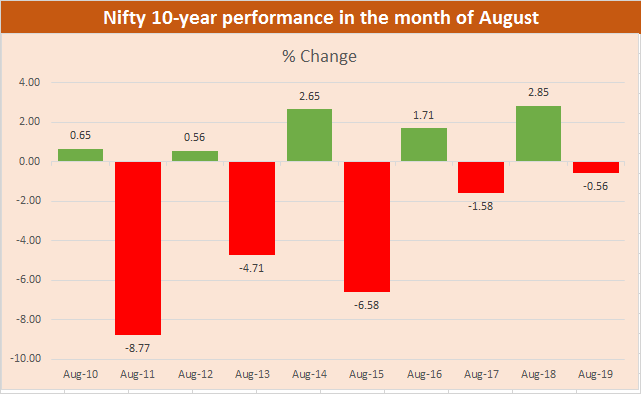

The Nifty50 recorded a cut of nearly 9 percent in the year 2011, followed by 2015 when it slipped 6 percent, and in the year 2013, it dropped by about 4 percent.

Waiting for another 7 percent rally in benchmark indices? August might disappoint you as valuations look stretched, and the index is trading in an overbought zone, suggest D-Street experts.

Anecdotal evidence suggests that bulls remained in control of the D-Street in five out of the last 10 years in August. The Nifty50 recorded a cut of nearly 9 percent in the year 2011, followed by 2015 when it slipped 6 percent, and in the year 2013, it dropped by about 4 percent, according to data collated from AceEquity.

The gains have not been that inspiring as compared to cuts which market saw in the last 10 years. The index rallied by nearly 3 percent in the year 2018 followed by the year 2014 in which it rose by 2.6 percent, and in the year 2016, it gained 1.7 percent.

The Indian market rallied 7 percent in July and benchmark indices are trading near crucial resistance levels. With no immediate triggers in sight apart from June quarter earnings which have remained mixed, the momentum could slow down but the downside remains protected due to positive global cues.

It is difficult to guesstimate the market movements on a monthly basis, but this year markets defied the annual trend of going down in May month. The Nifty50 has already rallied by about 50 percent from the recent swing low of 7500 recorded in March.

As long as global markets remain buoyant, Indian markets could stay afloat and would climb all wall of worries, but the valuations do look stretched and some consolidation cannot be ruled out, suggest experts.

“Global liquidity, the negative real interest rate in the west and falling Dollar Index are factors driving gold, commodities, and equities. We don’t have any view as to when liquidity will go away. As of now, most central banks are in accommodative stance and we could see some more stimulus coming in from the US and some other countries,” Rusmik Oza, Executive Vice President, Head of Fundamental Research at Kotak Securities told Moneycontrol.

“On pure fundamentals and valuations, Nifty50 looks stretched for the near term. On a one-year FW basis, the Nifty50 is trading ~22x, which is quite on the higher side and it is difficult to make money by entering at these valuations,” he said.

Oza further added that from a valuation point of view and considering that the second phase of earnings coming mainly from the manufacturing side could disappoint we can expect some kind of correction in August.

After a strong rally, the expectations are rife for the markets to consolidate or correct in the near term. But, a major correction will be triggered if global markets correct else most of the dips which we have seen in July are being bought into.

“The Indian markets have been moving to the tunes of global markets where the mood is upbeat backed by stimulus announcement and overwhelming liquidity. Having said that, there is enough negative news as well for the investors to remain nervous with rising cases in the US, and India and demand, even though has recovered, remains below pre-COVID levels,” Ajit Mishra, VP Research, Religare Broking told Moneycontrol.

“Amid mixed signals, we feel the decline in the benchmark could be limited, thanks to buoyancy in the select index majors but traders should be cautious as we usually see a sharp reaction in midcap and smallcap counters even on a marginal dip in the index,” he said.

In terms of technicals, Nifty50 is trading above crucial support of 11,000, and as long as 10,800-11,000 remains intact, bulls could still remain in charge, suggest experts.

“If Nifty breaches its crucial support level of 11,000, it is expected to test its level of 10,600 in the coming weeks. As long as Nifty holds 10,800, the possibility of Nifty heading towards 11,500 is quite high. Investors are advised to remain cautious and manage overnight risk,” Gaurav Garg, Head of Research at CapitalVia Global Research Limited told Moneycontrol.

“The index is overbought in the short-term. Nifty is expected to test its level of 10,600 in the coming weeks. Progress on a domestic as well as overseas vaccine for COVID-19 treatment will be closely watched,” he said.

Institutional Activity

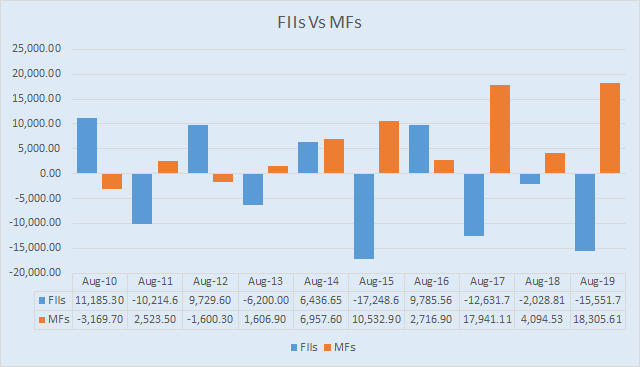

Foreign institutional investors (FIIs) have been net sellers in August in six out of the last 10 years, according to data from AceEquity.

In the rest of the instances, they pulled poured more than Rs 11,000 crore in 2010, and nearly Rs 10,000 crore in 2012 and 2016 in the month of August.

DIIs were also mostly net buyers in June in eight out of the last 10 years. They poured in more than Rs 18,000 crore in 2019, Rs 18,000 crore in 2017, and Rs 10,000 crore in the year 2015.