CHENNAI: In a bid to increase liquidity in the hands of individuals, the RBI on Thursday said it will increase lending limits for gold for non-agricultural purposes. So, you can now borrow against your household gold for a maximum 90% of its value — up from the earlier 75%. This will be in force till March 2021.

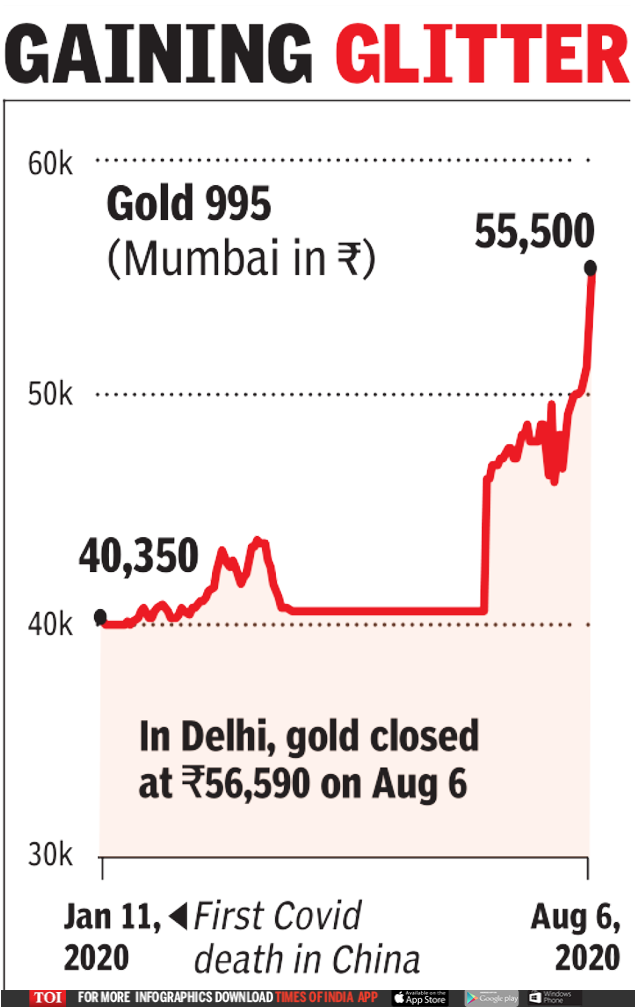

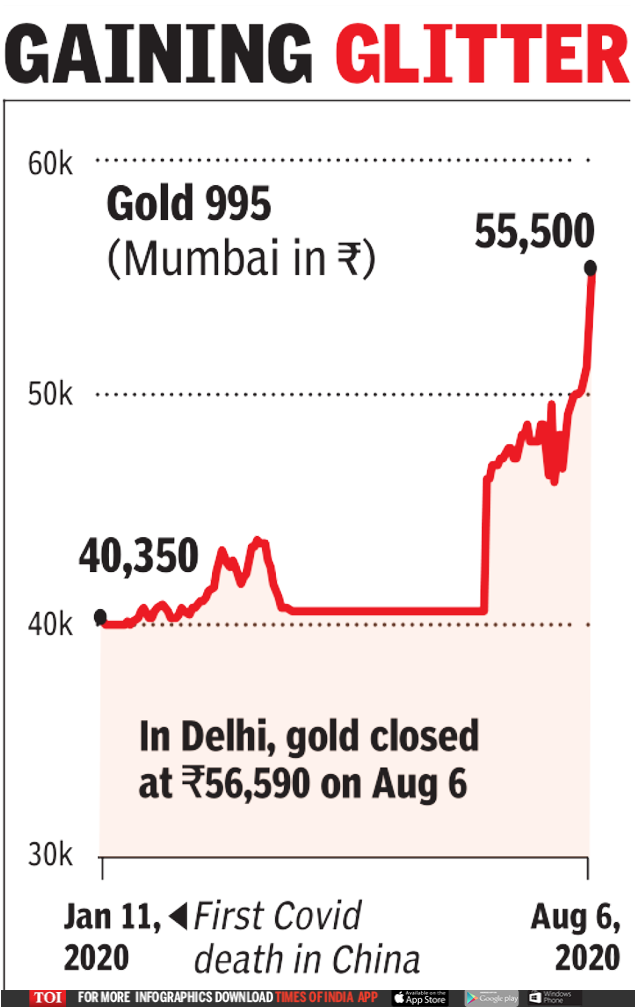

Gold loans are short-term in nature and easy to liquidate, should there be a default. Besides, with gold prices at historic highs, the central bank has chosen the easiest way for small and unorganised businesses to borrow money to fund their businesses. In equal measure, the risk associated with lending against an asset that is already at never-beforeseen prices is fraught with fear.

