The acquirer in this delisting offer is a subsidiary of the promoter and is an investment holding company for the The Baring Asia Private Equity Fund VII, L.P. and its affiliated funds.

IT and business process outsourcing services provider Hexaware Technologies opened its delisting offer on September 9.

The company has fixed a floor price of Rs 264.97 per equity share for the offer which will close on September 15, 2020.

On the first day of offer, the share price closed at Rs 421, up 1.3 percent.

Given that the floor price is at a huge discount from the current market price, all analysts are advising to avoid taking the delisting offer for the time being or till the announcement of new floor price by the company.

"The promoters have offered Rs 264.97 per share as a part of their delisting offer, which is 35.68 percent less than its current trading price of 412 per share (closing price on September 8, 2020). In my opinion, investors won't show much interest in delisting offer as delisting price is at significant discount. Investors should wait for a better price as valuations are cheaper compared to floor price," Gaurav Garg, Head of Research at CapitalVia Global Research told Moneycontrol.

Prashanth Tapse, AVP Research at Mehta Equities also advised investors to hold on for some more time as the indicative offer price for delisting made by the promoter group on June 4 of Rs 264.97 per share appears to be significantly lower than what investors were expecting.

He believes the indicative offer price is based on very conservative valuations, but post COVID-19 saga IT sector has got re-rated ahead of better-than-expected April-June quarter results and improved outlook from almost all IT firms.

Analysts feel the floor price has to be at hefty premium over current market price.

Tapse presumed promoters will have to increase the offer price for getting a strong shareholders response and expects the revised final delisting price to be significantly above the current market price of Rs 400, most likely in the Rs 450-475 per share range to get investor interest in the delisting process.

Going by the previous de-listing offers by other larger IT firms like Polaris, Patni, some expect the final de-listing to be significantly higher than the current price offered.

Investors should wait for a few days and see what kind of revised offer comes before taking a definitive view, Vineeta Sharma, Head of Research at Narnolia Financial Advisors advised.

The offer price is on the lower side in the case of Hexaware, the promoter had earlier issued shares in 2018 at a floor price of Rs 447 way higher than the price of Rs 264 being offered currently. Also, the current market price is above Rs 415.

Post sharp sell-off induced by the pandemic where many companies stock prices fell way below their intrinsic value, many promoters are opting for de-listing. The stated reason for the de-listing is taking full control over the company and necessitating various cost control measures.

Promoters currently held 62.08 percent stake in the company and the rest 37.92 percent shareholding is held by public. Promoters' shareholding has to reach 90 percent of total paid up capital post offer, to make the delisting offer successful.

"Delisting might help the organization to take aggressive decisions along with implementing certain cost saving measures in its operations. Also, delisting process will make the process of change of ownership much smoother," Gaurav Garg said.

Now the stock price doubled from March closing lows given the strong June quarter results published by the company amid pandemic COVID-19, as work-from-home and digitalisation were one of reasons behind their earnings performance.

"If we generally analyse past delistings offers, an average successful delisting has been at a premium of 35-40 percent to the pre-announcement price and in some cases it has also been as high as 80-100 percent premium to floor offer. So if we simply extrapolate similar trends for Hexaware offer considering re-rated IT sector the exit price could be in the range of average of 60-65 percent premium and if in case the delisting process fails to cheer majority shareholders, the share price could potentially slip back to pre-announcement offer levels," Prashanth Tapse said.

While there could be many reasons for delisting and the process in India is generally complicated, with investors expecting a significant premium and promoters wanting investors to take a cheap haircut exit from good quality businesses.

As per our understanding Hexaware's promoter Baring Private Equity plans to go voluntary delisting as an option to obtain full ownership of the company and to re-channel management bandwidth towards business growth and this will also help in cost savings business in COVID scenario, Tapse feels.

The acquirer in this delisting offer is a subsidiary of the promoter and is an investment holding company for the The Baring Asia Private Equity Fund VII, L.P. and its affiliated funds.

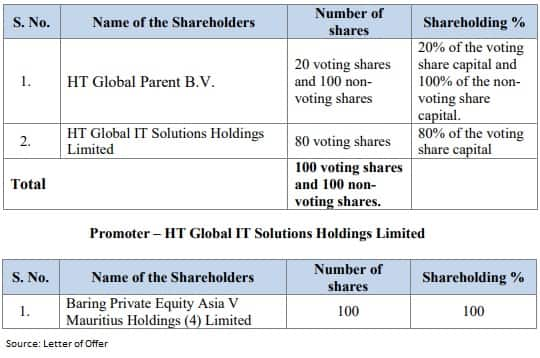

The promoter holds 80 percent of the voting share capital of the acquirer, while HT Global Parent B.V. holds 20 percent of the voting share capital and 100 percent of the non-voting share capital of the acquirer.

The acquirer is indirectly owned by the Fund VII entities. Fund VII iscontrolled by its general partner Baring Private Equity Asia GP VII, L.P. which, in turn, is controlled by its general partner Baring Private Equity Asia GP VII (Baring VII).

The shareholding pattern of the Acquirer as on the date of the Letter of Offer is as follows: