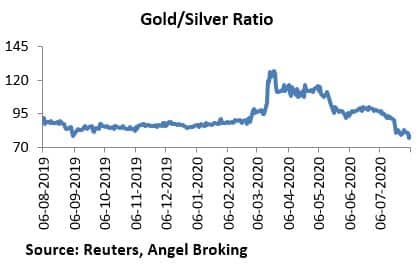

The gold-silver ratio represents the number of ounces of silver it takes to buy a single ounce of gold. At present it hovers in the range 75-80.

"There is no right or wrong time to invest in gold. In India, the desire to hold the gold in physical possession is purely on the basis of need (specifically for religious functions, marriage, birthdays). Hence, it would be incorrect to time the gold markets as well as prices," Prathamesh Mallya, AVP - Research Non Agri Commodities and Currencies at Angel Broking said in an interview to Moneycontrol's Sunil Shankar Matkar.

Q: Gold finally hit fresh high, rising in double digit year-to-date. Do you think liquidity is the only reason behind the rally in yellow metal or it is pointing towards serious risk which is yet to be seen?

A: The unprecedented amounts of liquidity is the prime reason for the surge in the gold as well as silver prices in the recent months. The fact, however, remains that Central Banks have always come to rescue the global economy in times of risk and uncertainty. And the Coronavirus Pandemic has left the global world in a void with large risk of possible corporate defaults and systemic risk arising of the global economy in a crackdown scenario.

It clearly means that the Central Banks are foreseeing unavoidable risks and they are doing whatever they can to bring back the global economy on track.

Q: Is it the right time to invest in gold? What are those options for investment in gold? What should be the proportion for gold in a portfolio?

A; There is no right or wrong time to invest in gold. In India, the desire to hold the gold in physical possession is purely on the basis of need (specifically for religious functions, marriage, birthdays). Hence, it would be incorrect to time the gold markets as well as prices.

The ideal allocation in any portfolio should be around 10 percent, however, taking into consideration the uncertain global economy, the allocation should be increased to 15 percent. However, for those who need to have options to invest in gold are as follows.

1) Physical Buying of Gold Jewellery/ornaments - In India, the investments in gold are more of need and desire based. Hence, purchase of physical jewellery and ornaments takes dominance.

However, the pandemic has resulted in wider shutdowns of the economy globally and India was no different. The lockdowns in India continue till 31st July 2020, which is much-much longer than anticipated, hence, the physical jewellery and the demand took a drastic hit in 2020.

However, one can buy gold in India through following modes:

There are five ways to purchase gold:

1) Buying physical gold from local jeweller – It is as simple as paying in cash and purchasing the jewellery from the local jeweller2) Investing in gold ETF’s (Exchange Traded Funds) (not so popular in India) – Gold ETF's does not enjoy much popularity in India, it is popular for international investors, hence this option is ruled out for Indian investors.

3) Gold Accumulation Plans (GAP) (gaining momentum) - One can buy gold online via mobile wallets such as Paytm, Phonepe, and under the Gold Rush plan of Stock Holding Corporation of India. These gold buying options are offered either in association with MMTC-PAMP or SafeGold or both.

4) Buying/selling gold on futures/options platform- This is purely from a trade perspective, wherein one wants to trade in gold by keeping margins in their accounts and benefit out of the price volatility.

5) Investing in Sovereign Gold Bonds issued by the Government of India – In a bid to turn gold into a productive asset in India, the government introduced Gold Monetization Scheme (GMS) on 5th November 2015 to help one earn interest on the unused gold lying idle in bank lockers.

Since gold constitutes the major imports for the Indian economy and the major outflow of foreign currency, the gold bond scheme introduced by the government of India will be key for the investors who want to diversify their portfolio in gold.

Although there are several ways one can buy gold, Indian consumers are fond of buying physical gold as the safest option. However, the restrictions, lockdowns and other measures due to the Pandemic has dented physical demand for gold in India.

Sovereign gold bonds have a tenor of eight years, with investors having the option to exit after the fifth year on interest payment dates. The redemption price will be the simple average of the closing price of gold on the previous three days. In addition, they are traded on the stock exchange with investors having the option to sell, though liquidity is low.

In that case Gold Accumulation Plans are the safest bets and the way it works is as follows.

