The deadlock over standardised COVID-19 treatment charges continues as insurers and hospitals harden their positions, leaving patients in the lurch

After the General Insurance Council released its indicative rate chart for COVID-19 treatment last month, hospitals have put out a charge structure that they believe is reasonable. These rates are 70-108 per cent higher than GI Council’s charge structure. “We have shared our rates with the GI Council. Further discussions with the council to reach a consensus continue,” says Dr Alexander Thomas, President, Association of Healthcare Providers (India).

The hospital data, collated by AHPI, is based on treatment records of six hospitals across the country, including Narayana Health, Bangalore, Medica Super Specialty Hospital, Kolkata and Bhagat Chandra Hospital, Delhi. This data forms part of the report prepared by a committee comprising insurance and hospital officials as also independent experts. Chaired by Dr S Raghunath, Professor of Strategy, Indian Institute of Management Bangalore, it was constituted to compare the AHPI’s and GIC’s costs for COVID-19 treatment at private hospitals.

Huge gap in cost structures

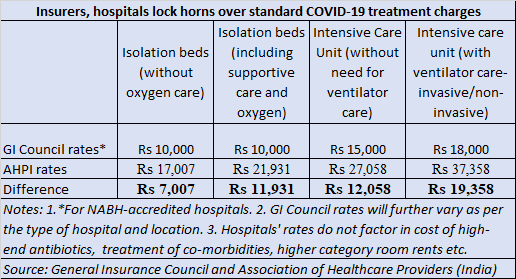

The gap between the GI Council’s rates and hospitals’ charge structures is extremely wide. For example, the former has prescribed a cap of Rs 10,000 per day for isolation beds with oxygen care, while the hospital association’s estimates suggest a cost of Rs 21,931 a day. Likewise, insurers have decided to pay daily charges of up to Rs 18,000 for intensive care unit (ICU) with ventilator care, whereas the hospital body has quoted Rs 37,358. Hospitals’ charge structure has been computed assuming that a patient would have an average of 10-14 days’ stay.

What’s more, the rate card does not include treatment of co-morbidities and other complications, which can prolong your stay and inflate the hospitalisation bill significantly. “This does not apply to private and higher category rooms, as charges will vary depending upon the facilities,” the report added. Neither does it cover high-end antibiotics, immunotherapy and interventional procedures such as chemo-port insertion, bronchoscopy procedures and biopsies, pleural or ascitic tapping and tracheostomy.

Capping of charges

The cost of personal protection equipment (PPE) are capped at Rs 1,200-2,000 (and included in per day charges) in the GI Council’s indicative rate chart, depending on the severity of ailment. On the other hand, AHPI’s estimate pegs these charges at Rs 1,900-Rs 5,000. “The use of certified PPE in COVID wards is 2.4 units per patient per day at Rs 800 per PPE and is almost double in ICUs as the per-patient manpower increases in ICUs. The use of the PPE is 1.8 units per patient a day in the rest of the hospital,” the committee’s comparison chart states.

While the general insurance body’s charge structure is not binding on insurers, many have started adhering to it. “We have started implementing the council’s rate chart issued in July. Hospitals have submitted their rate card and discussions are on. If the GI Council feels the need to revise its charge structure, it will take a call in September based on data analysis, after consulting member insurers,” says Nikhil Apte, Chief Product Officer, Health Insurance, Royal Sundaram General Insurance. Insurance companies have justified the rate caps, citing the ‘customary and reasonable charges’ condition. This clause states that treatment costs should be in line with charges for similar illnesses and service quality in the geographical location.

If both entities do not budge from their respective positions, policyholders – patients and their families – will have to bear the brunt. They will have to shell out a significant sum – up to 50 per cent in some cases– from their own pockets. “Some insurers have asked us to implement the GI Council rate card and we have to follow their instructions. In such cases, patients have to foot the bill for the difference between actual hospital charges and the claim settled by insurers,” explained a senior executive at a third-party administrator (TPA).