Ajit Mishra, VP - Research at Religare Broking, advises traders to exercise "extra caution and active position management" and hedge their bets

The market remained volatile throughout the session and closed moderately higher amid mixed global cues on September 7, supported by FMCG and IT stocks.

The Sensex gained 60.05 points to close at 38,417.23 and the Nifty was up 21.10 points at 11,355. It formed a Doji kind of pattern on the daily charts, following a Bearish Engulfing pattern formation last week.

"The formation of lower high of 11,584 on September 3, presence of Nifty below the key multiple supports and the formation of significant Bearish Engulfing pattern of August 31 are all pointing towards limited upside possibilities from here. There are chances of a resumption of weakness from the highs in the next few sessions," Nagaraj Shetti, Technical Research Analyst at HDFC Securities, told Moneycontrol.

"The Bearish Engulfing pattern on the weekly chart is also intact. Hence, any rising attempt from here could encounter selling pressure at the highs. Last week's high of 11,794 could be considered as a near term top for the market as of now," he said, adding that 11,350-11,300 are immediate supports for the next few sessions.

The Nifty FMCG and IT indices gained 0.57 percent each, while other sectoral indices closed flat with a negative bias.

Ajit Mishra, VP - Research at Religare Broking, advises traders to exercise "extra caution and active position management" and hedge their bets.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the NiftyAccording to pivot charts, the key support levels for the Nifty is placed at 11,277.4, followed by 11,199.8. If the index moves up, the key resistance levels to watch out for are 11,406.9 and 11,458.8.Nifty Bank

The Bank Nifty continued to underperform the Nifty, falling 66.50 points to 22,945 on September 7. The important pivot level, which will act as crucial support for the index, is placed at 22,737.83, followed by 22,530.57. On the upside, key resistance levels are placed at 23,130.73 and 23,316.37.Call option data

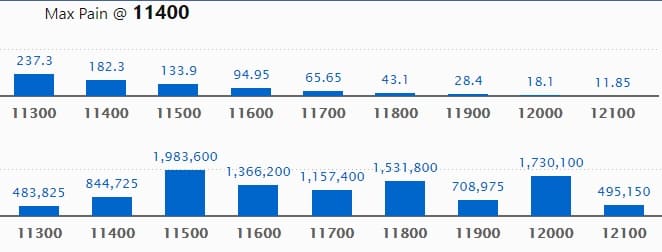

Maximum Call OI of 19.83 lakh contracts was seen at 11,500 strike, which will act as crucial resistance in the September series.

This is followed by 12,000, which holds 17.30 lakh contracts, and 11,800 strikes, which has accumulated 15.31 lakh contracts.

Call writing was seen at 11,300, which added 1.53 lakh contracts, followed by 11,800, which added 80,625 contracts, and 12,100 strikes, which added 50,925 contracts.

Call unwinding was seen at 12,000, which shed 93,975 contracts, followed by 11,500 strikes, which shed 88,050 contracts.

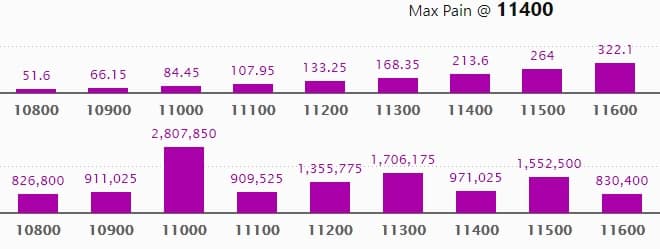

Maximum Put OI of 28.07 lakh contracts was seen at 11,000 strike, which will act as crucial support in the September series.

This is followed by 11,300, which holds 17.06 lakh contracts, and 11,500 strikes, which has accumulated 15.52 lakh contracts.

Put writing was seen at 11,100, which added 1.06 lakh contracts, followed by 10,700 strikes, which added 67,050 contracts.

Put unwinding was witnessed at 11,400, which shed 1.81 lakh contracts, followed by 11,500 strikes, which shed 99,525 contracts.

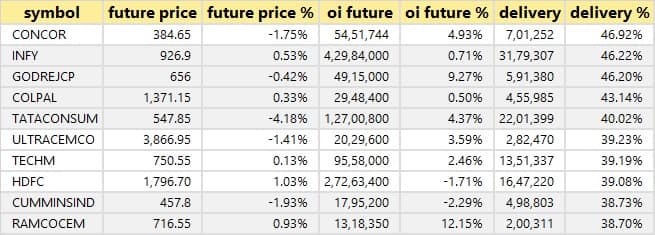

A high delivery percentage suggests that investors are showing interest in these stocks.

Based on the OI future percentage, here are those 10 stocks in which long build-up was seen.

