The broader markets also corrected in line with frontliners as the BSE Midcap dropped 2.8 percent and Smallcap index was down 2.6 percent

The market took a breather with benchmark indices falling over 2.5 percent in the week ended September 4 dented by weakness in global peers and India-China border tensions. GDP contraction by 23.9 percent in Q1FY21 and uncertainty over loan recovery after Supreme Court order also hit sentiment, though strong recovery in August auto sales data on sequential basis and Supreme Court's verdict on AGR dues supported the market.

Sensex fell 2.81 percent to 38,357.18 and the Nifty50 declined 2.7 percent to 11,333.85 during the week.

Given the nervousness on the Street and no major event in the coming week, experts feel the market is likely to consolidate further with a negative bias and the participants will keep a close eye on global cues and India-China border situation.

"Uncertainties await the market for next week, be it global economic data points or geo-political uncertainties related to Indo-China border tensions. Indian markets have been in sync with its global counterparts and will have an impact. Markets seem to have lost its momentum in the near-term and could be heading into a round of consolidation. Investors advised to be alert and cautious," Vinod Nair, Head of Research at Geojit Financial Services told Moneycontrol.

Among sectors, barring telecom (up 1.5 percent), all other indices closed in the red with Bankex and Realty losing the most (down over 6 percent).

The broader markets also corrected in line with frontliners as the BSE Midcap dropped 2.8 percent and Smallcap index was down 2.6 percent.

Here are 10 key factors that will keep traders busy next week:

India-China Border Situation

The situation at India-China border will play a crucial role in terms of direction for the market as both sides have been engaged in talks through both diplomatic and military channels to ease the pressure. Last week suddenly tensions increased in eastern Ladakh when the People's Liberation Army (PLA) unsuccessfully attempted to occupy Indian Territory on the southern bank of Pangong Tso.

In a meeting held in Moscow with Chinese counterpart General Wei Fenghe, Defence Minister Rajnath Singh on September 4 "categorically conveyed' India's position on the developments along the India-China Line of Actual Control (LAC) and said the two sides should continue discussions, through both diplomatic and military channels, "to ensure complete disengagement and de-escalation and full restoration of peace and tranquillity along the LAC at the earliest'.

SC Hearing on Interest Rate Waiver

Banking stocks will remain in focus in the coming week as the next Supreme Court hearing on petitions seeking interest rate waiver for the moratorium period is scheduled to be held on September 10.

After the last hearing on September 3, Nifty Bank corrected 2.2 percent on Friday amid uncertainty over loan recovery. "Accounts not declared NPAs till August 31 not to be declared NPAs till further orders," the Supreme Court bench led by Justice Ashok Bhushan said in an interim order.

The June quarter earnings season will end on September 15, the deadline date extended by the SEBI in July due to COVID-19 crisis. About 341 companies will release their quarterly earnings scorecard in the coming week.

Key results to watch out for would be BHEL, IRCTC, CG Power and Industrial Solutions, Future Lifestyle Fashions, General Insurance Corporation, Info Edge India, Parag Milk Foods, Future Consumer, Simplex Projects, Eveready Industries, Shriram EPC, Hindustan Aeronautics, Jammu & Kashmir Bank, Sintex Industries, Adani Green Energy, BF Utilities, Eros International, Premier Explosives, Sintex Plastics Technology, GIC Housing Finance among others.

After a lull in primary market activity for more than a month following Rossari Biotech in July, two companies - Happiest Minds Technologies and Route Mobile decided to launch their IPOs next week.

IT services company Happiest Minds is set to open its Rs 702-crore initial public offering on September 7 and will close on September 9, with a price band has been at Rs 165-166 per share. IPO consists a fresh issue of Rs 110 crore and an offer for sale of 3,56,63,585 equity shares by promoter Ashok Soota and investor JP Morgan-backed CMDB II.

