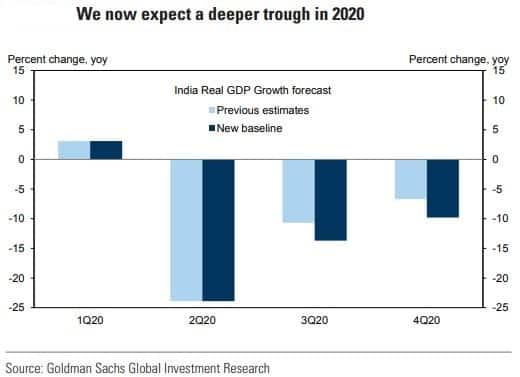

India’s real GDP growth fell to -23.9 percent year-on-year (YoY) in Q2CY20 against 3.1 percent YoY in Q1CY20.

The Indian economy is expected to climb from a deeper trough in the calendar year 2020 (CY20) and see a stronger rebound in the year 2021, according to global financial firm Goldman Sachs.

"While the economy must now climb out of a deeper trough in 2020, we have upgraded our expectations of a rebound next year," Goldman Sachs said in a report.

In the second quarter of the year 2021, Goldman expects real GDP growth to bounce back sharply on a year-over-year basis due to favourable base effects.

"Assuming nearly 70 percent of the lost output in June 2020 is recovered in June 2021, we expect real GDP in the second quarter of 2021 at +27.1 percent YoY," Goldman said.

"Going forward, assuming a step down to more normal levels of sequential growth, we now expect average annual GDP growth in CY21 and FY22 at 9.9 percent and 15.7 percent, respectively, (relative to 3.8 percent and 7 percent before). Our forecasts assume that in level terms, real output in March 2022 would still be nearly 2 percent below its level in March 2020," said the global financial firm.

Read more: India GDP outlook: India Ratings forecasts a contraction of 11.8% in FY21 GDP

On a seasonally adjusted annualised basis, GDP contracted by a 69 percent in Q2, relative to a +19 percent pace in Q1.

Read More: Global economy seeing sharper V recovery, raising the case for inflation: Morgan Stanley

Goldman sees Q3CY20 and Q420 GDP growth of -13.7 percent YoY and -9.8 percent YoY, respectively, compared to -10.7 percent YoY and -6.7 percent YoY previously.

"Our estimates imply that real GDP falls by 11.1 percent in CY20, and by 14.8 percent in FY21 against the growth of -9.6 percent and -11.8 percent in our previous forecasts," Goldman Sachs said.

India’s real GDP growth fell to -23.9 percent year-on-year (YoY) in Q2CY20 against 3.1 percent YoY in Q1CY20.

Disclaimer: The above report is compiled from information available on public platforms. Moneycontrol advises users to check with certified experts before taking any investment decisions.