We recommend buying Canara Bank around Rs 104 with a stop loss of Rs 97 for higher targets of Rs 117/130.

Shabbir Kayyumi

What is Trendline Breakout?

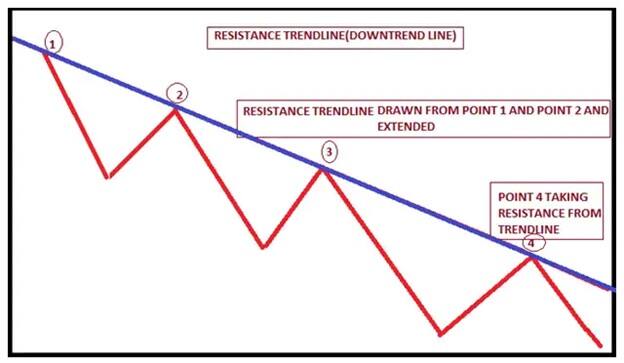

Trendlines are an important tool in technical analysis for both trend identification and confirmation. One of the basic tenets put forth by Charles Dow in the Dow Theory is that stock prices moves in a trend. Trends are often measured and identified by "Trendlines".

These trendlines can help us to identify potential areas of increased supply and demand, which can cause the market to move down or up respectively. Trendlines can help traders identify buying and selling opportunities that occur within a strong trend.

Figure.1. Resistance Trendline line Breakout

Figure.1. Resistance Trendline line Breakout

Why to buy Canara Bank?

A trendline is a straight line that connects two or more price points and then extends into the future to act as a line of support or resistance. Think of trendline as the diagonal equivalent of horizontal support and resistance.

Buy Signal

Prices are consolidating in a zone of Rs 110 on higher side and Rs 98 on lower side since last one month. At the same time, this stock is trading above its 20 DMA and 50 DMA which is supportive for upside movement. Recently downward sloping trendline connecting Rs 117-113-105 is breached from below and can be considered as a breakout of prices. However this breakout is also supported by volumes and possibility of sustainability is quite high and acceleration will come on a daily close above Rs 108 mark. Looking at above mentioned rationale one can buy this stock for higher targets. Figure.2. Trend line Breakout and Buy signal on Canara Bank

Figure.2. Trend line Breakout and Buy signal on Canara Bank

Profit Booking

As per one of the method of Trendline Breakout one can use previous swing pivot for profit booking. These levels are standing around Rs 117 and should provide immediate resistance on higher side, moving further Rs 130 will attract more profit bookings. So one can consider profit booking near Rs 117 and higher side towards Rs 130 mark.

Stop Loss

Entire bullish view negates on a breach of immediate swing low and in a case of Canara Bank, we will consider Rs 97 as a stop loss level closing basis.

Conclusion

We recommend buying Canara Bank around Rs 104 with a stop loss of Rs 97 for higher targets of Rs 117/130 as indicated in above chart.

The author is Head - Technical Research at Narnolia Financial Advisors Ltd.

Disclosure: Narnolia Financial Advisors/Analyst (s) does/do not have any holding in the stocks discussed but these stocks may have been recommended to clients in the past. The stocks recommended are based on our analysis which is based on information obtained from public sources and sources believed to be reliable, but no independent verification has been made nor is its accuracy or completeness guaranteed.

Disclaimer: The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.