The post-office term deposit (POTD) is similar to a bank fixed deposit, where you save money for a definite time period, earning a guaranteed return through the tenure of the deposit. At the end of the deposit's tenure, the maturity amount comprises the capital deposited and the interest it earns.

Capital Protection

The capital in the POTD is completely protected, with guaranteed returns, as the scheme is backed by the Government of India.

Inflation Protection

The POTD is not inflation protected, which means whenever inflation is above the guaranteed interest rate, the return from the scheme earns no real returns. However, when the inflation rate is below the guaranteed return, it does manage a positive real rate of return.

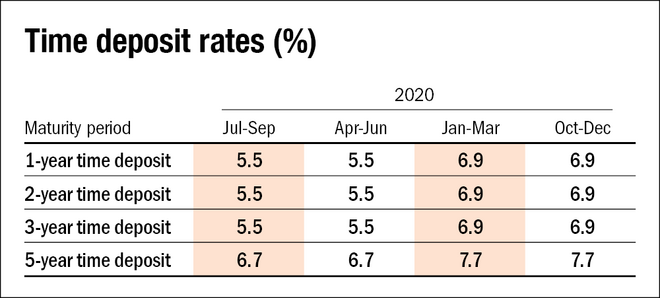

Guarantees

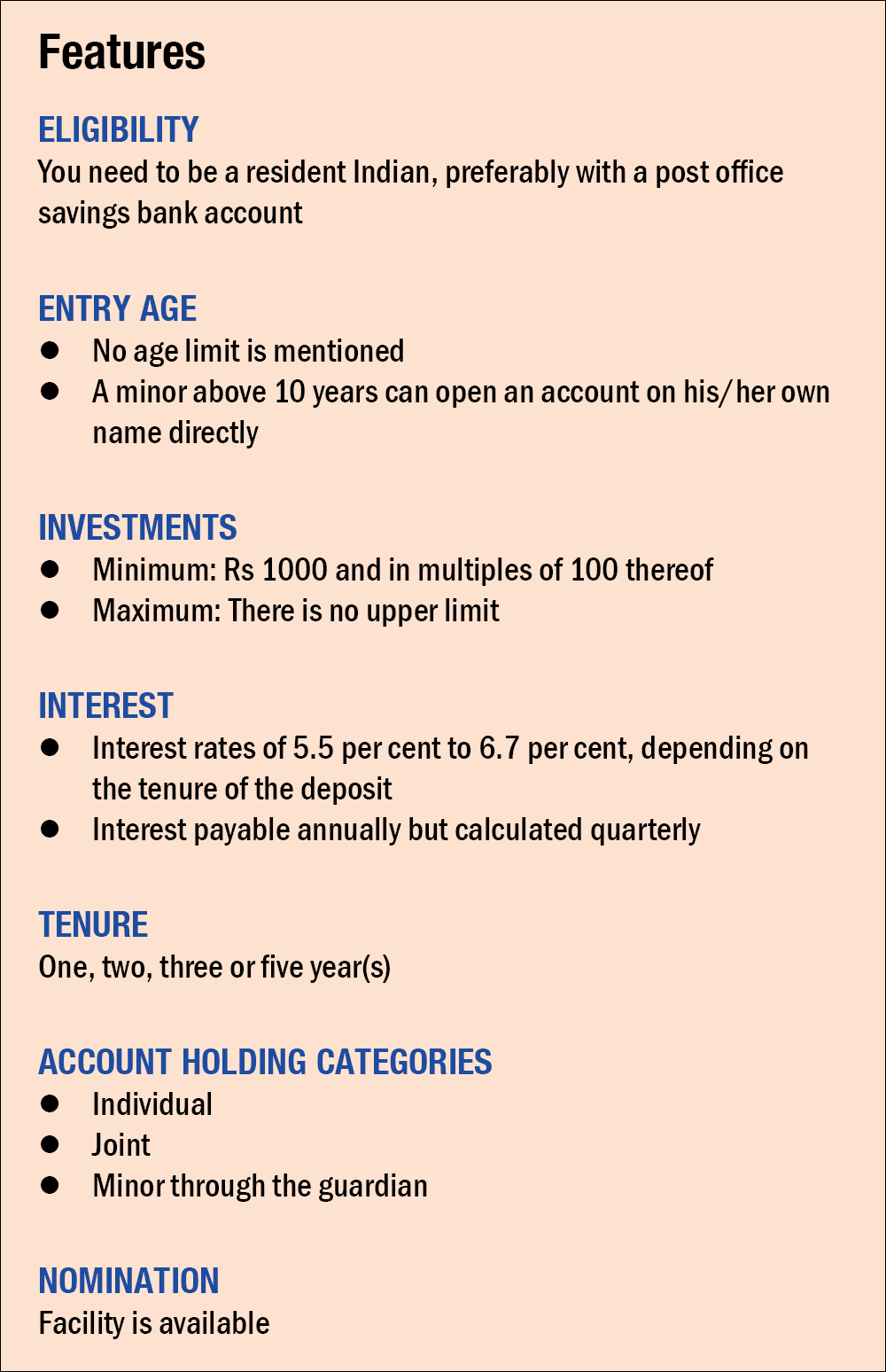

The interest rate on the POTD is guaranteed for the tenure one opts for. It currently varies from 5.5 per cent for a yearly deposit to 6.7 per cent for a five-year deposit. The interest rates on this deposit are notified every quarter and are aligned with G-sec rates of similar maturity, with a spread of 0.25 per cent. However, the rates will remain unchanged for the entire term of a deposit after one has made an investment.

Liquidity

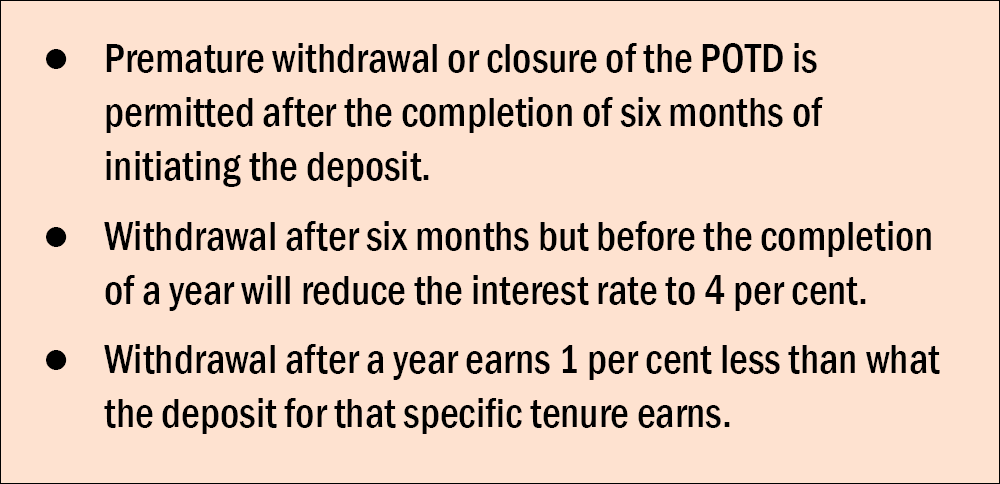

The POTD is liquid, despite the deposit lock-in. One can borrow against the deposit or withdraw the deposit prematurely.

Other Risks

There is no risk associated with this investment and hence it is risk-free.

Credit Rating

As the POTD is offered by the Government of India, it does not require any commercial rating.

Tax Implications

There is no tax benefit on the deposits with less than five-year tenure. The five-year deposit qualifies for income-tax deduction on the sum deposited under Section 80C.

Where to Open an Account

You can open the account at any head or general post office.

How to Open an Account

Once you have selected the post office to open the POTD account, you can open a POTD for which you will need the following documents:

- A deposit-opening form provided by the post office

- Address and identity proof such as the Aadhaar card; copy of the passport; PAN (permanent account number) card or declaration in the Form 60 or 61 as per the Income Tax Act, 1961; driving licence; voter's ID; or ration card

- Carry original identity proof for verification at the time of account opening

- Choose a nominee and get a witness signature to complete the formalities

How to Operate the Account

- You need a pay-in slip with the initial deposit-opening sum to be credited into your account.

- Payment can be made by cash or cheque. If you have an active internet banking facility with a post office savings account, the same can be used to make the payment.

Points to Remember

- Portability of the account between post offices is possible.

- Facility of extending the deposit on maturity is available.

- Interest income is taxable.

- Maturity proceeds not drawn are eligible to savings-account interest rate for a maximum period of two years.