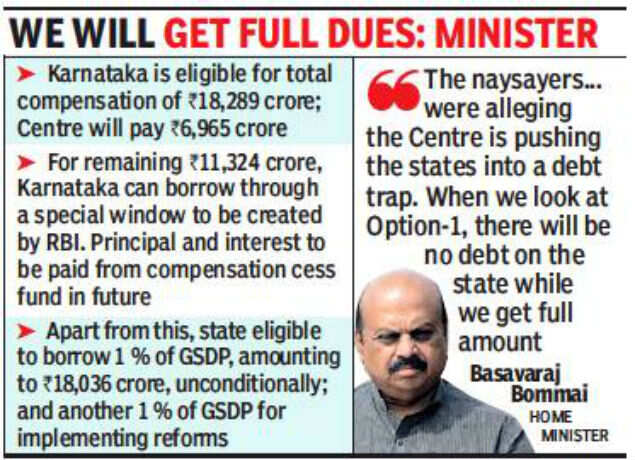

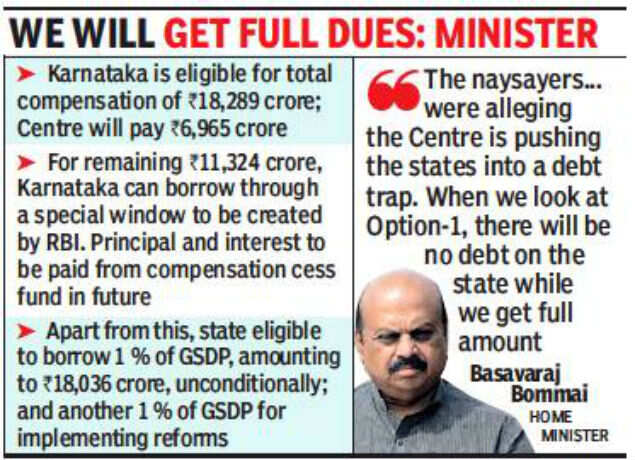

BENGALURU: BJP-ruled Karnataka said on Wednesday that it has decided to go with the first of two options offered by the Centre on borrowing to meet the shortfall in GST revenues. Under this, the state will be eligible for total compensation of Rs 18,289 crore for the period between April 2020 and January 2021.

The decision was taken after chief minister BS Yediyurappa, who also holds the finance portfolio, held discussions with finance department officials. “After the evaluation of both options, it is felt that option 1would be more beneficial to the state’s finances. Hence, we have decided to convey to the Centre its preference for Option 1,” the chief minister’s office (CMO) said.

The CMO said the chosen option would help the state augment its revenues in the present financial year. It noted that Karnataka would be eligible for total compensation of Rs 18,289 crore, of which Rs 6,965 crore would come from the collected cess. For the balance of Rs 11,324 crore, the state would be able to borrow through a special window with the entire burden of principal and interest repayment being met out of compensation cess fund in the future: the cess with tenure up to July 2022 being levied on selected sin goods such as pan masala, tobacco products and luxury cars.

Apart from this, the state will get eligibility to borrow 1% of its gross state domestic product (GSDP) — amounting to Rs 18,036 crore — unconditionally. It can avail another 1 % of GSDP as borrowing by virtue of its achievements in implementing reforms. While this additional borrowing is part of the Centre’s initiative to relax the borrowing limit of the state from 3% of GSDP to 5% under the provision of Fiscal Reforms and Budget Management Act, Karnataka is allowed to carry forward this additional borrowing to 2021-22 in case it fails avail the loan in the current fiscal year.

Under option 2, the CMO said Karnataka would be eligible for a total compensation of Rs 25,508 crore, out of which Rs 6,965 crore would come from the cess collected.