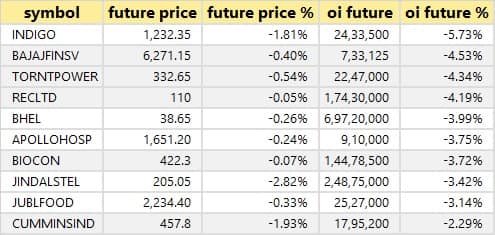

Based on OI future percentage, here are the top 10 stocks in which long unwinding was seen.

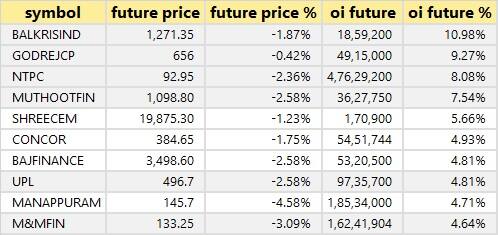

An increase in OI, along with a decrease in price, mostly indicates a build-up of short positions. Based on the OI future percentage, here are the top 10 stocks in which short build-up was seen.

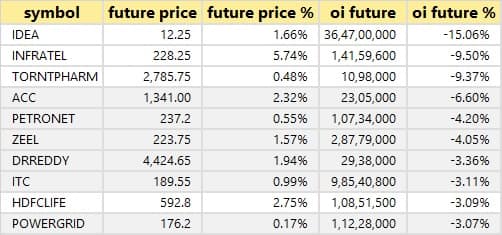

A decrease in OI, along with an increase in price, mostly indicates short-covering. Based on the OI future percentage, here are the top 10 stocks in which short-covering was seen.

Indiabulls Housing Finance: Franklin Mutual Series Funds-Franklin Mutual Beacon Fund sold 31 lakh shares in the company at Rs 194.04 per share on the NSE.

Shree Pushkar Chemicals & Fertilisers: Gautam Gopikishan Makharia bought 1,97,950 shares in the company at Rs 104.18 per share on the NSE.

Shriram City Union Finance: Arkaig Acquisition (FPI) bought 12,23,810 shares in the company at Rs 965 per share. Cornalina Acquisition (FII) was the net seller on the NSE.

Bharat Road Network: Spark Mall and Parking bought 24,32,750 shares in company at Rs 35.02 per share. Ayodhya Gorakhpur SMS Tolls was the net seller for same shares on the NSE.

(For more bulk deals, click here)

Earnings on September 8CESC, Dishman Carbogen Amcis, Future Consumer, Jindal Stainless, Mafatlal Industries, Bal Pharma, Sharon Bio-Medicine, Simplex Projects, SML Isuzu, Spencer's Retail, Texmaco Rail & Engineering among 37 stocks will announce June quarter earnings on September 8.Stocks in the news

EIH: Board approved raising up to Rs 350 crore via right issue

Amber Enterprises India: Board approved QIP issue on September 7 at a floor price of Rs 1,798.72 per share.

Rushil Decor has fixed September 11 as record date to receive Rights Entitlement in the rights issue.

Orissa Minerals Development Company: LIC cut its stake in the company to 11.16 percent from 13.2 percent earlier.

Dr Reddy's Laboratories launched Fulvestrant injection in the US market.

McNally Bharat Engineering Company: Q1 loss at Rs 30.67 crore versus a loss of Rs 32.58 crore, revenue at Rs 104.95 crore versus Rs 222 crore YoY.

Parag Milk Foods: Q1 profit at Rs 3.23 crore versus Rs 27.5 crore, revenue at Rs 435.6 crore versus Rs 629.74 crore YoY.

SBI plans to recruit more than 14,000 people this year.

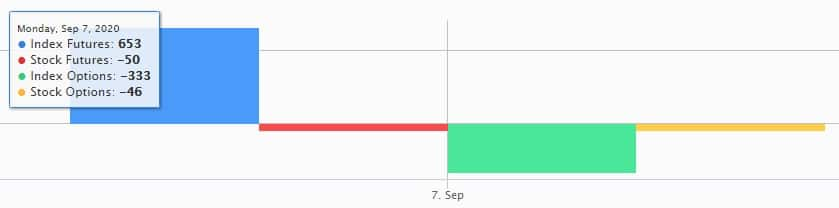

Fund flow

Foreign institutional investors (FIIs) net sold shares worth Rs 6.93 crore, while domestic institutional investors (DIIs) net offloaded shares worth Rs 815.82 crore in the Indian equity market on September 7, as per provisional data available on the NSE.Stock under F&O ban on NSESix stocks -- Bharat Heavy Electricals (BHEL), Canara Bank, Indiabulls Housing Finance, Vodafone Idea, Jindal Steel & Power and Punjab National Bank -- are under the F&O ban for September 8. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.