti-consensus play in case of a faster than expected global recovery becomes a reality,” Rajesh Saluja, CEO & MD, ASK Wealth Advisors told Moneycontrol.

“Global plays including direct global allocation should play an important role in any portfolio. Domestically non-bank sector including insurance remains a long term play while we are cautious on banks because of NPA overhang, a judgment needs to be taken how much of it is already in the price,” he said.

Experts have handpicked seven stocks that are from sectors such as IT, consumption, media, chemicals, and the Make in India theme. Most of the stocks mentioned have rallied in double digits post-March 23 when Nifty hit a low of 7,500. The stocks mentioned are a long term play.

Expert: Vinod Nair, Head of Research at Geojit Financial Services.

On the contrary, subscription revenues grew by 5 percent on a YoY basis, aided by a surge in online viewers. Gradual recovery in Ad and Subscription revenues on account of upcoming festivities should aid top-line growth in H2FY21.

With the rise in viewership and the arrival of new content, we expect steady improvements in ZEEL’s performance in the coming quarters. We thereby upgrade our rating to BUY with a revised target price of Rs. 245, based on 15x FY22 Adj. EPS.

Q1FY21 revenue and profitability declined by 55 percent and 65 percent on account of COVID-19 related disruptions. The order backlog is at ~Rs14,393 cr, including a recently booked order of 2 Autonomous Electric Ferries, providing strong visibility for the next 3 years.

Management’s focus is on doubling of ship repair business for this CSL is ramping-up its ship repair facilities and construction of a new dry dock. Given the improvement in order book visibility, capacity expansion, and strong execution capabilities, we continue to maintain our positive view on the stock.

We value CSL at a P/E multiple of 10x on FY22E with a target price of Rs445 and maintain a BUY rating.

Expert: Paras Bothra, President of Equity Research, Ashika Stock Broking

Phillips Carbon Black Ltd (PCBL) is a part of RPG Group and the largest carbon black manufacturers in India by capacity and 7th largest carbon black company globally.Post-COVID era, PGBL is expected to benefit from a shift towards personal mobility and pent up demand in automobiles. The company continues to expand its product portfolio of high-performance high-margin grades for both rubber and specialty black applications.

The company identifies Specialty Carbon as the next growth driver thus expanding its capacity to meet the demand and also to sustain higher margins. The government’s increasing focus on the domestic manufacturing sector by reducing import dependency is another positive catalyst for PGBL in the long run.

MIDHANI has a unique business model due to its presence in the niche precision defense and space equipment market and its aggression towards targeting import substitution products to increase its market share.The company’s focus to diversify its products from the current 2-3 sectors to other sectors like railway, oil and gas, automobile, aerospace, etc. will help it to minimize the business risk and improve future revenue visibility.It is believed that the increasing number of launches by ISRO and the government’s focus toward the defense modernization program through 'Make in India' is a positive catalyst for the company.A strong order book in hand provides visibility of nearly 8-10 quarters, new product developments and better margins through cost reduction are other triggers for the company.

Hawkins is the second-largest player in the Rs 22,000 crore Kitchen appliance market in India. The organized market for cooker & cookware market is ~60% and post-GST, organized players like Hawkins have gained market share owing to reducing price differential, strong brand positioning, and superior quality of products.

In fact, over the last 6-7 years, it has grown higher than the market leader led by a strong dealer network coupled with new product launches and higher advertising & marketing spends which have allowed the company to gain market share in lower-tier/rural areas.

Pradhan Mantri Ujjwala Yojana scheme has also acted as a boon for the kitchenware appliance players as LPG gas penetration has increased to 95 percent from 56 percent in FY14. With restaurants shut and food delivery considered unsafe due to coronavirus, cooking at home is the new-found hobby for Indians.

This shift towards home-cooked food has augured well for the company, even as most businesses struggle to make ends meet.

In the current environment, we see the IT Services sector as an attractive investment destination, because of WFH and INR limiting the COVID impact in FY21 and a strong recovery in FY22 on pent-up demand.

Wipro’s major positive in Q1FY21 is the surge in the margin. Wipro hasn’t given guidance for the next quarter, but the company expects the September quarter to be one of stabilization.

As per the company, demand has bottomed in the consumer (e-commerce & new age Media), communications, and technology verticals, which contributes 34% of revenues, is positive for the company. New opportunities will emerge with increased cloud adoption, Automation, and workplace modernisation.

In the current unprecedented times where supply chain & manufacturing operations have been hit by lockdowns, NIL is less vulnerable given its presence in packaged foods.

Nestle can deliver strong growth going forward as well and will gain share in its core categories, led by distribution expansion, new product/ variant launches, a strong pipeline of products (can also leverage parents’ vast brand portfolio) backed by R&D capabilities and faster growth in premium portfolio leading to better pricing power.

With market leadership in ~80 percent of its categories, it has enough pricing power to further drive premiumization along with driving volume growth.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.