There is increased divergence of returns across funds even within the same category in recent years

Swapnil Pawar

Indian debt mutual funds had a great run up to 2018. Their returns were consistent, stable and fairly impressive. As the dictum goes – if something is too good to be true, it probably isn’t! In theory, while investors claimed to have understood the existence of credit risk in most debt mutual funds, they assumed these to be standard disclaimer type of statements. It was only in 2019 and 2020 that they were forced to face the brutal reality of risks in debt mutual fund investing.

The secular fall in debt returns in general over last two years has been accompanied by a subtle but unmistakable trend – a divergence of returns amongst debt funds. The range of debt fund returns till 2018 was typically quite narrow. Unlike equity funds whose returns gyrated between -20 per cent and +50 per cent per year from one year to next, debt funds stayed in a largely predictable +5 per cent to +15 per cent range – and if one excluded gilt and dynamic bond funds, an even narrower +5 per cent to +10 per cent per annum. Over last two years, however, investors have experienced eye-watering falls of as much as -50 per cent in some debt funds. What is more, such large falls were not limited only the credit risk funds, where one would assume some possibility of negative returns by the very nature of the funds’ mandate. Negative returns also occurred in supposedly safer categories such as ultra-short-term debt or liquid funds.

The secular fall in returns

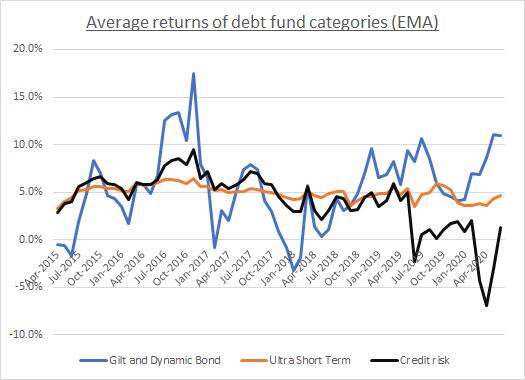

Firstly, let us look at the better known and recognized phenomenon that the average returns in debt are falling. The chart below shows the secular fall in average returns of debt mutual funds in India. We have considered major categories such as credit risk funds, ultra-short term debt funds and gilt/dynamic bond funds to enable easy visualization without getting swamped with details. Also, the returns are winsorized to exclude outliers, smoothed by taking an exponential moving average on a monthly basis and annualized.

As expected, the fall in repo rate in last two years meant bumper returns for gilt funds. However, this is unlikely to be repeated for foreseeable future as RBI pauses the rate cuts to let the transmission of the monetary policy occur. Contrary to the good times seen by gilt funds, the fall in returns of credit funds is very sharp and sudden – starting in early 2019. While the fall in returns of ultra-short term debt funds seems more orderly and small, it is unmistakably there.

An interesting connected phenomenon is the variations in credit spread between zero risk short term funds and credit risk funds. Till 2018, credit spread was behaving well. Starting 2019, the realized spread (differential in delivered returns of the funds) narrowed even as the actual credit spread paid by individual issuers of debt increased. This means while the cost of new debt issuance for individual companies went up, the actual defaults by many existing issuers led to a spate of write-downs for securities already held by debt funds – leading to the reduced realized returns of credit funds.

Another way to look at the fall in the spread of credit funds over liquid funds is to see it as averaging out over a long horizon. The spreads in 2015-18 period were too high and hence to make them ‘fair’ over the business cycle (2015-2022) they had to be very low in the second half of the cycle.

Low rates are here to stay – this time, it may be different indeed

The interest rates in the advanced economies have been quite low for most of the past decade. However, in India, we have been through one full cycle of rate fall (2008-2011), increase (2012-14), fall again (2015-20). Many investors are expecting the risk-free rates to rise again – hopefully to the 6 per cent levels again, once the pandemic damage is contained. This may not come to pass for two reasons.

Firstly, the rich world rates are not going up anytime soon. At most the unprecedented fiscal and monetary stimulus (through QE) may end over the next few quarters. It may be quite some time before interest rates in the advanced economies rise again.

Secondly, the inflation in Indian economy may remain subdued for foreseeable future – owing to the economic slowdown that was pervasive even before Covid-19, coupled with likelihood of at best a sluggish recovery even if a cure/vaccine for Covid-19 is found in next few months.

It is a fool’s errand to forecast beyond 1-2 years in general! However, I wonder if Indian investors will ever see a return to risk-free rates higher than 7 per cent.

The widening returns divergence amongst funds

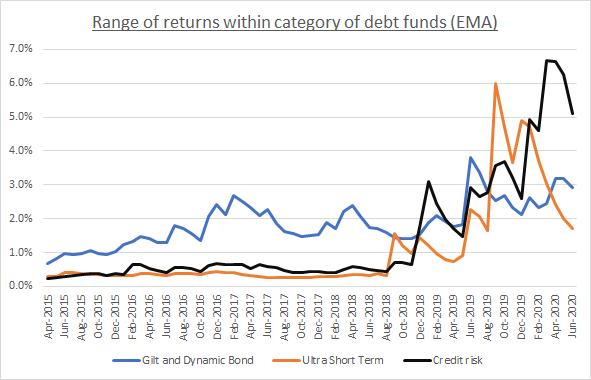

Let us now come to a less appreciated phenomenon occurring in parallel to the secular fall in debt yields. This is the increased divergence of returns across funds within a given category in recent years. Chart 2 shows the sharp jump in this range for gild/dynamic bond funds, ultra-short-term debt funds and credit risk funds.

To start with, let us look at the easy case of gilt and dynamic bond funds. Given the high interest rate risk they carry, these categories understandably have a high variation across different funds – since some managers will keep duration low and others high, thus responding differently to expectations of rate cut or otherwise. This variation has not increased all that much in last one year.

Now look at the sudden jump in the range of returns of ultra-short term debt funds and credit risk funds. Starting second half of 2019, the range exploded from below 1 per cent to beyond 2 per cent and crossed even 5 per cent subsequently. The range values are not annualized. This means, if annualized, the peak range would be as high as 60 per cent per annum!

The main driver of this was security selection by individual fund managers. Defaults by some issuers in some portfolios led to those schemes doing very poorly in that month. One can generalize from this and conclude that fund selection by investors has become highly central to debt fund investing in India. Till 2018, it was a simple matter of comparing past returns, checking having AUM higher than some minimum threshold and going with a large/better-known AMC. That has changed now. Even within the same AMC, one may have some good funds and some avoidable ones. Large AUM may not always signify strength and may even be a liability for funds that seek to generate credit alpha.

The brave new world

Given the continued fall in fixed deposit rates at banks and low yields-to-maturity of overnight funds, most debt investors will look at options to increase their yield by at least a little bit! And it is not all that difficult to get a small premium over the rock-bottom risk-free rates. It is just that investors need to alter their mindset when evaluating debt mutual funds. They are neither like fixed deposits with known returns and no risk other than bank’s credit risk, nor are they like equity funds where a manager’s skills in generating alpha are central to fund selection. Debt funds are an independent investment avenue on their own and require adequate attention to become accustomed to their unique risks and returns. Investors would also be well-advised to keep an eye on the portfolio of securities held by the funds they are invested in – for risks arising from credit contagion, business house concentration and/or industry concentration besides the obvious concern of borrower concentration.

(The writer is Founder, ASQI Advisors)