Building a portfolio should not be event-based but it should be focused on fundamental aspects backed by quantitative and qualitative analysis, suggest experts.

The outbreak of COVID-19 has changed life for all of us, including how we invest our money. Although, some investors might have become risk-averse, but a majority of them don’t mind taking that extra risk to generate wealth over a period of time.

If you have an all-equity portfolio, it makes sense to reshuffle the amount allocated towards each sector which are likely to benefit the most from the current situation, and sectors that will benefit most from the government policies.

At any point in time, investors should not compromise on the quality of stocks which could endanger the overall health of the portfolio if kept unchecked. Hence, a quarterly review of the portfolio is required because leaders of today might not be leaders of tomorrow.

In terms of selecting stocks from each sector, investors should look at those companies which are essentially large-cap, leaders in their domain, and are high ROE or return on equity companies.

“In terms of the equity bucket, as a core-satellite approach, the core portfolio would consist of high-quality defensive sectors, which in today’s context would mean large-cap high ROE consumption sectors like Pharma, FMCG, entry-level Auto, some IT,” Siddharth Panjwani, Chief Strategy Officer, Pickright Technologies told Moneycontrol.

“About 50-70% of the equity portfolio would go in these sectors as the core. The core could also consist partly or entirely of the benchmark index if one were to forego potential chances of market outperformance,” he said.

He further added that the Satellite portion (remaining 50%-30%) of equity could consist of names which have a high propensity of alpha – high-quality stocks and sectors which are beaten currently down due to Covid and have a high chance of future outperformance, like Financials, Discretionary Consumption, Capital Goods and so on.

Building a portfolio should not be event-based but it should be focused on fundamental aspects backed by quantitative and qualitative analysis, suggest experts.

As mentioned above the investment in equity asset-class for a beginner should be routed through index funds or equity mutual funds. “Sectoral allocation in the current scenario should be a blend of defensive and growth play to work out a quality portfolio,” Dinesh Rohira, Founder, CEO, 5nance.com told Moneycontrol.

We have collated model portfolios from various experts to battle COVID-19 storm:

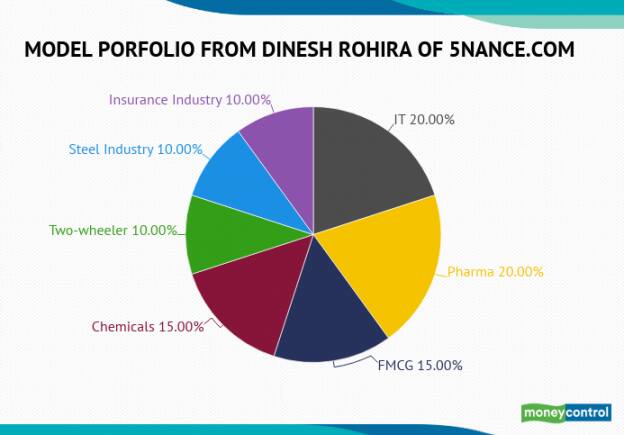

Expert: Dinesh Rohira, Founder, CEO, 5nance.com

IT Sector 20%:

Despite a complete lockdown in economic activities across the key geography business areas, the largecap IT companies reported a decent set of earnings numbers for the Q1FY21 with stable operating margin and above estimated net profit growth.

The management also indicated bottoming out of pandemic impact with many firms maintaining healthy margins guidance along with some recovery in revenue in the next few quarters.

With the world moving towards the digital ecosystem, India has emerged as a digital hub with around 75 percent of global digital talent present in the nation.

The current situation is likely to reset the business model for many companies irrespective of their size to leverage on digital platforms which will benefit the consumer-focused IT businesses.

The initiative of the government to enhance its capabilities on AI and Machine Learning will provide innovative opportunities for IT companies coupled with the added advantage of favorable currency tailwinds.

Pharma Sector 20%:

The pharma companies witnessed a surge in their valuation during the pandemic phase as investors believed in business opportunities arising out of crisis and also a defensive bet in the portfolio.

Despite the run-up in price, the select pharma stocks still offer attractive buying opportunities for a long-term investment with evolving business prospects in the healthcare space.

The India Pharma industry continues to be a world leader in generic drugs globally and it has been resilient to the pandemic. The medicine spending in India is expected to clock 9-12 percent growth over the next five years that will enable volume growth as witnessed during the recent period in the domestic market.

The advantage of a lower cost of production coupled with aggressive investment in R&D and a shift in global supply chain with India as a hub are expected to provide a competitive advantage for the Indian Pharma industry.

