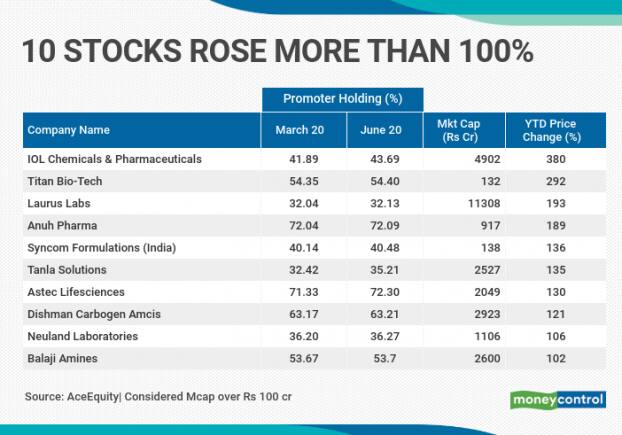

10 out of 211 companies rose more than 100 percent so far in the year 2020 that include names like IOL Chemicals, Titan Bio-Tech, Laurus Labs, Anuh Pharma, Astec Lifesciences, and Dishman Carbogen, etc.

Indian market rallied by about 20 percent in the June quarter and promoters used the momentum to increase their stake in their respective companies during the period.

Promoters raised their stake in 211 companies on a sequential basis in Q1, data shows. Of them, 1o stocks have risen more than 100 percent so far 2020 including IOL Chemicals, Titan Bio-Tech, Laurus Labs, Anuh Pharma, Astec Lifesciences, and Dishman Carbogen among others.

Even though some stocks from the mid & smallcap space more than doubled investors' wealth in 2020, most stocks were under pressure in the March-April period because of uncertainty due to the spreadd of COVID-19.

Hence, promoters used the opportunity to increase their stake, although marginally.

“If observed closely, for most companies, promoters have increased stake negligibly around 100-200 bps in the June quarter. Steep correction in prices post March 2020 lows could be one of the most logical reasons for promoters to have added to their existing holdings,” Nirali Shah, Senior Research Analyst, Samco Securities told Moneycontrol.

Why Promoters raise stake?

Promoters could raise stake because of multiple reasons. It could be to increase their hold in the company or buy at prices where they think the stock is undervalued. But, the fact that promoters are raising stake amid a tough business environment, highlights their commitment and faith in their respective businesses.

“Promoters’ holding in the company is a significant parameter in stock analysis. Many times, the shareholding level acts as an important indicator and confidence level of the promoters in the business as well as the strength of leadership control on the company,” Gaurav Garg, Head of Research at CapitalVia Global Research Limited told Moneycontrol.

“From the investor point of view, this might act as a positive parameter as the overall objective of any business is to create the wealth for its shareholders,” he said.

Generally, any increase in promoter holding is read positively by the investor community.

“It is also understood that an increase in their holding is akin to putting money where one’s mouth is which ideally means that they actually believe in the future of the company and want to be a part of the journey. But again, investing blindly and solely on the basis of the increase in promoter stake would be a very risky proposition,” says Shah of Samco Securities.

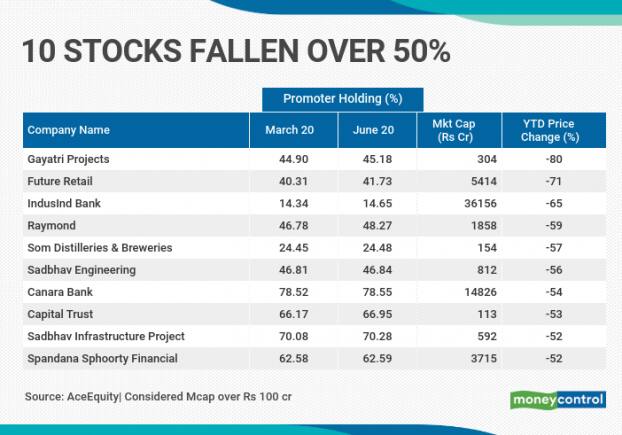

Rise in stake despite falling stock

Of the 211 companies we looked at, 10 companies saw promoters raising stake despite a fall of more than 50 percent in calendar 2020.

Shah of Samco Securities says that an increase in promoter stake by a substantial amount would be a good parameter to look at before investing, however, it is certainly not the only factor to form a judgement about a stock.

“Given the uncertainty due to the pandemic, investors are advised to thoroughly check the consistency of future free cash flows, debt to equity ratio, interest coverage ratio, provisions, management’s assessment of the situation, promoter’s pledge, future Capex plans along with a number of other fundamental factors before taking any decision on stocks, buy or sell,” she added.

Stocks that have fallen more than 50 percent include names like Future Retail, Gayatri Projects, Canara Bank, IndusInd Bank, and Sadbhav Engineering among others. All these companies have a market cap of more than Rs 100 crore.

“I believe the growth factors might drive these stocks. Some of the quality companies like Indusind Bank, Sadbhav Engineering, Future retails and many others might turn out to be dark horse,” says Gaurav Garg of CapitalVia Global Research Limited.

“With global market rallying and good liquidity inflows, Indian equities may continue to shine and so will the stocks where promoters believe in the business,” he added.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.