‘State can ramp up its capital expenditure’

The remaining amount of Rs 18,543 crore would be allowed to be borrowed through an issue of market debt. However, in this option, unconditional borrowing of 1% of GSDP (Rs 18,036 crore) will not be separately available to the state, as a result of which net borrowing will reduce substantially by Rs 10,817 crore, it explained. Further, under option 2, the interest on the above borrowing through issue of market debt shall be paid by the state from its own resources, it added.

“What the state government has chosen is the best possible option in the given circumstance,” said BT Manohar, member of Karnataka State GST Advisory Council. “What is important is that the state will be able to ramp up its capital expenditure since the money that is coming is the debt on it.”

Following the GST council meeting last week, the central government had written to states, suggesting options of borrowing money to make up for the Rs 2.3 lakh crore shortfall in GST revenues expected in the ongoing fiscal.

The decision was taken after chief minister BS Yediyurappa, who also holds the finance portfolio, held discussions with finance department officials. “After the evaluation of both options, it is felt that option 1would be more beneficial to the state’s finances. Hence, we have decided to convey to the Centre its preference for Option 1,” the chief minister’s office (CMO) said.

The CMO said the chosen option would help the state augment its revenues in the present financial year. It noted that Karnataka would be eligible for total compensation of Rs 18,289 crore, of which Rs 6,965 crore would come from the collected cess. For the balance of Rs 11,324 crore, the state would be able to borrow through a special window with the entire burden of principal and interest repayment being met out of compensation cess fund in the future: the cess with tenure up to July 2022 being levied on selected sin goods such as pan masala, tobacco products and luxury cars.

Apart from this, the state will get eligibility to borrow 1% of its gross state domestic product (GSDP) — amounting to Rs 18,036 crore — unconditionally. It can avail another 1 % of GSDP as borrowing by virtue of its achievements in implementing reforms. While this additional borrowing is part of the Centre’s initiative to relax the borrowing limit of the state from 3% of GSDP to 5% under the provision of Fiscal Reforms and Budget Management Act, Karnataka is allowed to carry forward this additional borrowing to 2021-22 in case it fails avail the loan in the current fiscal year.

Under option 2, the CMO said Karnataka would be eligible for a total compensation of Rs 25,508 crore, out of which Rs 6,965 crore would come from the cess collected.

‘State can ramp up its capital expenditure’

The remaining amount of Rs 18,543 crore would be allowed to be borrowed through an issue of market debt. However, in this option, unconditional borrowing of 1% of GSDP (Rs 18,036 crore) will not be separately available to the state, as a result of which net borrowing will reduce substantially by Rs 10,817 crore, it explained. Further, under option 2, the interest on the above borrowing through issue of market debt shall be paid by the state from its own resources, it added.

“What the state government has chosen is the best possible option in the given circumstance,” said BT Manohar, member of Karnataka State GST Advisory Council. “What is important is that the state will be able to ramp up its capital expenditure since the money that is coming is the debt on it.”

Following the GST council meeting last week, the central government had written to states, suggesting options of borrowing money to make up for the Rs 2.3 lakh crore shortfall in GST revenues expected in the ongoing fiscal.

Coronavirus outbreak

Trending Topics

LATEST VIDEOS

City

Drug link in SSR case: My son wrongly framed, there are bigger names involved, says father of the accused

Drug link in SSR case: My son wrongly framed, there are bigger names involved, says father of the accused  SSR death case: Mumbai Police under lens? Central agencies to probe whether Call Data Records were leaked

SSR death case: Mumbai Police under lens? Central agencies to probe whether Call Data Records were leaked  With a new turn in SSR case, BJP leader Vishwas Sarang demands dope test for actors

With a new turn in SSR case, BJP leader Vishwas Sarang demands dope test for actors  SSR death: Imtiaz Khatri's alleged role in drug mafia-Bollywood nexus needs to be thoroughly probed, says BJP leader Ram Kadam

SSR death: Imtiaz Khatri's alleged role in drug mafia-Bollywood nexus needs to be thoroughly probed, says BJP leader Ram Kadam

More from TOI

Navbharat Times

Featured Today in Travel

Get the app