As on August 10, 2020, these 150 startups have raised over $20 billion in total funding across over 600 deals from more than 900 unique investors.

Indian firms Pharmeasy and Qure.ai have featured among the world's most promising digital health startups, according to a report by US-based market and business analytics platform CB Insights. The Digital Health 150 is CB Insights' annual ranking of the 150 most promising digital health startups in the world.

As on August 10, 2020, these 150 startups have raised over $20 billion in total funding across over 600 deals from more than 900 unique investors. The list also includes 12 unicorns (companies valued at over $1 billion).

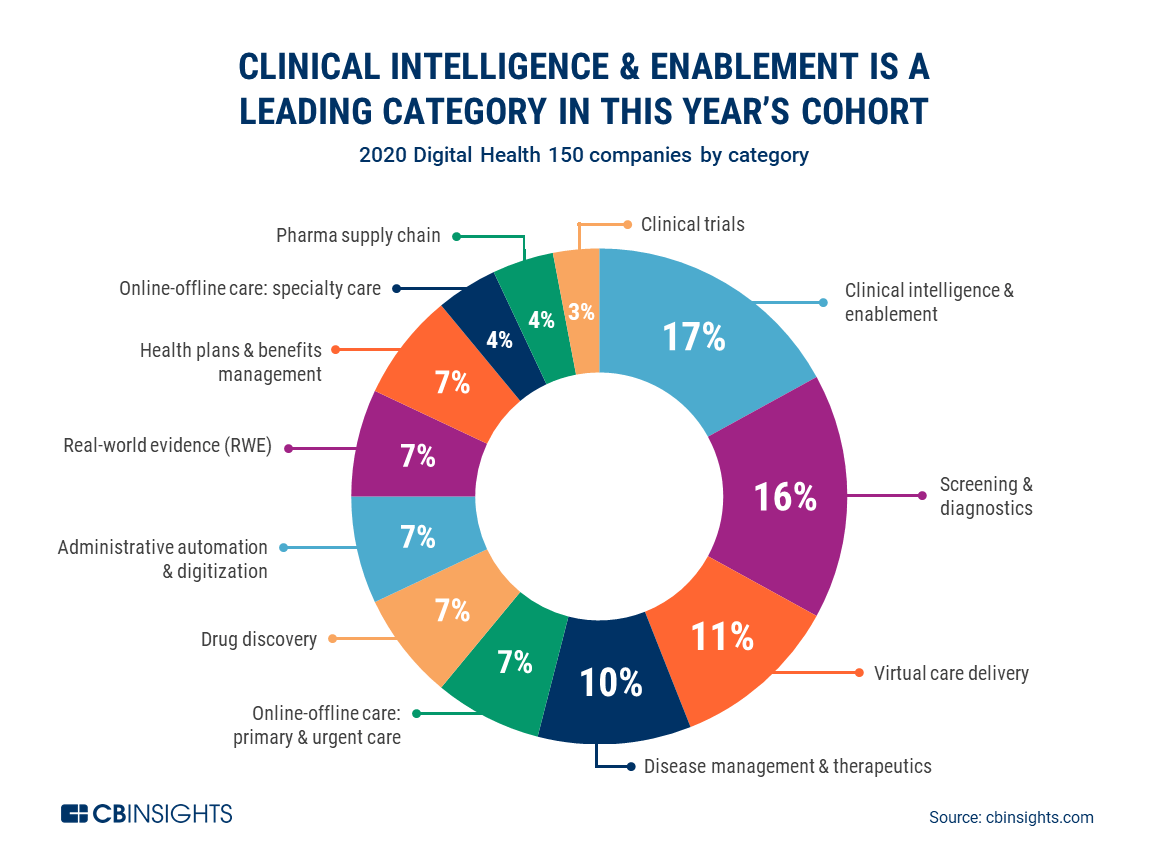

The 150 digital health startups in the 2020 rankings are working on software-enabled solutions across 12 core categories.

They have been shortlisted from among nearly 8,000 startups, based on several factors-- patent activity, business relations, investor profile, news sentiment analysis, proprietary Mosaic scores, market potential, competitive landscape, team strength, and tech novelty. US-based startups make up 77 percent of the 150 companies, dominating the list.

About Qure.ai and Pharmeasy

In India, the coronavirus pandemic has given a much-awaited boost to many health-tech startups. The National Digital Health Mission (NDHM), unveiled by Prime Minister Narendra Modi on August 15, is being touted as another step in this direction. Apart from providing a digital health ID to Indians in order to make access to medical services easier, e-Pharmacy and Telemedicine are also key building blocks of the mission.

Mumbai-based Qure.ai is among the ten selected startups that have developed artificial intelligence (AI)-enabled medical imaging solutions. Founded in 2016, Qure.ai has developed an artificial intelligence-based system to identify abnormalities in head CT scans. The pharma startup received USFDA clearance for its head CT scan product in June earlier this year.

PharmEasy, which was founded in 2015 by Dhaval Shah and Dharmil Sheth, has Trifecta Capital, Nandan Nilekani-backed Fundamentum, Temasek and Swiss firm LGT among its investors. Moneycontrol had reported last month that the online pharmacy startup is in talks to acquire rival Medlife for about $200 million.