The machinations of the market frequently surprise investors. These times are no different. On the one hand, the interest rates on deposits have seen a sharp fall; on the other, the equity market has witnessed greater volatility since the start of this year, thanks to the uncertainty created by COVID-19. Situations like these leave investors wondering where they should invest. For conservative investors, equity savings funds are a good option. These funds came into being in late 2014 and currently have assets of over Rs 11,000 crore.

Categorised under hybrid funds, equity savings funds are an improvisation of conservative hybrid funds, earlier called monthly income plans (MIPs). Conservative hybrids funds invest primarily in debt, with 10-20 percent of their portfolio invested in equity. This helps them provide higher returns than fixed deposits, making them suitable for conservative investors. However, since these funds have a major allocation to debt, they are subject to debt taxation.

On the other hand, equity savings funds invest in equity, arbitrage and debt. Each of these makes about one-third of the portfolio. The arbitrage portfolio provides dual benefits. While it is similar to debt in terms of volatility and returns, it is considered to be a part of the equity portfolio. Thus, arbitrage and equity together make more than 65 per cent of the portfolio of these funds, making them eligible for equity taxation.

Who should invest in them?

Equity savings funds are meant for conservative investors who want a measured dose of equity, or those who have a medium investment horizon of three to five years. They may also appeal to those who have passed the earning stage of their life and now wish to draw a regular income from their retirement corpus.

The equity portfolio of these funds aims to generate superior returns, while the debt and arbitrage portions provide stability. The category acts as a mid-way option for investors who wish to have some equity exposure but not much volatility. For instance, for those looking for a regular income, the equity allocation of conservative hybrid funds may be too little to beat inflation in the long run, while aggressive hybrids may be too volatile for their comfort. So equity savings funds can provide an asset allocation that suits them.

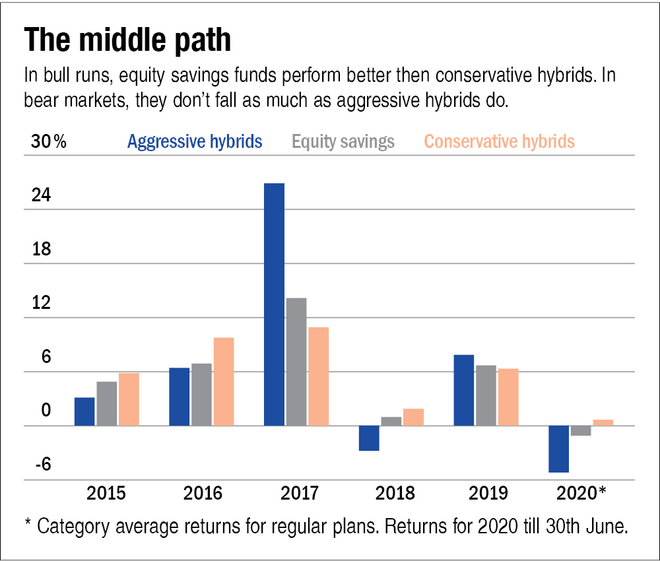

The limited equity exposure makes equity savings funds better equipped than aggressive hybrids to handle market falls, while providing higher returns than conservative hybrids during bull phases (see below).

How they are managed

Equity savings funds are mandated to invest a minimum of 65 per cent of their assets in equity and arbitrage and the remaining in fixed income. The category constituents somewhat differ in their approach towards managing their net equity (unhedged) exposure. While some keep it in a narrow range and close to a third, some others manage it more dynamically and alter it depending upon the level of equity markets. This also has a bearing on the degree of volatility witnessed by them over short periods.

Most funds manage their equity portion conservatively by investing well over 70 per cent in large caps and that's how it should be, given that these funds are meant for conservative investors. There are only a few funds in the category which allocate more to mid- and small-cap stocks.

On the debt side, the portfolios primarily consist of corporate bonds and term deposits. The portfolio duration is usually dynamically managed as most funds move up and down the maturity curve depending upon their interest-rate outlook. In the last five years, the average maturities of several funds have varied from about one year to 13 years. On the credit-risk side, funds differ significantly. Some funds stick to AAA rated corporate bonds, while others go slightly down the credit-rating curve.

__w1000__h564__.jpg)