Ajit Mishra of Religare Broking feels the decisiveness is still missing and suggests traders to place their bets wisely

The market traded rangebound with a positive bias on August 19, but extended gains for the third straight day. The Nifty closed above 11,400 for first time since February and the Sensex gained 86.47 points to close at 38,614.79, driven by banking and financial stocks.

The Nifty climbed to a new swing high of 11,460.35 in early trade and then remained rangebound for the entire session, before signing off with a 23-point gain at 11,408.40. It formed a bearish candle on the daily charts as the closing was lower than opening levels.

"One may expect further upside in the market in the short term, but the narrow range, with a positive bias, is expected to continue in coming sessions," Nagaraj Shetti, Technical Research Analyst at HDFC Securities, told Moneycontrol.

"There is a possibility of the Nifty touching 11,550-11,600 levels in the next few sessions, before showing another round of profit booking from the highs. Immediate support is placed at 11,375-11,350 levels," he said.

The broader markets stayed positive as the Nifty Midcap and Smallcap indices were up 0.6 percent and 1.24 percent, respectively.

Ajit Mishra, VP-Research at Religare Broking, sees rotational buying on the sectoral front with almost all sectors contributing to the move. "However, the decisiveness is still missing and thus we suggest traders to choose their bets wisely," he added.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the NiftyAccording to pivot charts, the key support level for the Nifty is placed at 11,381.57, followed by 11,354.73. If the index moves up, the key resistance levels to watch out for are 11,447.77 and 11,487.13.Nifty Bank

The Bank Nifty closed at 22,285.90, up 115.30 points. The important pivot level, which will act as crucial support for the index, is placed at 22,206.96, followed by 22,128.03. On the upside, key resistance levels are placed at 22,392.07 and 22,498.23.Call option data

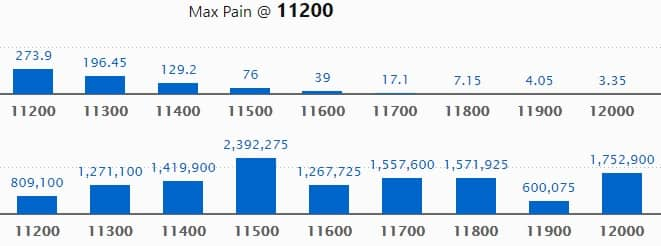

Maximum Call open interest of 23.92 lakh contracts was seen at 11,500 strike, which will act as crucial resistance in the August series.

This is followed by 12,000, which holds 17.52 lakh contracts, and 11,800 strikes, which has accumulated 15.71 lakh contracts.

Call writing was seen at 11,800, which added 3.99 lakh contracts, followed by 12,000, which added 2.72 lakh contracts, and 11,700 strikes, which added 2.31 lakh contracts.

Call unwinding was seen at 11,200, which shed 1.55 lakh contracts, followed by 11,300 strikes, which shed 1.47 lakh contracts.

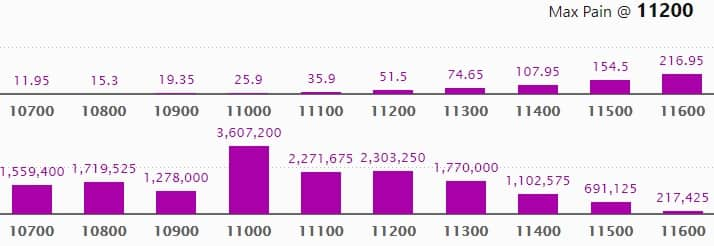

Maximum Put open interest of 36.07 lakh contracts was seen at 11,000 strike, which will act as crucial support in the August series.

This is followed by 11,200, which holds 23.03 lakh contracts, and 11,100 strikes, which has accumulated 22.71 lakh contracts.

Put writing was seen at 10,700, which added 4.14 lakh contracts, followed by 11,400, which added 3.98 lakh contracts, 10,800, which added 2.47 lakh contracts, and 11,100 strikes, which added 2.1 lakh contracts.

Put unwinding was witnessed at 11,200, which shed 1.86 lakh contracts, followed by 11,000 strikes, which shed 81,900 contracts.

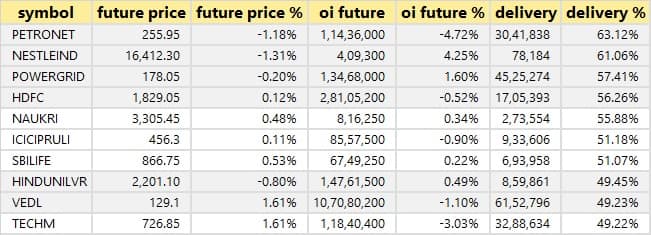

A high delivery percentage suggests that investors are showing interest in these stocks.

