Migrant labourers return to New Delhi from parts of Uttar Pradesh on August 10, 2020. (Express Photo: Praveen Khanna)

Migrant labourers return to New Delhi from parts of Uttar Pradesh on August 10, 2020. (Express Photo: Praveen Khanna)The GDP decline in the April-June quarter (Q1) is primarily due to the pandemic and does not relate to the economy’s performance leading into the pandemic. The data unmistakably establish this fact and also suggest that the economy is recovering strongly in the unlock phase.

Let us first correct an elementary, conceptual misunderstanding among some commentators that “one quarter of the GDP as on June 30, 2019, has been wiped out in the last 12 months”. As GDP is a flow variable, the GDP in the April-June quarter measures economic activity undertaken in these three months. Changes in GDP are compared to the GDP during the same quarter last year only to adjust for seasonality in economic activity. Therefore, it is conceptually incorrect to infer that “one quarter of the GDP has been wiped out in the last 12 months”. The correct inference is that economic activity in April-June 2020 was 23.9 per cent lower than in April-June 2019.

India had the most intense lockdown starting from March 25. This was required because, by definition, network effects that drive the pace of a pandemic’s spread are more pronounced in larger populations, and particularly so when the population density is high. But for the intense lockdown, the pandemic would have spread like wildfire from March itself, thereby providing no time to ramp up the health or testing infrastructure. Using the fatality rates in March-April, we can estimate that if cases had gone to 90,000 a day in April when the infrastructure was ill-prepared, we would have lost about 3,000-4,000 more people on a daily basis, thereby grieving at higher orders of magnitude of deaths.

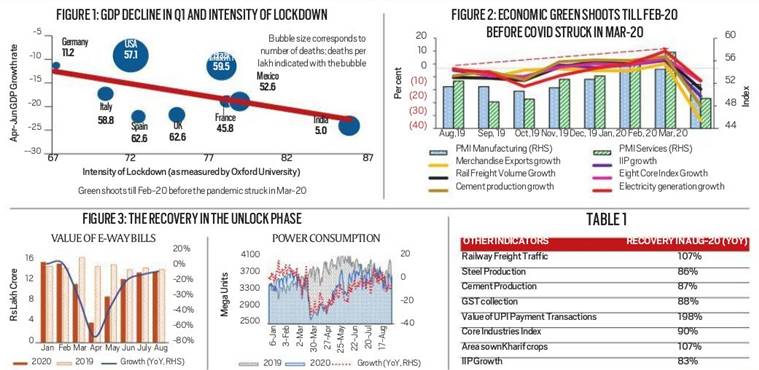

Figure 1 shows that India’s GDP being 23.9 per cent lower was primarily due to the pandemic-induced lockdown. Spain and the UK are negative outliers as their GDP declines in Q1 were worse than those predicted by the intensity of their lockdowns. The US and Brazil — positive outliers on economic growth, but the two countries with the largest number of deaths — have paid an enormous human cost for not imposing stringent lockdowns. Apart from the absolute number of deaths, India’s death per lakh is an order of magnitude lower. This reinforces India’s humane economic policy based on the principle that while GDP growth will recover — and the evidence establishes the same — human lives that are lost cannot be brought back.

This inference is also strengthened by the fact that the economy was undeniably displaying green shoots till February, when the COVID pandemic struck India. Google’s index of mobility reveals that the pandemic started affecting economic activity in India from March, when mobility dropped by about 20 per cent vis-à-vis January and February. The services sector — the dominant engine of growth in India — has been most affected by the need for social distancing and the lockdown.

Figure 2 establishes unambiguously that economic green shoots were developing until February. First, all the key economic indicators showed positive growth for the first time in seven months in February 2020; this occurred last in July 2019. Second, each of these indicators had been trending upwards from October 2019 to February 2020. Third, the purchasing managers index (PMI), which captures the future direction of economic activity, had trended up sharply with Services PMI registering the best growth by February before dropping precipitously below 50 per cent in March. Absent the impact of the pandemic in March, the Q4 growth rate would have been significantly higher than 3.1 per cent. The green shoots before the advent of the pandemic display undoubtedly that the government’s policy thrust since July 2019 was having the desired impact.

Critically, the high-frequency indicators show that the economy is recovering strongly in the unlock phase. As seen in Figure 3 and Table 1, several indicators such as PMI Manufacturing, eight core sectors, e-way bills, power consumption, railway freight, cargo traffic, passenger vehicle sales and kharif sowing are converging to levels observed at the same time last year. The V-shaped recovery in these indicators suggests that the government’s measures are enabling a recovery in the unlock phase. Specifically, all countries including India used measures for liquidity, credit and transfers as all of these collectively impact aggregate demand. The recovery in the unlock phase is an outcome of these steps.

The pandemic, however, is a severe exogenous shock that affects consumer sentiment in an unprecedented manner. Every crisis creates uncertainty that leads individuals and firms to save rather than spend. However, every crisis witnessed before originated from economic factors. In contrast, this crisis originates from a pandemic that requires social distancing. Therefore, the effect on consumer spending, especially discretionary spending, and thereby on investment, is unmatched. Further, in an economy where private consumption and investment contribute about 90 per cent to GDP and government spending (excluding transfers) about 10-12 per cent, every 1 per cent decline in consumption and investment requires an 8-9 per cent increase in government spending to keep GDP at the same level. While the government remains committed to responding to this enormous crisis, this basic arithmetic must be kept in mind.

The Q1 decline has sparked debate — rightly so — as an informed debate is essential to policymaking. The evidence, however, clearly demonstrates that the decline is primarily due to the pandemic and does not relate to the economy’s performance leading into the pandemic. Crucially, the economy is recovering strongly in the unlock phase.

This article first appeared in the print edition on September 8, 2020 under the title ‘On economy, follow evidence’. The writer is Chief Economic Advisor to the Government of India