Omnichannel cloud communication service provider Route Mobile will open its three-day maiden public offer on September 9, with a price band at Rs 345-350 per share. The company aims to raise Rs 600 crore through IPO comprising a fresh issue of Rs 240 crore and an offer for sale of Rs 360 crore by promoters.

Rupee and FIIs

The Indian rupee gained 179 paise in last one month and strengthened by 25 paise in the passing week to end at 73.14 against the US dollar, backed by huge FPI inflow especially during August. Experts expect the currency to appreciate further in coming days.

"The rupee is likely to appreciate further, versus the US dollar, towards 72.80 and 72.40 levels, after the RBI's indication that rupee appreciation could reduce imported inflation in India. An appreciation in domestic currency reduces the net import costs," Abhishek Bansal, Founder Chairman at Abans Group told Moneycontrol.

Devarsh Vakil, Deputy Head of Retail Research at HDFC Securities also feels an improved current account, higher yields attracting foreign flows, and the government encouraging FDI flows indicate that supply of the dollar may remain strong in the near term, leading USDINR further lower, towards 72.5 per dollar levels in the medium term.

FIIs were net sellers in passing week to the tune of Rs 3,800 crore after several weeks of consistent buying.

India crossed 40 lakh confirmed COVID-19 infections with around 70,000 deaths, as per Johns Hopkins University. The significant rise in cases on week-on-week basis is largely due to increase in tests count, but consistent improvement in recovery rate and fatality rate is a good part, experts feel.

The recovery rate stood at 77.36 against 76.58 last week, while the fatality rate was at 1.72 percent against 1.8 percent in same period.

Globally there were more than 2.6 crore confirmed infections, so far, with over 8.7 lakh deaths.

Bharat Biotech's coronavirus vaccine Covaxin will soon enter phase II of clinical trials after successful in phase I, while the phase II of the vaccine produced by the Pune-based Serum Institute of India (and developed by Oxford University and Swedish-British drugmaker AstraZeneca) has started at the BJ Medical College. Experts largely feel globally the vaccine availability is possible only by December-end or in the first quarter of 2021.

Technical View

The Nifty50 fell 1.7 percent to form Doji kind of pattern on daily charts Friday and lost 2.7 percent for the week to witness Bearish Engulfing pattern formation on the weekly scale, indicating further weakness in coming days.

The index held on to crucial 11,300 levels which could remain act as near term support and if the index breaks the same then there could be correction up to 11,000 mark, experts feel.

"Nifty, on the weekly timeframe chart formed a reversal pattern like Bearish Engulfing. This is important pattern on the weekly chart, which has not formed in the last few months. The recent upside breakout attempt of significant intermediate uptrend line (intermediate trend line as per change in polarity-weekly/monthly chart) has turned out to be a false downside breakout. This is negative indication," Nagaraj Shetti, Technical Research Analyst at HDFC Securities told Moneycontrol.

"The short term trend of Nifty has turned down after a minor upside bounce. Any upside bounce attempt from the lower support of 11,300-11,325 could be a sell on rise opportunity in the near term. A decline below the support could open a broader weakness in the market towards 10,800 levels for the next few weeks, he said.

F&O Cues

After recent correction, the activity in the Option front indicated the Nifty could trade in the range of 11,100-11,600 levels in coming days, against earlier trading range of 11,200-11,800 levels.

Maximum Call open interest was seen at 11,500 strike followed by 12,000 and 11,800 strikes, while maximum Put open interest was seen at 11,000 strike, followed by 11,300 strike.

Significant Call writing was seen at 11,500, 11,400 and 11,600 strikes, while Put writing was witnessed at 11,300 and 10,800 strikes.

"The Nifty saw Put writing at ATM Put strike of 11,300. These levels are likely to remain a crucial support for the Nifty in the coming sessions. A move below 11,300 may push the index towards 11,000, which is the highest Put base of the series. On the higher side, immediate hurdle is expected around 11,600. Any fresh upside momentum is likely only above these levels," ICICI Securities said.

