The last time two big corporate entities jostled for the official jersey rights was in 2010 when Sahara secured the rights by paying Rs 3.34 crore compared to Airtel's Rs 2.89 crore per international game offer.

The Board of Control for Cricket in India (BCCI) is the richest cricketing body in the world and the game’s roaring popularity has meant that it has seldom found itself on a sticky wicket on the financial front.

But, if the bidders for the recently-concluded IPL title sponsorship bids are seen as any indication, it can be seen that none of the old-economy companies explored the prospect of associating with the most popular T20 tournament in the world.

Dream11, Unacademy and Byju's were the three entities which submitted bids while Tata Sons, which had evinced interest, did not place a bid, much to the BCCI’s chagrin.

Tata Sons and BCCI could not come to an agreement over the number of categories available for sponsorship. The fact that it was the only old-economy to confirm its interest in the rights shows the dwindling interest of the corporate houses and the emergence of startups and new-age companies in the cricket ecosystem.

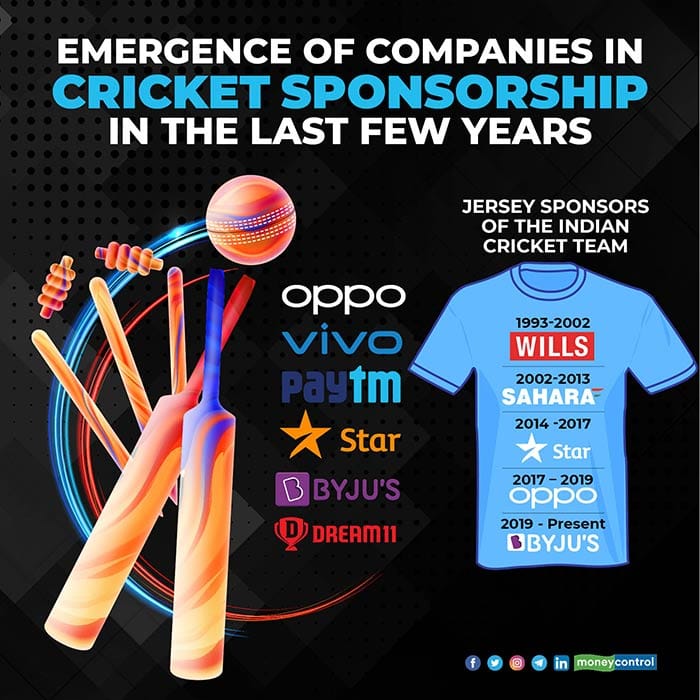

Before Vivo, the IPL was sponsored by leading brands such as DLF and Pepsi while the Indian cricket team's official jersey sponsorship rights were held by the likes of ITC and Sahara. Star India also held the rights for three years.

The last time two big corporate entities jostled for the official jersey rights was in 2010 when Sahara secured the rights by paying Rs 3.34 crore compared to Airtel's Rs 2.89 crore per international game offer.

Corporate India's big foray into cricket board sponsorship came in 1987 when Reliance Industries became the title sponsor of the World Cup, which was being held outside England for the first time.

Other companies like Hero MotoCorp and Reliance Communications have also been associated with the International Cricket Council as commercial partners.

In 2019, Byju's replaced Oppo as the jersey sponsor, thus sending a signal that the startups are willing to splash the cash to catch the eyeballs.

But, in the past few years, the BCCI has not seen many top companies lining up to bid for the jersey or title sponsorship rights.

In 2017, when Star's contract with BCCI was coming to an end and bids were called, two Chinese handset manufacturers were in the fray – Oppo and Vivo. Oppo offered to pay Rs 1,079 crore, almost double the BCCI's reserve price of Rs 538 crore.

In 2019, Paytm bagged the BCCI title sponsorship rights until 2023 for Rs 326.8 crore.

"It is not just Indian companies, even MNCs such as Pepsi, Samsung, Coca-Cola, Vodafone and Nike have been steadily showing declining interest. Whether it is value perception only or combined with an indifferent attitude of cricket administrators towards sponsors that is keeping them away, is tough to say," Harish Thawani, founder of Nimbus Communications, told Moneycontrol.

Thawani said apart from new-age brands like Paytm, Byju’s and Dream11, the rest simply cannot afford the investment in cricket.

"The landscape changes every few years. It was dominated by Pepsi, LG, Samsung, Hero MotoCorp, Vodafone and Airtel Now, the Chinese brands and some new-age brands are dominating. Two years from now, there will be others," he said.

Saurabh Uboweja, Managing Partner of managing consulting firm BOD Consulting, feels the cricket sponsorship segment is following the worldwide trend of brands catering to youngsters garnering the bulk of sports sponsorship deals.

"The new-age companies follow the new trends. If you look at the digital gaming segment, it is massive and it makes sense for Dream11 to bid for the rights. Earlier, it used to be the likes of Oppo and Vivo, which used to target the new-age customers. Whenever brands take sponsorship of sports events, they look at the target audience. Earlier, Pepsi and Coca-Cola used to heavily sponsor cricket tournaments but of late due to people’s perception of cola-based drinks, they have stopped spending heavily in that segment. A brand like Amul is now trying to reinvent itself and has focused a lot on sports sponsorships. A brand which is already young in terms of image will always try to go all out in terms of associating with sports properties," he told Moneycontrol.

Jagdeep Kapoor, brand guru and Chairman and Managing Director, Samsika Marketing Consultants, said the big Indian companies have missed a golden chance of propelling their brands opportunity by passing up the opportunity to associate with this year's IPL.

"Big Indian companies missed a great opportunity as IPL is a great property. In brand building and sponsorship, companies need to have a long-term view. The traditional companies have a vision but they are going for revision and slashing their marketing budgets. You can’t be cutting your nose to spite the face. Dream11 has got a goldmine and is a good move from their point of view. According to me, the established players have missed out on a great opportunity," he told Moneycontrol.

With COVID-19 putting a dent on the finances of India Inc, it was widely speculated that the BCCI would have a tough time in getting a deal similar to the one they had inked with Vivo. Ultimately, Dream11 has offered to pay Rs 222 crore for this year and the cricket board will have to look for associate sponsorship slots to reduce the deficit.

So, has the BCCI been able to salvage the situation vis-a-vis the IPL sponsorship?

"In the pandemic affected market, to get 50 percent of what Vivo was paying is a reasonable result. But one hears other central sponsors have pulled out too. So, let's see how that pans out," said Thawani.

(Disclosure: Reliance Industries is the sole beneficiary of Independent Media Trust which controls Network18 Media & Investments)