Mobile wallet providers like Paytm, PhonePe, Google Play, etc. have started offering digital gold.These digital players are selling gold in collaboration with MMTC-PAMP. Some of them have collaborated with SafeGold.

SafeGold is a digital platform that has tied up with various mobile wallet apps allowing customers to buy, sell and receive vaulted gold from as low as Re 1

Both, MMTC-PAMP and SafeGold, offer gold of 24KT. However, in terms of fineness, MMTC-PAMP offers gold of 99.9 percent purity whereas SafeGold offers 99.5 percent purity.

Q: Silver also traded in line with yellow metal, but few experts feel silver may overtake gold. Do you feel so, and why?

A: Alternative investment in a relatively volatile market and a proxy to gold is what defines the investment in this asset class. The movers and shakers for silver prices in the second half of 2020 will be a combination of potent forces of heavy industrial use, investment demand and its strategic importance as a currency hedge during times of uncertainty.

Rising investment demand as witnessed in 2019 and the similar trend to continue in 2020 will ensure that silver prices will rise further from here on.

Q: What is the Gold-Silver ratio and what does it generally indicate (on upside/downside fronts). Why is this ratio having so much importance?

A: The gold-silver ratio represents the number of ounces of silver it takes to buy a single ounce of gold. At present it hovers in the range 75-80.

General Indications of gold-silver ratio•>> Investors use the gold-silver ratio to determine the relative value of silver to gold.

•>> Investors who anticipate where the ratio is going to move can make a profit even if the price of the two metals fall or rise.

•>> Today, the ratio floats and can swing wildly. That's because gold and silver are valued daily by market forces, but this has not always been the case. The ratio has been permanently set at different times in history and in different places, by governments seeking monetary stability.

Importance of Gold silver ratio

•>> The gold-silver ratio is still a popular tool for precious metals traders•>> They can, use it to hedge their bets in both metals; taking a long position in one, while keeping a short position in the other metal

•>> So when the ratio is higher, and investors believe it will drop along with the price of gold compared to silver, they may decide to buy silver and take a short position in the same amount of gold.

Q: Crude oil prices seem to be gradually moving upwards with intermittent consolidation. Do you think Brent crude futures formed the base around $40 a barrel now and are inching towards $50 a barrel?

A: Steady fall in global oil inventories, opening up of the global economy, possible production lift by OPEC+ alliance amidst the increasing global demand recovery, and increasing refinery run rates across US and Europe in order to process the crude oil in to products (gasoline & distillates), are possible green shoots of recovery for the global oil demand to stabilise.

We see WTI oil prices (CMP:$42 per barrel, to move higher towards $50 barrel in a month time frame while MCX oil futures might possibly move higher towards Rs 3,500 per barrel in the same time frame.

Q: Base metals also witnessed buying interest with the re-opening of economic activities globally. What are your thoughts and what should be your strategy?

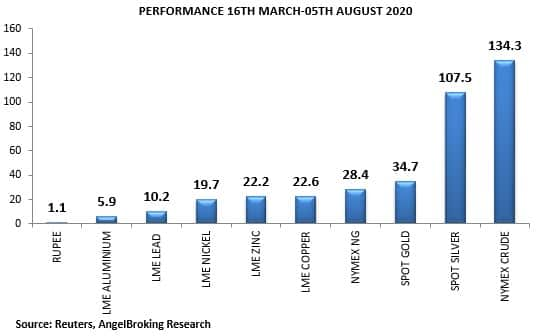

A: The chart above clearly explains the rally in all the metals with double digit returns of more than 20 percent in Zinc, Copper, and Nickel while Lead rallies by around 10 percent in the time frame 16th March 2020 to 05th August 2020.

The global economy is slowly opening up and the recent manufacturing numbers released from the US, Euro area and Japan is an indication of possible green-shoots of recovery, although it is too early to say at this point in time.

The recent projections from the International Monetary Fund say a global economy contraction of 4.9 percent in 2020 adds pessimism to the story.

However, hope is the only belief that this world has now and things will be back to normal is what the presumption is after the Central banks across the globe have infused massive amounts of liquidity to bring back normalcy in the economy.

The demand destruction has already happened and it will resume its normal course once every country starts resuming its normal course of work and operations.

Base Metals recovery here to stay for the time being, however, a note of caution attached, as the recovery of the global economy from this pandemic might take longer time than usual.

Disclaimer: The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.