Analysts are of that as long as Nifty trades below 11200 levels, the possibility of further profit booking cannot be ruled out. Crucial support is placed at 11000-11950 levels.

When the week started, it looked like the market has enough strength to push benchmark indices above crucial resistance levels, but bears took control in the second half of the week and pushed Sensex below 38,000 while Nifty50 closed below 11,200 levels.

The S&P BSE Sensex wiped out gains made in the week gone by and closed with a minor cut of 0.4 percent while the Nifty50 fell 0.3 percent for the week ended August 14.

The real action was seen in the broader market space which outperformed the benchmark indices. The S&P BSE Mid-cap index rose 1.5 percent, and the S&P BSE Small-cap index closed with gains of 1.3 percent for the week ended August 14.

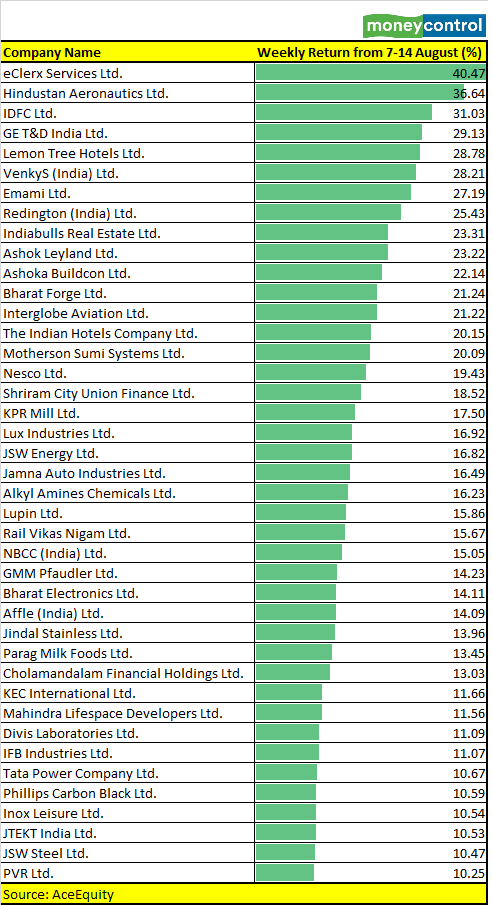

There are as many as 41 stocks in the S&P BSE 500 index which rose 10-40% in the week gone by, including PVR, JSW Steel, IFB Industries, Divis Laboratories, GMM Pfaudler, Bharat Forge, Ashok Leyland and eClerx Services.

Indian market started the week on a positive note but the sharp sell-off in the second half of the week largely on concerns of escalating US-China tensions, the possibility of no rate cut from the Reserve Bank of India (RBI) in 2020, and muted earnings capped the upside.

“Markets opened on a positive note at the start of the week but did not have any clear headway. Indices saw a sharp selloff led by financials in the second half on Friday on signs of escalating US-China tensions. Profit booking was witnessed as investors turned cautious, although this could just be a correction in the recent rally,” Umesh Mehta, Head of Research, Samco Group told Moneycontrol.

“Foreign Investors are positive on the India story for a long term horizon and retail investors are moving towards broader markets, which were undervalued, rather than rushing towards the already bloated large caps. This is leading to the outperformance in mid & small caps compared to Nifty50 by 2-2.5%,” he said.

Mehta further added that investors should ideally wait for a decent correction before buying and at the same time traders should have a stock-specific approach going ahead and not get into volatile overbought stocks just to make a quick buck.

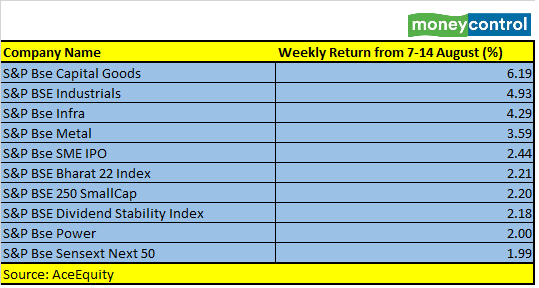

Sectorally, the action was visible in the S&P BSE Capital Goods index which was up 6.1 percent for the week followed by the S&P BSE Industrials (up nearly 5%), and Metals (up 3.5%).

“The previous market action during higher bottom formations have consumed two days of decline, after downside breakout/reversal from the highs (for two occasions - mid of July and early Aug 2020). As per this pattern one may expect another 2-3 sessions of weakness before showing any upside bounce again from the lows,” he said.

Shetti is of the view that the crucial lower supports to be watched around 11000-10950 in the next few sessions, before showing any upside bounce from the lows, while on the upside resistance are placed at 11400-11500 levels.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.