The Pension Fund Regulatory and Development Authority (PFRDA) has recently announced more details about the tax-saving scheme of National Pension Scheme (NPS) Tier-II account, which is meant for central government employees. In 2018, the government talked about the scheme and finally, it got notified in the last month.

Until recently, tax benefit was available only for investing in the Tier-I account of NPS. The Tier-II account didn't provide any tax benefit. Further, in the Tier-II account, a subscriber was free to withdraw his investment anytime without any restrictions.

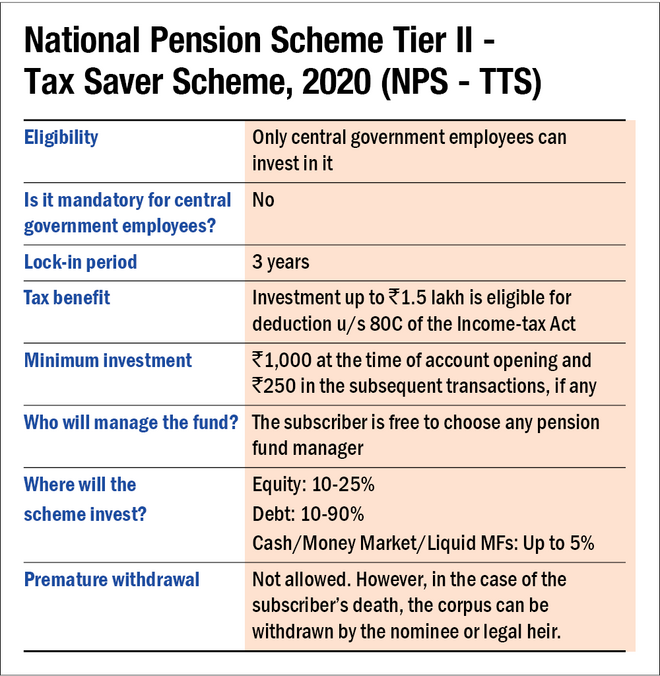

The new variant of NPS will be known as National Pension Scheme Tier- II -Tax Saver Scheme, 2020 (NPS - TTS). It will have a lock-in period of three years and investments in it will be eligible for deduction under Section 80C of the Income-tax Act. However, it is meant only for central government employees. Although subscribers are free to choose a pension fund manager of their choice at the time of investing, there is no flexibility to choose an asset allocation.

The scheme has a fixed mandate of investing between 10 and 25 per cent in equity and the remaining in fixed income. Exposure to cash and money market securities has been restricted to a maximum of 5 per cent.

This scheme should appeal to conservative investors who don't want to invest in an all-equity tax-saving mutual fund, as they now can have two advantages with this scheme. One, the portfolio is heavy on fixed-income and the other is that the scheme has the shortest lock-in period of three years among all other fixed-income tax-saving alternatives. Other fixed-income-based tax-saving alternatives, including National Savings Certificate (NSC), tax-saving bank fixed deposit and Public Provident Fund (PPF) have much longer lock-in periods. While the tax-saving bank fixed deposits and NSCs have a lock-in period of five years, PPF has a tenure of 15 years.

But Equity-Linked Savings Scheme (ELSS) has the potential to give superior returns. Also, given the fact that the NPS Tier-II Tax Saver Scheme is currently open only for central government employees, a vast base of investors do not have an option to invest in it. The following table summarises the key features of the NPS Tier-II - Tax Saver Scheme, 2020.