HDFC Pension Fund scores over its peers on three as well as five-year returns

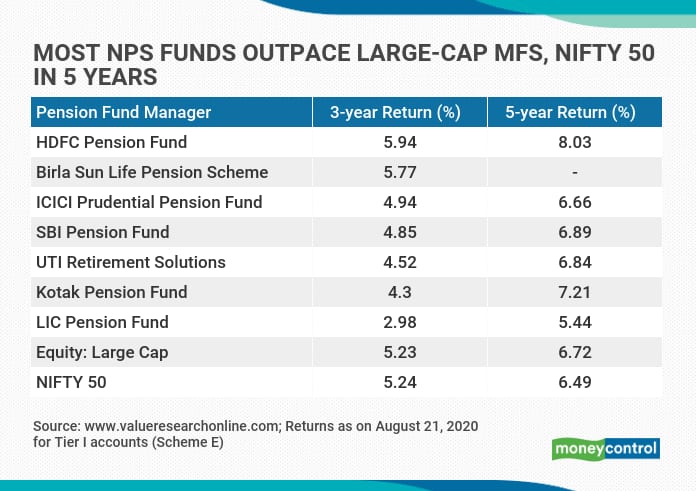

Only two out of seven National Pension System (NPS) equity funds have outperformed large-cap mutual funds and Nifty 50 over three years, data from mutual fund tracking firm Value Research showed.

Schemes E, or equity funds under NPS, managed by HDFC Pension Fund and Birla Sun Life Pension Scheme have delivered annualised returns of 5.94 per cent and 5.77 per cent respectively over a three-year period. In comparison, large-cap equity mutual funds and benchmark index Nifty 50 have yielded 5.23 per cent and 5.24 per cent respectively during the same period. However, the other five NPS fund managers’ schemes have lagged behind, fetching only 2.98-4.94 per cent annually.

Retirement saving vehicle

NPS funds fare better in the five-year returns bracket, though, with HDFC Pension Fund’s scheme retaining the top spot with 8.03 per cent return. Three other schemes – from Kotak Pension Fund, SBI Pension Fund and UTI Retirement Solutions– have beaten both the benchmark and large-cap mutual funds category average. All funds with five-year track record, barring LIC Pension Fund, have outperformed Nifty 50 during the period.

NPS is a defined contribution scheme, originally introduced for government employees in 2004. Subsequently, the subscription was opened to general public and corporate sector (to contribute on employees’ behalf). It has emerged as a popular retirement-planning avenue, thanks largely to tax deductions doled out over the years.