Shrikant Chouhan of Kotak Securities advised traders to be either stock specific or intraday traders.

The market erased gains in the last hour of trade and closed the session on a negative note on September 8 as India-China border tensions and weak global cues dented sentiment.

The BSE Sensex was down 51.88 points at 38,365.35, while the Nifty50 fell 37.60 points to 11,317.40 and formed bearish candle on daily charts.

"Geo-political conditions always invite the sale or liquidation of a long position. Technically, for the second time, the Nifty closed below the 20-day SMA support, which is negative and could invite further weakness at 11,100 level," Shrikant Chouhan, Executive Vice President, Equity Technical Research at Kotak Securities, told Moneycontrol.

Currently, traders should either be stock specific or intraday traders, he advised.

Technology stocks and Reliance Industries supported the market, but the sell-off was led by metals, pharma, and select banks, auto and FMCG stocks.

The broader markets underperformed frontliners as the Nifty Midcap index dropped 1.4 percent and Smallcap declined nearly a percent.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three- month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty is placed at 11,259.47, followed by 11,201.63. If the index moves up, the key resistance levels to watch out for are 11,406.17 and 11,495.03.

Nifty Bank

The underperformance of Bank Nifty against Nifty50 continued on September 8 also, falling 200.65 points to 22,744.40. The important pivot level, which will act as crucial support for the index, is placed at 22,569.13, followed by 22,393.87. On the upside, key resistance levels are placed at 22,991.93 and 23,239.46.

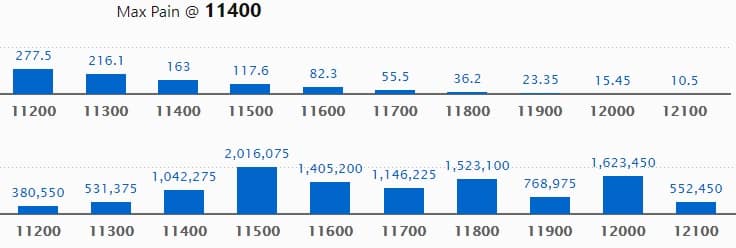

Call option data

Maximum Call open interest of 20.16 lakh contracts was seen at 11,500 strike, which will act as crucial resistance in the September series.

This is followed by 12,000 strike, which holds 16.23 lakh contracts, and 11,800 strike, which has accumulated 15.23 lakh contracts.

Call writing was seen at 11,400 strike, which added 1.97 lakh contracts, followed by 11,900, which added 60,000 contracts, and 12,100 strike, which added 57,300 contracts.

Call unwinding was seen at 12,000 strike, which shed 1.06 lakh contracts, followed by 11,700 strike, which shed 11,175 contracts.

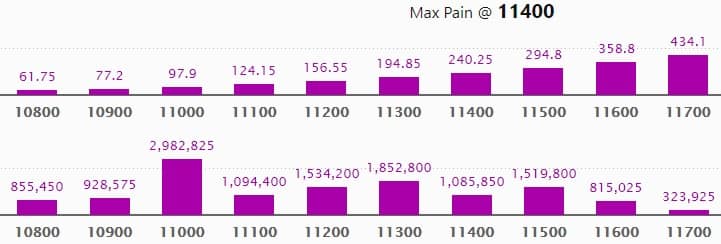

Put option data

Maximum Put open interest of 29.82 lakh contracts was seen at 11,000 strike, which will act as crucial support in the September series.

This is followed by 11,300 strike, which holds 18.52 lakh contracts, and 11,200 strike, which has accumulated 15.34 lakh contracts.

Put writing was seen at 10,700 strike, which added 3.73 lakh contracts, followed by 11,100 strike, which added 1.84 lakh contracts and 11,200 strike which added 1.78 lakh contracts.

Put unwinding was witnessed at 11,500, which shed 32,700 contracts, followed by 11,600 strike which shed 15,375 contracts.

