GMM Pfaudler (up 201 percent), Dixon Technologies (India) (up 153 percent) and Sterlite Technologies (up 106 percent) were the biggest gainers.

After falling to multi-year lows in March this year, lead by the fear of economic consequences of COVID-19, the equity segment of the Indian market registered a strong comeback with almost 90 percent of the stocks trading in the green. Some stocks have even generated multibagger returns in just under five months.

The steep 40 percent correction in the benchmark indices since forming all-time highs in January left many stocks trading at multi-year lows in March. The D-Street took a liking to the cheap valuations and has since pushed Nifty up by 50 percent.

The broader markets also participated in the rally with Nifty Midcap posting similar returns while the Smallcap index outperformed both of them with 59 percent gains.

Apart from valuations, the rally was also backed by ample liquidity as trillions of dollar made their way to households from stimulus packages given by central banks across the world. Better than expected earnings in June quarter, unlocking of economies, progress in the development of vaccine were some other factors that pleased the D-Street.

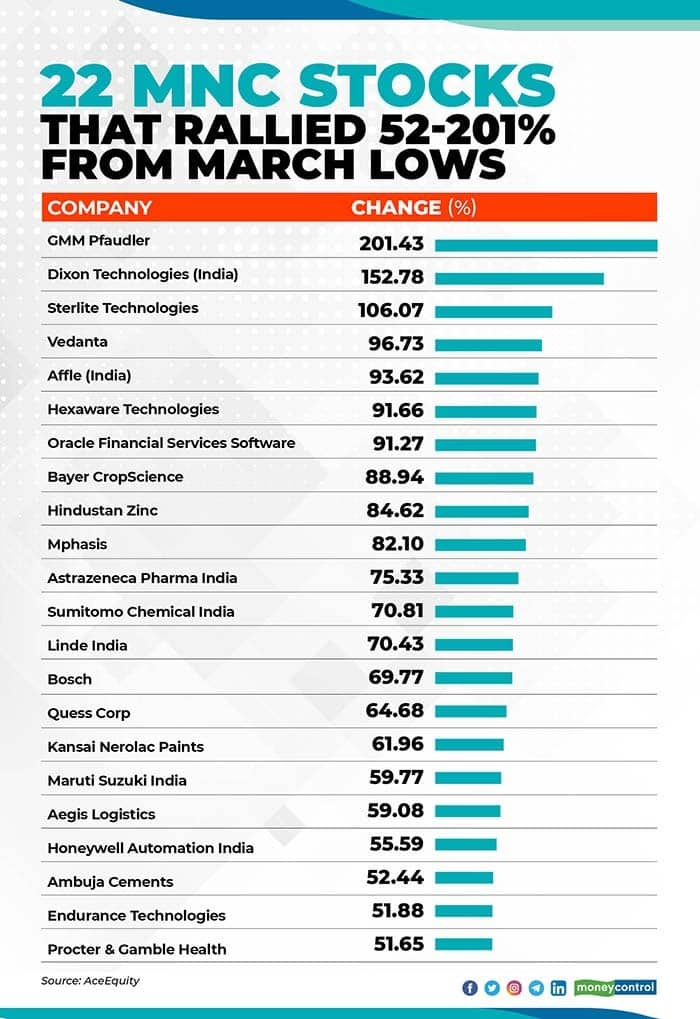

Shares of multinational companies also acted in a similar fashion with more than 90 percent of them trading in green now, compared to their March lows. About 51 stocks have gained at least in double-digits and with filtering the same data further, the top 22 stocks shot up 52-201 percent.

GMM Pfaudler (up 201 percent), Dixon Technologies (India) (up 153 percent) and Sterlite Technologies (up 106 percent) were the biggest gainers.

Vedanta, Affle (India), Hexaware Technologies, Bayer CropScience, Astrazeneca Pharma, Linde India, Bosch, Kansai Nerolac Paints, Maruti Suzuki, Aegis Logistics, Ambuja Cements, Procter & Gamble Health etc gained more than 51 percent.

Note: AceEquity data says there are 180 MNCs listed on exchanges. For this story, we considered only companies which have market capitalisation of Rs 5,000 crore and more.

Majority of sectors participated in the run with Pharma, IT, Auto and Metal leading the charge rising 50-80 percent in five months. Telecom and chemical stocks also logged big gains.

"Chemical, technology and MNC pharma stocks have witnessed strong momentum in the last six months even after the disrupted supply-chain amid lockdown. The companies have shown very good trends because of potential growth in earnings and optimism over the economy to get back on track faster than was thought earlier. Growth led rally in stocks might continue to shine and give good returns in the mid to long-term," Gaurav Garg, Head of Research at CapitalVia Global Research told Moneycontrol.

Multinational companies generally maintain good cash flows and have the latest technology with a clean balance sheet and good corporate governance. These factors attract investors because of the stability they get while investing in such companies.

"Most MNCs have very low corporate governance issue, pay full tax, have technology access from the parent, strong global parentage, higher dividend payout and a clean balance sheet. All these reasons lead to higher valuations for most MNCs in India," Rusmik Oza, Executive Vice President, Head of Fundamental Research at Kotak Securities told Moneycontrol.

"In most MNCs, the parent holding is also anywhere between 51 percent to 74 percent which provides higher confidence to minority investors. The lower free float in the market also leads to lower supply of the stock. Many of the MNCs have very good free cash flows and higher return of equity (RoE) which also supports higher valuations for them," he said.

Strategy

Rusmik Oza feels investors must have a few good MNC companies in their portfolio. "Most MNC companies have created good wealth in the long run. If for reasons the parent is consistently reducing its stake then one needs to be cautious and re-evaluate the company," he said.

Gaurav Garg said most of the stocks have already rallied, hence, investors should try to lighten their holdings. But they should try to accumulate fundamentally sound stocks in the event of any healthy correction, he advised.

Disclaimer: The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.