How to exit a laggard mutual fund? Please suggest the best strategy. Should I exit the older fund through an SWP and transfer that amount to a new fund of another fund house in the category through an SIP or should I find a better fund of the same fund house and then, transfer my investments through an STP?

- Manas Gupta

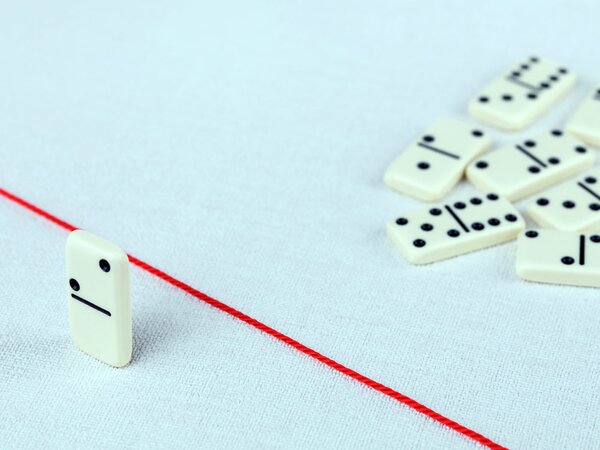

First, you need to understand which fund in your portfolio is a laggard. If the fund has underperformed consistently as compared to its peers in the category and the benchmark over the last one-three years, it is a laggard. In that case, get out of such a fund and look for a superior alternative. Invest in a fund that has been consistently outperforming its peers and the benchmark. Also, check whether there is any recent change in the fund manager. These two parameters matter a lot when it comes to choosing an alternative fund.

While you move your investments to the new chosen fund, don't complicate your decision. Move your money in a lump sum at one go. The entire idea of SIP, STP is to spread your investments over a period of time and reduce the risk of catching the market at high. The averaging of your investments that you wish to move to a better fund has already been done while you were continuing your SIPs in the older fund. So, there is no point in averaging it from here on. Start your SIPs in the new fund and move all your accumulation from the older fund in a lump sum to the new fund.