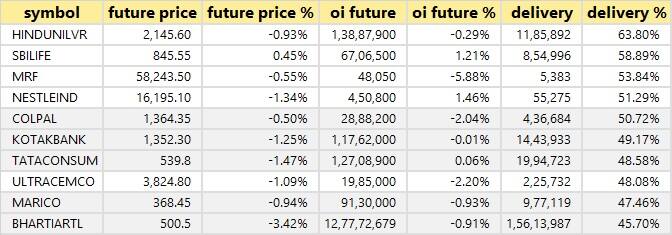

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

8 stocks saw long build-up

Based on the open interest future percentage, here are those 8 stocks in which long build-up was seen.

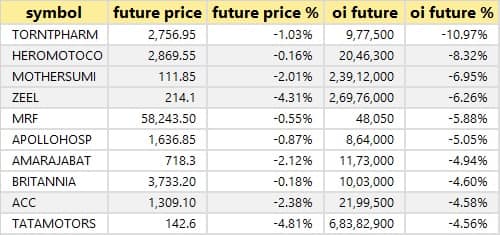

64 stocks saw long unwinding

Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

50 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which short build-up was seen.

16 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

Bulk deals

Future Consumer: Enam Finance sold 1 crore equity shares in the company at Rs 10.13 per share on the NSE.

Future Supply Chain Solutions: Edelweiss Crossover Opportunities Fund offloaded 4,21,609 equity shares in the company at Rs 129.33 per share and Dhunseri Ventures sold 2,27,744 shares at Rs 129.2 per share on the NSE. Tejas Tradefin LLP net bought over 3 lakh shares in the company at Rs 129.2 per share.

Strides Pharma Science: Societe Generale acquired 6,26,279 shares in the company at Rs 612 per share. However, Brookdale Mauritius International sold 6,26,279 shares in the company at Rs 612 per share.

Tejas Networks: Mayfield XII Mauritius FDI sold 44,42,733 shares in the company at Rs 66.46 per share.

(For more bulk deals, click here)

Earnings on September 9

Indiabulls Ventures, CESC Ventures, Emami Realty, Eveready Industries India, Lovable Lingerie, Shriram EPC, Texmaco Infrastructure among 45 stocks to announce quarterly earnings on September 9.

Stocks in the news

IRCTC: The government plans to sell about 15-20 percent stake in IRCTC via offer for sale (OFS).

IDBI Bank: The lender has sold its remaining 0.21 percent stake or 10,25,683 shares of National Stock Exchange of India (NSE).

Future Consumer: The company reported a loss of Rs 68.37 crore in Q1FY21 against a loss of Rs 175.47 crore QoQ. Revenue from operations fell to Rs 380.5 crore against Rs 947 crore QoQ.

ICICI Prudential Life Insurance Company: New business premium grew to Rs 892 crore in August 2020 against Rs 849 crore in July.

Power Grid Corporation: Cabinet has approved asset monetisation of the company's subsidiaries via InvITs.

Indian Hume Pipe: Company has received Rs 134.82 crore water supply contract in Odisha.

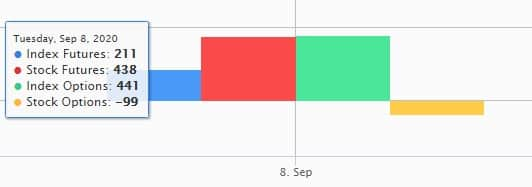

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net sold shares worth Rs 1,056.52 crore, whereas domestic institutional investors (DIIs) net bought shares worth Rs 620.29 crore in the Indian equity market on September 8, as per provisional data available on the NSE.

Stock under F&O ban on NSE

Seven stocks -- Bank of Baroda, BHEL, Canara Bank, Indiabulls Housing Finance, Vodafone Idea, Jindal Steel & Power and Punjab National Bank -- are under the F&O ban for September 8. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: "Reliance Industries Ltd. is the sole beneficiary of Independent Media Trust which controls Network18 Media & Investments Ltd which publishes Moneycontrol."