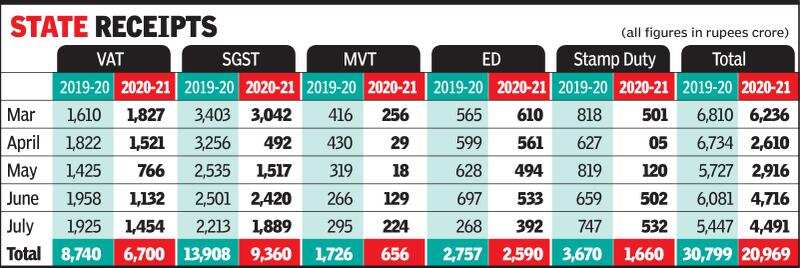

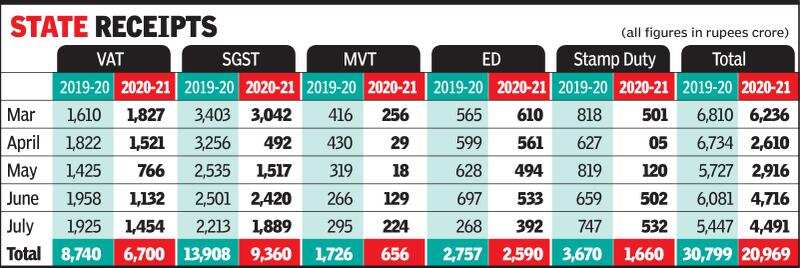

GANDHINAGAR: Despite more economic activities being allowed in July compared to June, actual revenues of the state government slid by Rs 225 crore in July from the previous month.

While income from value added tax (VAT) on petrol and diesel increased substantially as a result of the state raising VAT on these products and increased consumption, GST revenues have surprisingly fallen in July compared to the previous month.

Similarly, revenue from motor vehicle tax (MVT) and stamp duty on properties rose in July, but collections from electricity duty (ED) has been lower in July.

Similarly, revenue from motor vehicle tax (MVT) and stamp duty on properties rose in July, but collections from electricity duty (ED) has been lower in July.

The revenue of the state government between March 2019 and July 2019 stood at Rs 30,799 crore, while revenue for the same period in 2020 was Rs 20,969 crore, a shortfall of Rs 9,830 crore.

Officials in the state government said the fall in SGST revenue in July 2020 could be because of settlement of earlier dues in June, while July saw normal revenues. Similarly, the electricity duty reduction in July could be because of the fall in demand.

A source further said, “Due to a significant fall in government revenues due to the lockdown and the long-term impacts of Covid, we are assuming that there will be a fall in revenue of close to Rs 25,000 crore by the end of the financial year.

“We expect that SGST monthly income may also fall because of multiple reasons. If the central government further cuts its allocation of the CGST share, the state’s financial position will be more strained.”

While income from value added tax (VAT) on petrol and diesel increased substantially as a result of the state raising VAT on these products and increased consumption, GST revenues have surprisingly fallen in July compared to the previous month.

The revenue of the state government between March 2019 and July 2019 stood at Rs 30,799 crore, while revenue for the same period in 2020 was Rs 20,969 crore, a shortfall of Rs 9,830 crore.

Officials in the state government said the fall in SGST revenue in July 2020 could be because of settlement of earlier dues in June, while July saw normal revenues. Similarly, the electricity duty reduction in July could be because of the fall in demand.

A source further said, “Due to a significant fall in government revenues due to the lockdown and the long-term impacts of Covid, we are assuming that there will be a fall in revenue of close to Rs 25,000 crore by the end of the financial year.

“We expect that SGST monthly income may also fall because of multiple reasons. If the central government further cuts its allocation of the CGST share, the state’s financial position will be more strained.”

Coronavirus outbreak

Trending Topics

LATEST VIDEOS

City

Start of construction of Ram temple in Ayodhya marks fulfilment of key Sangh Parivar goal, RSS believes

Start of construction of Ram temple in Ayodhya marks fulfilment of key Sangh Parivar goal, RSS believes  MP Congress celebrates Ram Mandir Bhumipujan event at State Party Headquarter in Bhopal

MP Congress celebrates Ram Mandir Bhumipujan event at State Party Headquarter in Bhopal  Meghalaya: 24-kg tumour removed from woman's abdomen

Meghalaya: 24-kg tumour removed from woman's abdomen  Pending salaries for 3 months North Delhi Municipal Corporation teachers’ associations warn authorities

Pending salaries for 3 months North Delhi Municipal Corporation teachers’ associations warn authorities

More from TOI

Navbharat Times

Featured Today in Travel

Quick Links

Kerala Coronavirus Helpline NumberHaryana Coronavirus Helpline NumberUP Coronavirus Helpline NumberBareilly NewsBhopal NewsCoronavirus in DelhiCoronavirus in HyderabadCoronavirus in IndiaCoronavirus symptomsCoronavirusRajasthan Coronavirus Helpline NumberAditya ThackerayShiv SenaFire in MumbaiAP Coronavirus Helpline NumberArvind KejriwalJammu Kashmir Coronavirus Helpline NumberSrinagar encounter

Get the app