Shrikant Chouhan of Kotak Securities said the strategy should be to buy on dips.

The market corrected for the first time in the last four consecutive sessions due to weak global cues and a rise in Dollar index after Federal Reserve meeting minutes which raised worries over economic recovery in the US. Banking and financials stocks were at the forefront to drive the fall.

The BSE Sensex dropped 394.40 points or 1.02 percent to close at 38,220.39, while the Nifty50 declined 96.20 points to 11,312.20 and witnessed Doji kind of indecisive formation on the daily charts as closing was near to opening levels, indicating consolidation ahead.

"Though the major trend seems to be positive, Nifty requires to surpass recent swing highs to commence the next movement. Nifty has to hold above 11,250 to witness an upmove towards 11,500 while the support exists at 11,200," Siddhartha Khemka, Head - Retail Research at Motilal Oswal Financial Services told Moneycontrol.

Going ahead, the market volatility is likely to continue as investors remain cautious over the uncertainty regarding the global economic recovery, fresh US economic relief, the fallout of US-China tensions and worsening coronavirus crisis, he feels.

Shrikant Chouhan, Executive Vice President, Equity Technical Research at Kotak Securities said the strategy should be to buy on dips.

"Investors should buy Nifty if the index corrects further. Below 11,300 levels, the Nifty would halt at 11,240 with a final stop loss at 11,100," he detailed.

The broader markets bucked the trend today, with Nifty Midcap index was up 0.8 percent and Smallcap gained 0.66 percent.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support level for the Nifty is placed at 11,280.83, followed by 11,249.47. If the index moves up, the key resistance levels to watch out for are 11,352.53 and 11,392.87.

Nifty Bank

The Bank Nifty corrected 286.40 points or 1.29 percent to close at 21,999.50. The important pivot level, which will act as crucial support for the index, is placed at 21,897.43, followed by 21,795.46. On the upside, key resistance levels are placed at 22,090.63 and 22,181.87.

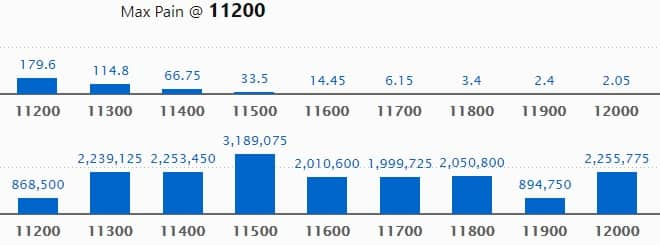

Call option data

Maximum Call open interest of 31.89 lakh contracts was seen at 11,500 strike, which will act as crucial resistance in the August series.

This is followed by 12,000 strike, which holds 22.55 lakh contracts, and 11,400 strike, which has accumulated 22.53 lakh contracts.

Call writing was seen at 11,300 strike, which added 9.68 lakh contracts, followed by 11,400 strike, which added 8.33 lakh contracts, and 11,500 strike, which added 7.96 lakh contracts.

Call unwinding was seen at 10,800, which shed 33,075 contracts, followed by 10,900 strike, which shed 3,750 contracts.

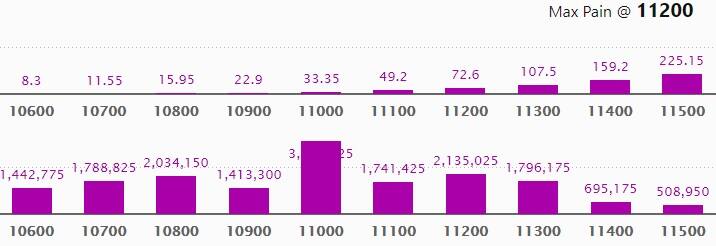

Put option data

Maximum Put open interest of 39.03 lakh contracts was seen at 11,000 strike, which will act as crucial support in the August series.

This is followed by 11,200 strike, which holds 21.35 lakh contracts, and 10,800 strike, which has accumulated 20.34 lakh contracts.

Put writing was seen at 10,800 strike, which added 3.14 lakh contracts, followed by 11,000 strike, which added 2.96 lakh contracts, 10,700 strike, which added 2.29 lakh contracts, and 10,900 strike, which added 1.35 lakh contracts.