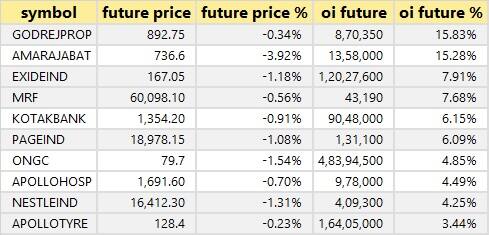

29 stocks saw long unwinding

29 stocks saw long unwindingBased on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

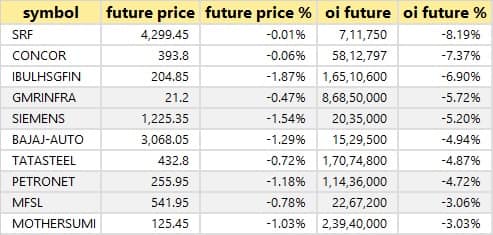

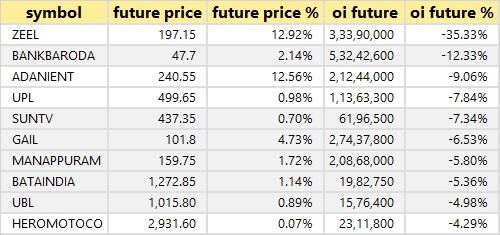

27 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which short build-up was seen.

40 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering.

Som Distilleries & Breweries: Vermilion Peak Master Fund and Karst Peak Asia Master Fund sold 6,45,827 and 12,74,630 shares in company at Rs 48.87 and Rs 48.88 per share, respectively. Shah Niraj Rajnikant acquired 2.1 lakh shares at Rs 49.07 per share.

GSS Infotech: Rao Marepally Raghunadha Rao acquired 7.5 lakh shares in company at Rs 22.23 per share. Elara India Opportunities Fund sold 98,118 shares in company at Rs 21.04 per share, Ambika Kapur 6,47,334 shares at Rs 22.06 per share, Nomura Singapore 7 lakh shares at Rs 21.33 per share and Sumant Kapur 2,14,420 shares at Rs 22.02 per share.

Satin Creditcare RE: Trishashna Holdings & Investments acquired 2,98,793 Rights Entitlement shares in company at Rs 19.42 per share.

Dolat Investments: Chandresh Popatlal Shah sold 11,64,828 shares in company at Rs 57 per share.

Suumaya Lifestyle: Nitu Trading Company sold 1.84 lakh shares in company at Rs 31 per share.

(For more bulk deals, click here)

Results on August 20HealthCare Global Enterprises, MOIL, Indian Overseas Bank, J Kumar Infraprojects, Accelya Solutions India, Foods & Inns, IRB InvIT Fund, Madhucon Projects, McDowell Holdings, Metalyst Forgings, Sheela Foam, Swelect Energy Systems, Valecha Engineering, etc will announce their quarterly earnings on August 20.Stocks in the news

Zee Learn: Ajey Kumar resigned as Managing Director of the company.

L&T Finance Holdings: Board approved raising up to Rs 200 crore via non-convertible debentures.

Sobha: Promoter group Ravi PNC Menon and persons acting in consort (PACs) raised stake in company to 3.28 percent from 3.27 percent earlier.

Ramky Infrastructure: Q1 loss at Rs 61.96 crore versus loss at Rs 5.77 crore, revenue at Rs 238 crore versus Rs 546.67 crore YoY.

Ruchi Soya Industries: Q1 profit at Rs 12.3 crore versus Rs 14.01 crore, revenue at Rs 3,043 crore versus Rs 3,112.3 crore YoY.

Sunflag Iron & Steel: Veena Ravi Bhushan Bhardwaj, part of promoter group, acquired 10,62,050 equity shares in the company, increasing stake to 1.99 percent.

PNB Housing Finance: Board approved raising up to Rs 1,800 crore equity capital.

Fund Flow

FII and DII data

Foreign institutional investors (FIIs) bought shares worth Rs 459.01 crore whereas domestic institutional investors (DIIs) sold shares worth Rs 97.13 crore in the Indian equity market on August 19, as per provisional data available on the NSE.Stock under F&O ban on NSEThirteen stocks -- Adani Enterprises, Aurobindo Pharma, Bank of Baroda, Bharat Heavy Electricals (BHEL), Canara Bank, Century Textiles, Indiabulls Housing Finance, Vodafone Idea, Jindal Steel & Power, Manappuram Finance, Steel Authority of India (SAIL), Sun TV Network and Vedanta -- are under the F&O ban for August 19.Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.