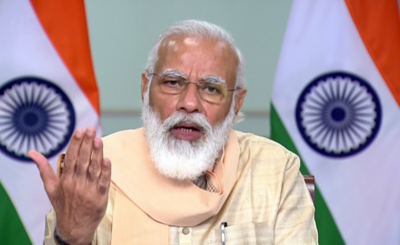

NEW DELHI: Prime Minister Narendra Modi on Thursday unveiled the much-awaited 'Transparent Taxation - Honoring the Honest' platform in order to "reform and simplify our tax system." The next phase of direct tax reforms is aimed at easing compliance and rewarding honest taxpayers, as the government looks to rebuild the pandemic-hit economy.

Here are the key points on the 'transparent taxation' platform:

* "The new platform launched has major reforms like faceless assessment, faceless appeal and taxpayers charter. Faceless assessment and taxpayers charter have come into force from today," PM Modi said.

* "The facility of faceless appeal will be available for citizens across the country from September 25. Today as the tax system is becoming faceless, it is giving confidence to the taxpayer of fairness and fearlessness," the Prime Minister added.

* "In the last 6 years, the government's focus has been 'Banking the Unbanked', 'Securing the Unsecured' and 'Funding the Unfunded'. Today a new journey is starting in a way - 'Honoring The Honest': PM Modi

* "Honest taxpayers of the country play a big role in nation-building. When the life of an honest taxpayer becomes easy then the country also develops": PM

* "Our effort is that our tax system should be seamless, painless and faceless. Seamless means that the tax administration should work to solve the problem instead of confusing every taxpayer": PM Modi

* Taxpayers charter is also a big step in the country's development journey: PM

* The taxpayer is now assured of fair, courteous and rational behavior. That is, the I-T department now has to take care of the taxpayer's dignity sensitively: PM

* Last year, the Centre reduced corporate tax to 22 per cent from 30 per cent for existing companies and 15 per cent for new manufacturing units, scraping of dividend distribution tax and faceless assessment.

* The Budget for 2020-21 fiscal unveiled on February 1, had announced a 'taxpayer charter', which is expected to have statutory status and will empower citizens by ensuring time-bound services by the Income Tax (I-T) department.

* The charter will ensure trust between a taxpayer and the administration and reduce harassment, as well as increase efficiency of the department, Union finance minister Nirmala Sitharman had said her Budget speech.

* "We wish to enshrine in the statutes a 'taxpayer charter' through this budget. Our government would like to reassure taxpayers that we remain committed to taking measures so that our citizens are free from harassment of any kind," she had mentioned.

* The Central Board of Direct Taxes (CBDT), which is the top decision making body in direct tax matters, administers personal income tax and corporate tax.

* Over the last few weeks, CBDT has been publicising the faceless tax assessment scheme — where the identity of the assessees and the tax officers are not known — that was launched last year.

* The government has for long talked about various plans — ranging from cashback or rewards under GST (goods and services tax) for those using digital modes of payment to make purchases — it has so far failed to implement them.

(With agency inputs)

Here are the key points on the 'transparent taxation' platform:

* "The new platform launched has major reforms like faceless assessment, faceless appeal and taxpayers charter. Faceless assessment and taxpayers charter have come into force from today," PM Modi said.

* "The facility of faceless appeal will be available for citizens across the country from September 25. Today as the tax system is becoming faceless, it is giving confidence to the taxpayer of fairness and fearlessness," the Prime Minister added.

* "In the last 6 years, the government's focus has been 'Banking the Unbanked', 'Securing the Unsecured' and 'Funding the Unfunded'. Today a new journey is starting in a way - 'Honoring The Honest': PM Modi

* "Honest taxpayers of the country play a big role in nation-building. When the life of an honest taxpayer becomes easy then the country also develops": PM

* "Our effort is that our tax system should be seamless, painless and faceless. Seamless means that the tax administration should work to solve the problem instead of confusing every taxpayer": PM Modi

* Taxpayers charter is also a big step in the country's development journey: PM

* The taxpayer is now assured of fair, courteous and rational behavior. That is, the I-T department now has to take care of the taxpayer's dignity sensitively: PM

* Last year, the Centre reduced corporate tax to 22 per cent from 30 per cent for existing companies and 15 per cent for new manufacturing units, scraping of dividend distribution tax and faceless assessment.

* The Budget for 2020-21 fiscal unveiled on February 1, had announced a 'taxpayer charter', which is expected to have statutory status and will empower citizens by ensuring time-bound services by the Income Tax (I-T) department.

* The charter will ensure trust between a taxpayer and the administration and reduce harassment, as well as increase efficiency of the department, Union finance minister Nirmala Sitharman had said her Budget speech.

* "We wish to enshrine in the statutes a 'taxpayer charter' through this budget. Our government would like to reassure taxpayers that we remain committed to taking measures so that our citizens are free from harassment of any kind," she had mentioned.

* The Central Board of Direct Taxes (CBDT), which is the top decision making body in direct tax matters, administers personal income tax and corporate tax.

* Over the last few weeks, CBDT has been publicising the faceless tax assessment scheme — where the identity of the assessees and the tax officers are not known — that was launched last year.

* The government has for long talked about various plans — ranging from cashback or rewards under GST (goods and services tax) for those using digital modes of payment to make purchases — it has so far failed to implement them.

(With agency inputs)

Download

The Times of India News App for Latest Business News

more from times of india business

Coronavirus outbreak

Business News

LATEST VIDEOS

More from TOI

Navbharat Times

Featured Today in Travel

Quick Links

ELSS Mutual Funds BenefitsIncome Tax Refund statusWhat is AssochamITR Filing Last DateHome Loan EMI TipsHome Loan Repayment TipsPradhan Mantri Awas YojanaTop UP Loan FeaturesIncrease Home Loan EligibilityHome Loan on PFTax Saving Fixed DepositLink Aadhaar with ITRAtal Pension YojanaNita AmbaniIndian EconomyRBIAadhaar CardSBIReliance CommunicationsMukesh AmbaniIndian Bank Ifsc codeIDBI Ifsc codeIndusind ifsc codeYes Bank Ifsc CodeVijay Bank Ifsc codeSyndicate bank Ifsc CodePNB Ifsc codeOBC Ifsc codeKarur vysya bank ifscIOB Ifsc codeICICI Ifsc codeHDFC Bank ifsc codeCanara Bank Ifsc codeBank of baroda ifscBank of America IFSC CodeBOM IFSC CodeAndhra Bank IFSC CodeAxis Bank Ifsc CodeSBI IFSC CodeGST

Get the app