Put unwinding was witnessed at 11,100, which shed 5.3 lakh contracts, followed by 11,400 strike, which shed 4.07 lakh contracts and 11,500 strike which shed 1.82 lakh contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

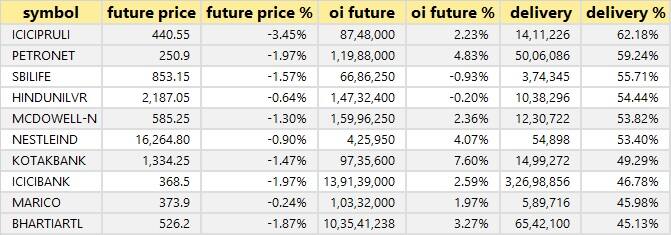

34 stocks saw long unwinding

Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

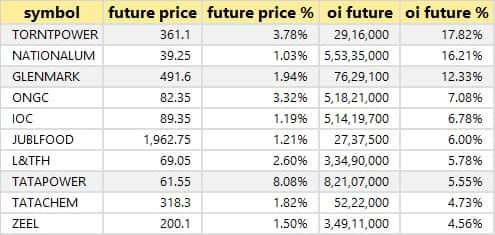

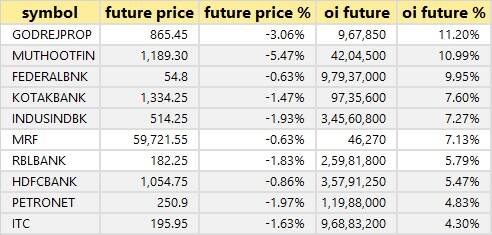

47 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which short build-up was seen.

25 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering.

Bulk deals

Alankit: LTS Investment Fund bought 11 lakh shares in the company at Rs 17.63 per share.

Future Consumer: CLIX Capital Services sold 1,11,65,000 shares in the company at Rs 11.2 per share.

GSS Infotech: Thakar Ashish Bhupendra acquired 1.8 lakh shares in the company at Rs 26.7 per share.

Jain DVR Equity Shares: V T Rajan bought 1.04 lakh shares in the company at Rs 12.03 per share.

Ruchira Papers: Radhey Health Care acquired 1,28,095 shares in the company at Rs 60.19 per share.

Supreme Engineering: Sanjay R Chowdhari sold 1.6 lakh shares in the company at Rs 17.03 per share.

Suumaya Lifestyle: Pranith Realities LLP sold 1.44 lakh shares in the company at Rs 31.47 per share.

V-Guard Industries: SBI MF acquired 94,96,719 shares in the company at Rs 160.25 per share. However, Axis MF was the seller at the same price.

Vikas EcoTech: Alpha Leon Enterprises LLP net sold 18,55,361 shares in the company at Rs 10.6 per share.

(For more bulk deals, click here)

Punjab National Bank, Union Bank of India, Oil India, Indiabulls Housing Finance, Coffee Day Enterprises, Automotive Stampings, Genus Paper & Boards, Harrisons Malayalam, Kolte-Patil Developers, Rossari Biotech, SMS Lifesciences, Suprajit Engineering, Venus Remedies, etc. will announce their quarterly earnings on August 21.

Stocks in the news

Jump Networks: The company shall be receiving firm, unconditional offer from Jump Networks, Inc, USA for investment on or before September 5, 2020.

Wipro: The company set up blockchain-based gas trading platform for Uniper Global Commodities SE.

Indian Overseas Bank Q1: Profit at Rs 120.69 crore versus loss Rs 342.08 crore, NII at Rs 1,412.32 crore versus Rs 1,288.46 crore YoY.

HealthCare Global Enterprises Q1: Loss at Rs 45.61 crore versus loss Rs 20.59 crore, revenue at Rs 193.46 crore versus Rs 268.88 crore YoY.

J Kumar Infraprojects Q1: Loss at Rs 20.81 crore versus profit at Rs 40.92 crore, revenue at Rs 285.25 crore versus Rs 667.74 crore YoY.

MOIL Q1: Profit at Rs 1.88 crore versus Rs 90.7 crore, revenue at Rs 152.3 crore versus Rs 280 crore YoY.

Premier Explosives: The company received an order from Israel Aerospace Industries, Israel (IAI) for development and supply of EDRM rocket motors for a total value of $520,000 (about Rs 3.90 crore). The order is expected to be delivered within 9 months.

GMM Pfaudler: The company signed definitive agreements to acquire a majority stake (54 percent) in the global business of the Pfaudler Group from Pfaudler UK.

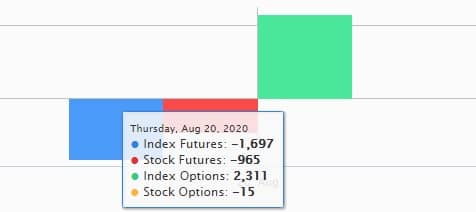

Fund Flow

FII and DII data

Foreign institutional investors (FIIs) offloaded shares worth Rs 268.46 crore and domestic institutional investors (DIIs) sold shares worth Rs 672.23 crore in the Indian equity market on August 20, as per provisional data available on the NSE.

Stock under F&O ban on NSE

Fourteen stocks -- Adani Enterprises, Aurobindo Pharma, Bank of Baroda, Canara Bank, Century Textiles, Indiabulls Housing Finance, Vodafone Idea, Jindal Steel & Power, Manappuram Finance, Muthoot Finance, NALCO, RBL Bank, Sun TV Network and Vedanta -- are under the F&O ban for August 21.

Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.