Unlike a corporate cover, an independent policy is ordinarily renewable for life

The novel Coronavirus disease pandemic has led to an increase in health insurance awareness in India. Humungous hospital bills for COVID-19 treatment have prompted many to buy – or enhance – health insurance covers.

However, only around 4 per cent of COVID-19 patients in the country have filed health insurance claims so far despite growing awareness – a pointer to the dismal levels of health insurance penetration in the country.

Even amongst those who are insured, many rely on their employer-funded group health insurance cover. It is a key benefit, as not only do such policies tend to cover elderly parents (some employers’ policies do, not all), but also pre-existing diseases. But such policies can fall short on several counts.

My employer’s group health insurance policy covers my parents too. Why should I buy a separate cover?

The employer-provided cover is not forever – it is there for you only till the time you have the job or are employed with that company. The day you move, the cover ceases to exist. That is why you need a standalone cover.

This harsh reality came to bite many in these COVID-19 times, when several people were laid off, depriving them and their families of a health insurance cover. The worst part was that this blow came at a time when the pandemic had just started, leaving people particularly vulnerable. Hospital bills, in some COVID-19 cases, were found to be soaring to Rs 18-24 lakh in some cases.

Unlike a corporate cover, an independent policy is ordinarily renewable for life. Moreover, most employers’ policies have a low sum insured of Rs 3-5 lakh, besides restrictions such as room rent sub-limits or co-pay.

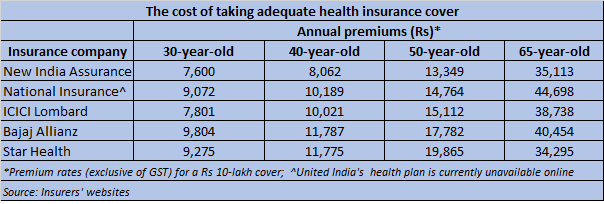

The table below, while not being exhaustive, gives an indicative list of rates charged by insurers.

So, how much health insurance do I really need?

Even if your ideal requirement is much higher, your budget may not permit it. In such cases, look for a basic threshold.

So, if you are in the age-group of 35-40 and live in a metro, you can start with a cover of at least Rs 10 lakh. “The cost of healthcare in metro cities is typically higher. Depending on the kind of hospitals you are comfortable with, a Rs 7-10-lakh cover should be good enough for younger individuals, since they are less likely to be hospitalised, particularly for serious ailments, at this stage,” says Priya Deshmukh Gilbile, Chief Operating Officer, Manipal Cigna Health Insurance. However, ensure that you review this cover at least once every five years to account for your health status as also medical inflation.

A young family of four, with the couple in the age-group of 35-40 and young kids, should have a family floater cover of at least Rs 20 lakh in place. COVID-19 resulted in multiple family members being hospitalised, necessitating a relatively larger floater cover.

The sum insured is shared amongst members, as it works on the assumption that not all family members will fall sick in the same year. This is an affordable alternative to buying individual covers for each member.

My parents are too old. They are also retired. Would they be covered in my health insurance?

Yes. If you buy a family floater policy, then your parents, even senior citizens, can be covered. But it’s best to not include them in your family floater. “They are likely to have chronic and critical conditions. The frequency of hospitalisation and claim amount will be higher. It is better to have a separate cover for them to ensure health cover’s sufficiency for all,” says Deshmukh-Gilbile.

If you are a senior citizen or are looking to buy insurance for your elderly parents, you must look at a sum insured as large as possible. In case it seems unaffordable, look at top-up plans or dedicated policies. We’ll get to that in a bit.

What are the factors I should keep in mind while buying health insurance?

You should factor in your age, affordability, income, standard of living, place of residence (metro or a non-metro) and your family health history, among other things.

“If you are in the younger age-groups, look at a Rs 15-20 lakh cover to start with, while a family floater cover should be for at least 20 lakh. Do not start with Rs 3-5 lakh and look to increase to Rs 15 lakh over a period of time. Insurers might not be in a position to give you a higher cover later due to lifestyle diseases that you might have contracted by then,” says Dr Bhabatosh Mishra, Director, Products, Underwriting and Claims, Max Bupa.

Hospital room rents vary as per the room category you choose and other charges are linked to it. So, if you prefer premium single rooms, you will need higher sums insured.

Securenow.in Co-founder Abhishek Bondia suggests a simple thumb rule: your health cover should be equal to your annual income. “For instance, someone who earns Rs 30 lakh a year would want to go to corporate hospitals where the cost of treatment, especially that of complicated surgeries, will be far higher than what a nursing home will charge,” he explains.

The advancements in the treatment of various illnesses and rising cost of healthcare means that you should buy a cover keeping future expenses in mind.

Should I buy a top-up to enhance my cover instead of buying a single large policy?

Yes, you can. A combination of a base (regular) policy and a top-up plan will be cheaper than buying a single large cover. This is because the top-up policy is triggered only after the base cover is exhausted. If you have a base policy of Rs 5 lakh and your hospitalisation bill amounts to Rs 7 lakh, the top-up will get activated to fund the additional Rs 2 lakh. If you do not have a base policy, you will have to fund this Rs 5 lakh, termed as deductible limit.

“However, your basic claims for common ailments, including cancer, should be taken care of by the base cover. Top-up covers are meant for outlier claims – for example, complicated cases of cancer or dengue. The claim process can be cumbersome if you have not purchased a top-up from the same insurer,” explains Mishra.

On your part, take a call based on your affordability, which, say, a Rs 5-lakh base and a Rs 10-15 lakh top-up plan can offer. But, make sure you buy a super and not plain-vanilla top-up plan. The former takes aggregate claims made during the year into account, unlike a regular one, which requires a single claim to exceed the deductible limit for the top-up to kick in.