The stock witnessed spurt in volume by more than 3.24 times and was trading with volumes of 3,407,638 shares, compared to its five day average of 1,369,528 shares, an increase of 148.82 percent.

Tata Power Company share price jumped over 8 percent intraday on August 13, a day after the company declared its June quarter numbers.

The company on August 12 reported a consolidated profit of Rs 268.1 crore for the quarter ended June 2020, a 10.3 percent year-on-year increase driven by lower tax cost and exceptional gain.

Revenue from operations fell 16.9 percent YoY to Rs 6,453 crore in the first quarter of FY21. The company earns most of its revenue from power generation and distribution segments, which showed weak performances.

The stock price surged 100 percent in the last three months and was trading at Rs 57.10, up Rs 4.15, or 7.84 percent at 11:53 hours. It has touched an intraday high of Rs 57.85 and an intraday low of Rs 52.65. The scrip was also one of the top BSE midcap gainers.

It was one of the most active stocks on NSE in terms of value with 7,63,31,983 shares being traded. It witnessed a spurt in volume by more than 3.24 times and was trading with volumes of 3,407,638 shares, compared to its five day average of 1,369,528 shares, an increase of 148.82 percent.

"Considering power supply being an essential service and lockdown restrictions being relaxed by the government, the management believes that there is not much of an impact likely due to this pandemic except that there exists some uncertainty over the impact of COVID-19 on future business performance of its coal mining companies and its EPC operations," Tata Power said in its BSE filing.

The management believes that the said uncertainty was unlikely to impact the recoverability of the carrying value its investment in such joint ventures and associates.

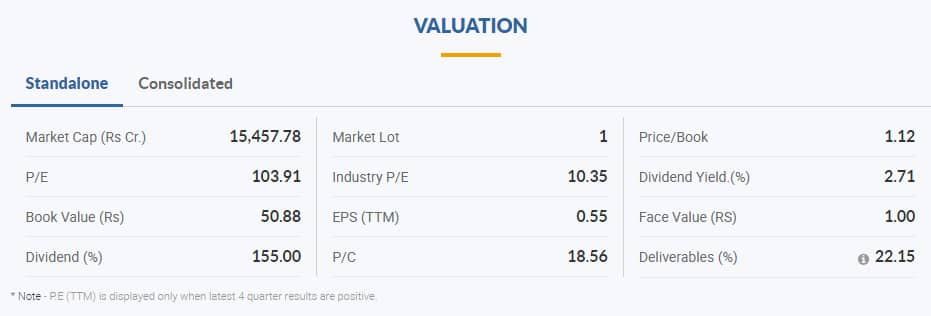

According to Moneycontrol SWOT Analysis powered by Trendlyne, the stock is showing strong momentum: price above short, medium and long term moving averages with the Book Value per share improving for last two years.

Moneycontrol technical rating is bullish with moving averages and technical indicators being bullish.

Disclaimer: The views and investment tips expressed by experts on moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.