At the global front, the demand for cotton has increased especially China due to easing lockdown, though China has not begun full-fledged buying of US agricultural products based on the Phase I US-China trade deal.

MCX Cotton Futures traded mixed to bullish during July and later in August witnessed some incline due to higher sowing and increased demand from the textile industries in the domestic market respectively as some states have started to further ease lockdown.

Moreover, easing farm activities in rural regions led to increased buying of cotton especially in the state of Gujarat; with easing tensions of lower supplies and arrival shortage, bringing support to the price in the July month.

At the global front, the demand for cotton had been reported to have increased especially China due to easing lockdown, though China has not begun full-fledged buying of US agricultural products based on the Phase I US-China trade deal. By August 6, MCX Cotton futures price closed at Rs 16,370/bale, higher by 2.31 percent compared to Rs 16,000/bale reported on July 1.

Fundamentals

Fundamentally for the month ahead, we expect MCX Cotton futures to continue to trade mixed owing to forecasts of higher production of cotton in India in the major states of Maharashtra and Madhya Pradesh by 15-20 percent.

High stocks report from last of approximately 85-90 lakh bales (1 bale = 170 kgs) for the year 2019-20, compared to 25-30 lakh bales for the year 2018-19 eventually to also cap spot and futures prices from any upside movement. But then, exports have shown recovery in the global markets in the past few weeks as CCI (Cotton Corporation of India) focuses on boosting more exports from India which could limit any major downside movement.

Earlier, rainfall has been lagging in central parts and western parts of India, however, rainfall has shown a good amount of recovery in the last week which can support the yield of the standing crops. But then again, the traders are also cautious over the flood-like situation in various parts of India that can damage the crops. Overall, we expect a sideways trend in MCX Cotton Futures for the month ahead.

Technicals

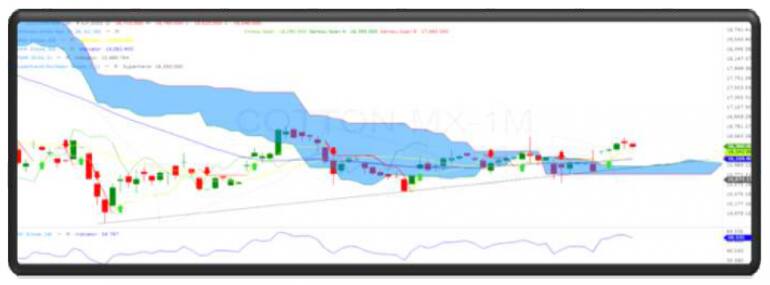

In the daily timeframe, MCX August Cotton has sustained above its “Upward Sloping Trend Line” which indicates that bullish trend is intact. Moreover, the price has been trading above its “Parabolic SAR”, which confirms strength in the counter.

Furthermore, the price has sustained above its 20*50 days “Simple Moving Average”, which confirm bullish control. Additionally, momentum indicator RSI (14) has sustained below its 50 level which suggests positive momentum. Moreover, Super Trend (7, 1) has given a buy signal which confirms bullishness.

Based on the above technical structure one can initiate a long position in MCX Cotton August future at CMP 16,360 or a fall in the price till Rs 16,280 levels can be used as buying opportunity for the upside target of Rs 17,860. However, the bullish view will be negated if MCX Cotton August closes below the support of Rs 15,600.

(The author is Executive Director at Choice Broking.)

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.