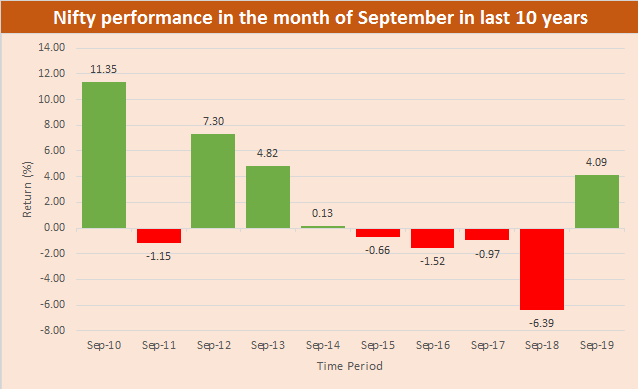

Nifty jumped over 11 percent in September 2010, followed by 7 percent in September 2012 and nearly 5 percent in September 2013 — three of the biggest gains in September in the last 10 years.

Indian market rallied by about 3 percent in August despite some profit booking seen on the last trading session of the month. So can the momentum continue in September as well?

Well, data from the last 10 years suggest that in the 5 out of the 10 years, Nifty50 closed in the green while for -the rest bears managed to take control of the market.

After rallying for three consecutive months, the market could take a breather but given the fact that global liquidity remains strong, dips could be bought into. Foreign investors poured in close to Rs 19,000 crore in the cash segment of Indian equity markets.

Historically, in September, 50 percent of the times bulls have controlled the D-Street, data from AceEquity showed.

The trend for the month of September would be dependent on global liquidity, news flow around the Coronavirus vaccine, macroeconomic trends, and news flow around US elections. September promises to remain volatile in 2020, suggest experts.

“We feel it could be a highly volatile month as several events and data would unfold. Firstly, the geopolitical tension between India and China would remain one of the key things to watch out for as further escalation could lead the Indian markets to decouple from global peers,” Ajit Mishra, VP - Research, Religare Broking Ltd told Moneycontrol.

“Additionally, apart from the fact that the current rally has been driven by global liquidity, the expectations are high that the economy is getting back on track thus crucial economic data like auto sales numbers, PMI and inflation data would also play a decisive role in setting the market direction,” he said.

Mishra further added that at the same time, the global markets too could witness some profit-taking as most the growth recovery looks priced in and some nervousness could creep in as we are near the US elections.

On the technical front, the Nifty September series commenced on a high note as market-wide rollover stood at almost 89% with strong rollovers in both the indices as compared to their 3 months average.

The long-short ratio has jumped towards 75 percent indicating strong aggressive longs to be continued by the FII. Options bounds as of now state a likely range of 12000-11000 as 11000 PE strike commands the highest OI within the chain.

“While 11500 is expected to be the mid-point of the range as denoted by the upper end of the rising trend line of the Broadening formation & reaffirmed by the OI concentration of PE & CE positions respectively,” Sacchitanand Uttekar – DVP – Technical (Equity), Tradebulls Securities told Moneycontrol.

“Since the rising trend line from 11550 levels of this Expanding/Broadening formation is also progressing along with the trend, any failure of the current breakout could be arrested in case the index again slips below 11450 from hereon,” he said.

With its daily RSI trending heading upwards, it is ideal to assume that despite the overbought state, the up move could continue until a reversal formation is witnessed.

Uttekar further added that since upside looks limited as of now it is ideal for investors to ramp up their exposures into defensives while post the sharp upward movement traders should avoid leverage, and focus on stock-specific longs due to the overbought state of the indices.

Institutional Activity:

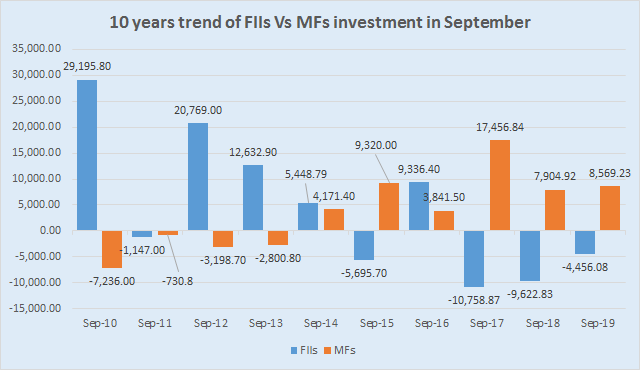

Foreign institutional investors (FIIs) have poured in by about Rs 19000 cr in the month of August, but September month has been volatile going by historical trends.

Experts are of the view that the global liquidity is likely to pour in September as well which would give support to the bulls in case of a dip or consolidation.“The central banks across the world have maintained their dovish stance and are more swayed towards getting the economy back on track. Also, India is among the top emerging markets thus we do not see the liquidity scenario changing unless something unexpected comes up,” said Mishra.

FIIs were net buyers of equities in six out of the last 10 years. FIIs bought equities worth nearly Rs 30,000 crore in September 2010, followed by Rs 20,000 crore inflows in September 2012, and over Rs 12,000 crore inflows recorded in September 2013.

On the other hand, DIIs were net sellers in September in 2 out of the last 10 years. They pulled out more than Rs 7,000 crore in 2010 and over Rs 3,000 crore in 2012.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.