FMCG 15%:

The FMCG companies remained resilient to the downturn in economic activities that were placed across the country. It managed to register decent volume growth backed with robust sales in rural and semi-urban markets.

The current Covid-19 crisis helped certain segments like health & wellness business, hygiene, and food products to clock staggering spikes in volumes despite the lockdown pressure.

The additional spend in MNREGA by governed among other stimulus coupled with hike in MSP and favorable monsoon is likely to help FMCG companies to maintain healthy growth.

Chemicals Sector 15%:

Many of the essential goods industries are heavily reliant on the chemical industry. During the ongoing lockdown, most plants catering to these sectors are operational.

India has a trade deficit of $15 billion in the chemicals sector, specialty chemicals is an area where there is a lot of scope to plug gaps.

Indian companies producing specialty chemicals could also use this as an opportunity to increase scalability as global companies are de-risking their supply to reduce dependence on Chinese imports.

Commodity chemicals like dyes and pigments might see a slow pick-up in demand as the manufacturing of end products could be deferred.

Two Wheeler segment 10%:

The last mile connectivity in the current pandemic. The auto industry as a whole has been facing headwinds with a drop in volume growth for more than 18 months.

However, the shift in mobility preference among millennials coupled with safety measures due to the virus situation is expected to fuel demand growth for the two-wheeler segment after economic resumption which is favored with a lower cost of ownership.

Further, the preference to travel solo against public transport in the current pandemic is also likely to boost the sentiment for two-wheelers which is a faster mode of commuting in the city.

Based on a certain survey, as many as 73 percent potential two-wheeler buyers will consider purchasing within three months after the lockdown is lifted.

Steel Industry 10%:

Steel forms a base sector for many industries like white goods, automobiles, real estate, capital goods, infrastructure, defense, and overall manufacturing as a whole.

Hence, its linkages to the economy are profound. Although the demand for steel is expected to decline by 18 percent in the current calendar year, it is likely to rebound to a 15 percent growth in 2021.

The government spends in infrastructure and rural development is likely to be a significant push this year. Affordable housing projects are also likely to increase construction activity.

Insurance Industry 10%:

In an underinsured country like India, there is scope for expansion in the sector. The term insurance product is even more relevant during times such as these when the pandemic has affected the entire population at least to some extent.

Health Insurance has been the focus point in general insurance, during such times with the breakout of the virus it has seen a surge in demand. It is an estimate that about 30% to 35% of India has some sort of health insurance, this number could easily be half the population for the current situation.

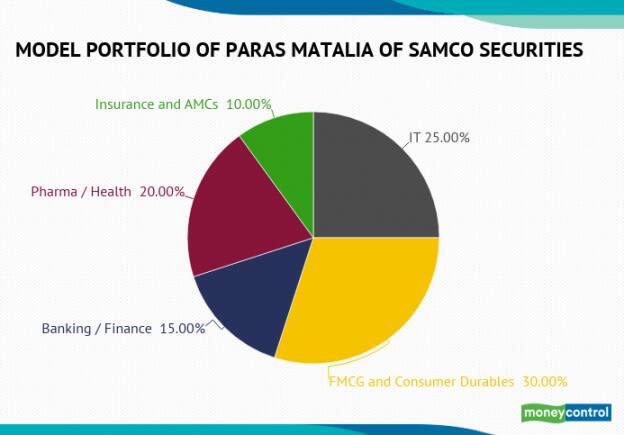

Expert: Paras Matalia, Head-StockBaskets, Samco Securities

The ideal portfolio for an investor in the current scenario would have the following sectors -

IT (25%):

One thing that businesses around the world have realised is that they have to adopt technology to survive and thus, good IT companies have outperformed in the past few months and are expected to have good growth going ahead.

Moreover, IT companies have steady cash flows, no or low debt, and have generated wealth for its investors.FMCG and Consumer Durables (30%):

Companies in these sectors also have strong fundamentals i.e. low debt, higher visibility, and superb return ratios.

Make sure to include companies from various sub-sectors such as paints, alcoholic beverages. Companies from this sector also add stability to the portfolio.Banking / Finance (15%):

There are a very few select players in the banking and finance sector that will not just survive these tough times, but come out stronger. One needs to be very careful when investing in banks/financials.

Pharma / Health (20%):

The pandemic has resulted in swift US FDA approvals and has helped push the entire sector into a bull run. Many companies have posted robust numbers this quarter too.

Financial Services - Insurance and AMCs (10%):This sector has tremendous room to grow, the trend of investing is shifting from physical assets to financial assets and these companies are well-positioned to benefit from this.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.