The global research firm has maintained an outperform rating on the stock with target of Rs 133 per share.

Vedanta share price shed over a percent intraday on September 3 despite CLSA maintaining outperform call on the stock.

The global research firm has maintained an outperform rating on the stock with a target of Rs 133 per share. According to a CNBC-TV18 report, the book value according to delisting regulation is at Rs 89.38 against calculated Rs 147 per share sets a lower floor price for delisting than earlier expectations.

It is of the view that the funds secured by promoters indicate the ability to offer Rs 128 per share for delisting.

The stock price has gained 33 percent in the last three months and was trading at Rs 130.00, down Rs 1.10, or 0.84 percent. It has touched an intraday high of Rs 130.55 and an intraday low of Rs 126.60.

Vedanta has informed about the creation of encumbrance over the equity shares of its subsidiary Hindustan Zinc.

In a regulatory filing on August 31, Vedanta said it had tied up a long-term syndicated loan facility for Rs 10,000 crore with State Bank of India as facility agent and SBICAP Trustee Company Limited as the security trustee with door to door maturity of 7 years.

The Supreme Court on August 31 issued notice to Tamil Nadu government on Vedanta's appeal against the Madras High Court’s order disallowing the reopening of the company's controversial copper smelter in the state's Thoothukudi.

Vedanta’s Sterlite Copper smelter has been shut since May 2018 on the orders of the Tamil Nadu government after escalating protests over the unit’s alleged environmental pollution boiled over into a confrontation between police and protesters. As many as 13 demonstrators had died in police firing.

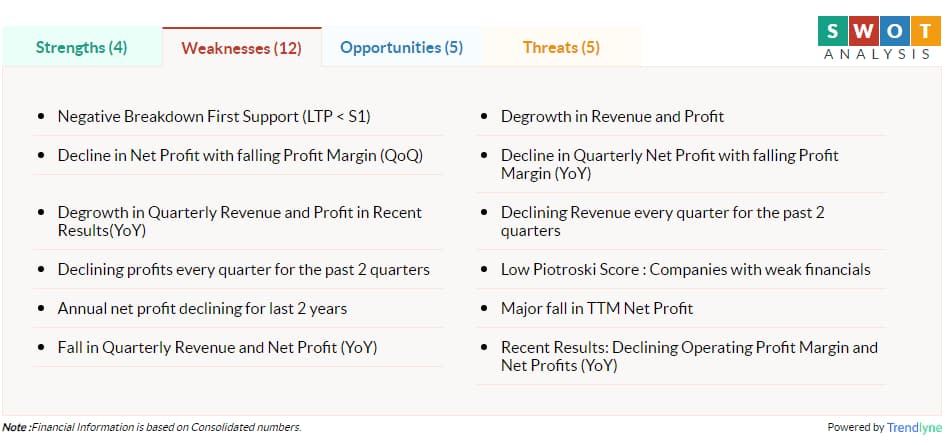

According to Moneycontrol SWOT Analysis powered by Trendlyne, the company's recent results indicate declining operating profit margin and net profits (YoY) with declining revenue every quarter for the past 2 quarters.

However, Moneycontrol technical rating is very bullish with moving averages and technical indicators being bullish.

Disclaimer: The views and investment tips expressed by experts on moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.