“With gold prices close to their peak, a higher LTV (loanto-value) does pose an additional risk. Lenders may choose to offer the higher LTV to shorter tenure loans and to customers who maintain better credit discipline and, hence, have a higher credit score,” said Kotak Bank’s joint president (government business & gold loans) V Swaminathan.

“On the other hand, banks see the skyrocketing of gold prices as a boon, since it drives incremental growth in their loan portfolio from borrowings made by non-agri businesses.”

The relaxation is only for banks and not for private financiers, including Muthoot and Manappuram, which are aggressive in gold loans. Some see this as a sign that the RBI expects a further uptick in gold prices, especially with the US elections in November, the run-up to which could lead to more geopolitical tensions. This would push investors to park their money in gold, and thereby boosting prices.

For example, City Union Bank has seen its gold loan portfolio grow by an additional 15% on the existing 25% monthly growth due to higher footfalls from MSMEs and personal loan borrowers against gold jewellery last month. The gold loan portfolio has doubled from Rs 15 crore recorded every month to Rs 25-30 crore in July.

Its MD & CEO N Kamakodi said, “Gold loan disbursement has revived quicker and better in the June-ended quarter, compared to other loan products. Micro-enterprises, which demand short-term liquidity, will benefit the most (with change in LTV).”

Gold loans are short-term in nature and easy to liquidate, should there be a default. Besides, with gold prices at historic highs, the central bank has chosen the easiest way for small and unorganised businesses to borrow money to fund their businesses. In equal measure, the risk associated with lending against an asset that is already at never-beforeseen prices is fraught with fear.

“With gold prices close to their peak, a higher LTV (loanto-value) does pose an additional risk. Lenders may choose to offer the higher LTV to shorter tenure loans and to customers who maintain better credit discipline and, hence, have a higher credit score,” said Kotak Bank’s joint president (government business & gold loans) V Swaminathan.

“On the other hand, banks see the skyrocketing of gold prices as a boon, since it drives incremental growth in their loan portfolio from borrowings made by non-agri businesses.”

The relaxation is only for banks and not for private financiers, including Muthoot and Manappuram, which are aggressive in gold loans. Some see this as a sign that the RBI expects a further uptick in gold prices, especially with the US elections in November, the run-up to which could lead to more geopolitical tensions. This would push investors to park their money in gold, and thereby boosting prices.

For example, City Union Bank has seen its gold loan portfolio grow by an additional 15% on the existing 25% monthly growth due to higher footfalls from MSMEs and personal loan borrowers against gold jewellery last month. The gold loan portfolio has doubled from Rs 15 crore recorded every month to Rs 25-30 crore in July.

Its MD & CEO N Kamakodi said, “Gold loan disbursement has revived quicker and better in the June-ended quarter, compared to other loan products. Micro-enterprises, which demand short-term liquidity, will benefit the most (with change in LTV).”

Download

The Times of India News App for Latest Business News

more from times of india business

Coronavirus outbreak

Business News

LATEST VIDEOS

Business

RBI's one-time window for companies, individuals to recast loans gives helping hand to India Inc

RBI's one-time window for companies, individuals to recast loans gives helping hand to India Inc  RBI announces regulatory, developmental measures for micro-economic conditions in wake of Covid-19 pandemic

RBI announces regulatory, developmental measures for micro-economic conditions in wake of Covid-19 pandemic  GDP growth estimated to be negative for year 2020-21: RBI governor Shaktikanta Das

GDP growth estimated to be negative for year 2020-21: RBI governor Shaktikanta Das  RBI brings startups under PSL for easier access to credit from banks

RBI brings startups under PSL for easier access to credit from banks

More from TOI

Navbharat Times

Featured Today in Travel

Quick Links

ELSS Mutual Funds BenefitsIncome Tax Refund statusWhat is AssochamITR Filing Last DateHome Loan EMI TipsHome Loan Repayment TipsPradhan Mantri Awas YojanaTop UP Loan FeaturesIncrease Home Loan EligibilityHome Loan on PFTax Saving Fixed DepositLink Aadhaar with ITRAtal Pension YojanaNita AmbaniIndian EconomyRBIAadhaar CardSBIReliance CommunicationsMukesh AmbaniIndian Bank Ifsc codeIDBI Ifsc codeIndusind ifsc codeYes Bank Ifsc CodeVijay Bank Ifsc codeSyndicate bank Ifsc CodePNB Ifsc codeOBC Ifsc codeKarur vysya bank ifscIOB Ifsc codeICICI Ifsc codeHDFC Bank ifsc codeCanara Bank Ifsc codeBank of baroda ifscBank of America IFSC CodeBOM IFSC CodeAndhra Bank IFSC CodeAxis Bank Ifsc CodeSBI IFSC CodeGST

Get the app