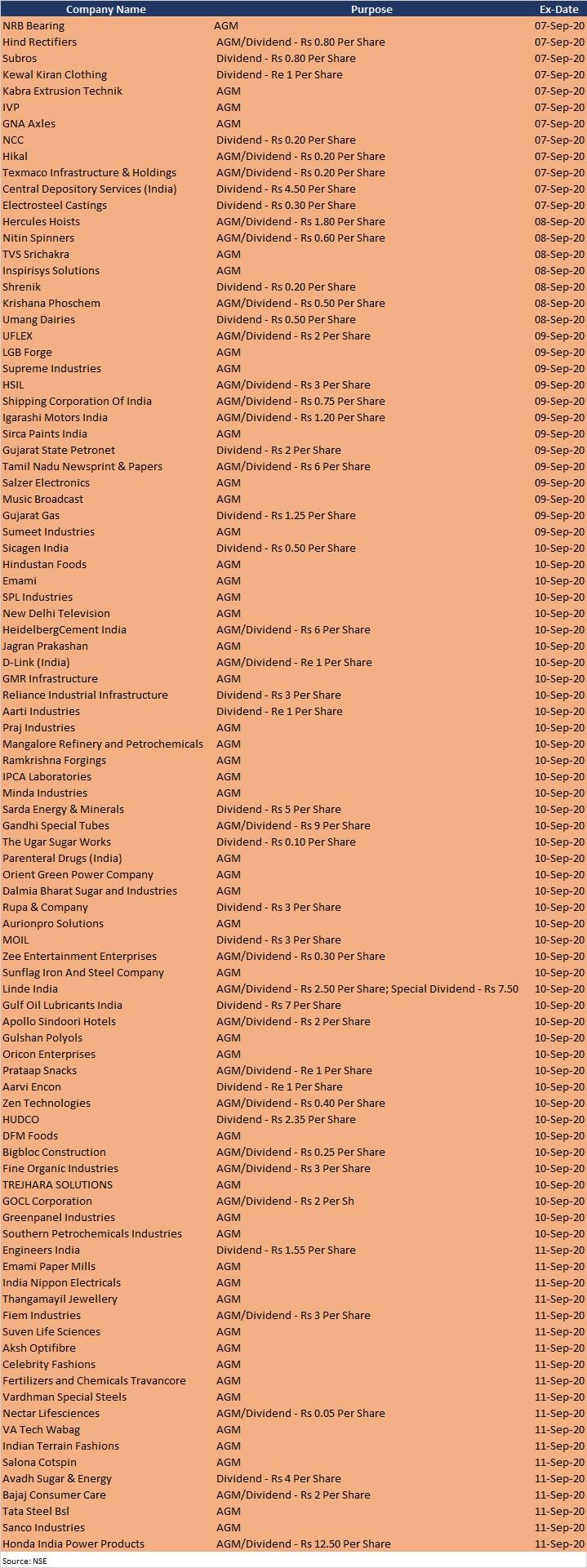

Corporate Action and Economic Data

Here are key corporate actions taking place in the coming week:

On the economic data front, industrial and manufacturing production data for July will be released on September 11, while deposit and bank loan growth for the week ended August 28, and foreign exchange reserves for week ended September 4 will be announced on the same day. All these data points will be released after market hours.

Industrial production in June contracted by 16.6 percent against 33.9 percent decline seen in May 2020, while manufacturing production was down by 17.1 percent in June.

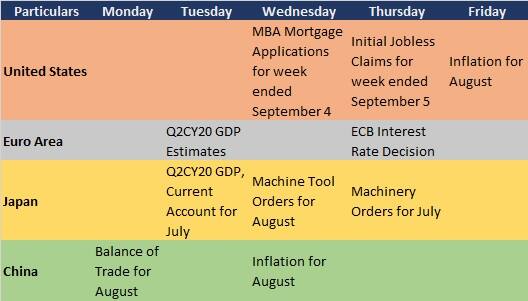

Global Cues

Here are key global data points to watch out for in the coming week: